Gold: Roaring Twenties Redux

Donald Trump pledged to lower prices and raise real incomes, believing that he can make America great again. First, he undermined globalization by utilizing presidential authority and emergency powers, harming businesses and consumers under the guise that foreign corporations had undermined American industry. That allowed China to take advantage of American demand for goods, becoming a superpower and arch competitor. Then, he overturned all of that, steamrolling Congress's power of the purse and the judiciary as his predecessors fought other people's wars and permitted the Deep State to seize control of its colleges, medical facilities, and other establishments.

The president thinks there are no barriers. However, the 1977 International Energy Economic Powers Act (IEEPA), which the president claims gives him broad authority to "deal with" any unique or extraordinary threat in a national emergency, is being heard by the Supreme Court in a historic case. Those emergency powers were utilized to bomb ships, impose international tariffs on any nation, and pursue his own policy objectives. What would happen if the president's use of IEEPA was ruled to be unlawful by the Supreme Court? Does he simply ignore the law?

We don’t know. Neither does he.

To make matters worse. We believe there is a growing deficit of trust in America’s credibility and institutions, exposing its vulnerability to a financial crisis of epic proportions.

This president has a different reality. The dissonance between what he thinks he is achieving and the reality is great. Tariffs are a levy paid by others, but in practice, US importers and consumers foot the bill—ask Walmart or the Mexicans who were meant to foot the tab for a wall. The engine of the US economy is domestic consumer spending which comprises more than two thirds of the US economy. Despite tariff inflation, job losses and now the immigration crackdown, the Atlanta Fed estimates Q3 GDP at 4.1 percent. Part of the reason is that the highest earning Americans make up 10 percent of the population but account for almost 50 percent of all consumer spending, up from a third in the 1990s. Trumponomics has also been good for markets, but in a different way. Volatility has picked up allowing arbitrage opportunities because the market players thrive on volatility. Wall Street is euphoric.

The downside is that Donald Trump’s weaponization of the economy are anti-growth and inflationary all together, while inflation is stuck at 3 percent. With the president’s polarizing immigration policy set to disrupt America’s labour peace, American workers have gained little, with no new jobs at a time when businesses lose competition due to higher input costs. Retaliating tariffs have already hit exports as the president faces renewed pressure to ease further in the wake of GOP setbacks where voters punished the party for failing to curb inflation or tackle cost of living concerns. This president seems to be everywhere, reshaping the world and America, all at the same time, in a vision only he knows. It has happened before.

Winter is Coming

America and Germany in the 1930s are being compared by certain historians. Back then, there was extraordinary suppression of academic freedoms, state control of the economy, draconian immigration policies, annexation of neighbouring countries and of course, tariffs. There was also a two-term autocratic leader whose party organized a putsch in 1923 and his second-coming fueled hyperinflation and a World War. To be sure Mr. Trump is not Hitler, but he certainly is transforming the world. We think the parallels with the Roaring Twenties, a decade earlier, provide a more accurate analogy in terms of economic, political, and cultural insights.

The Roaring Twenties was a time of great economic prosperity and societal change, followed of course by the Smoot-Hawley tariffs of 1930, which played a key role in the Great Depression. The Roaring Twenties were marked by boom times brought about by new technologies, electricity, autos, radio, and telephones, much like the euphoria around artificial-intelligence today. Consumers celebrated life, spending on new cars, jazz and flappers with the stock market reaching record highs. Like today, private finance and Wall Street with a huge concentration of wealth prospered as the stock market bubble drove the US economy, masking huge underlying income inequalities.

Soon cracks appeared. The Emergency Tariff Act of 1921 and the Fordney McCumber Tariff Act of 1922 were imposed by a Republican president to assist farmers who were struggling with growing expenses, overproduction, and low crop prices following the war to halt all wars. Over 60 million people, including immigrants, were farmers at the beginning of the 1920s, but they were quickly destroyed by mechanization, tariffs, and dust bowl conditions. After President Harding passed away in 1923, Calvin Coolidge took over and cut taxes from 73% to 24%. This led to a booming market, nosebleed valuations, and prosperous times. That was short-lived. In just 21 months, the Wall Street Crash of 1929 erased 90% of the Dow, the worst crash in history.

Modern Parallels

Today’s artificial-intelligence (AI) euphoria which might be the most transformative technology in generations but has a lot in common with previous bubbles, including the leveraged buyouts of 1980s, housing implosion in 2000s and Lehman collapse in 2008. All benefited from easy credit, Wall Street’s derivatives of mass destruction and unhinged from fundamentals. Today Santa has arrived early with everyone wondering when today’s AI bubble will burst. Ominously, history showed that the Gatsby-era good times of the Roaring Twenties, preceded the stock market crash and, the Great Depression.

A century later, speculative fever has returned with the mania this time over artificial intelligence which is to transform human-like intelligence. Eight of the ten biggest stocks in the S&P 500 today are tech stocks, and with this extraordinary growth, private credit is in a multi-billion-dollar dash to build data centers to power AI models, pushing valuations to the sky, despite little revenues to support the lofty valuations. There are 10 AI startups (OpenAI, AI, etc.) valued at $1 trillion that have yet to turn a profit. Some of those companies have taken on off-balance sheet loans using private credit and derivatives, in a modern-day version of subprime debt. Investors have again adopted a “what me worry” attitude.

As of October, the stock market’s total capitalization was about $68 trillion or more than twice US GDP. Back in 1929 some investors had 90 percent leverage. Today the stock market is climbing a wall of worry, accounting for 20 percent of the nation’s household wealth. Trump? Geopolitical battles? Trade wars? Yet the stock market reaches another record high, sharing similarities with the Twenties. According to Gallup, 60 percent of US households currently have exposure to stock market investments, either directly or through their 401ks as commission-free vehicles and derivatives make it easier for them to participate, eerily similar to the Roaring Twenties.

Our concern is that a 25 percent correction would be equivalent to wiping out America’s GDP. If the market replayed the catastrophic 90 percent loss in 1929, nothing would be spared.

Corrections are all too common. We recall Black Monday in October 1987 when the Dow lost almost 23 percent in one day on stretched valuations, and global fears about the dollar. More recently Covid fears caused the market to drop 11 percent in a single day, the worst since 1987. Today the lofty artificial intelligence influenced valuations of the five big tech stocks are worth a combined $15 trillion (Nvidia, Meta, Alphabet, Apple and Microsoft), almost equivalent to America’s GDP. This heavy concentration is increasingly funded by debt as investors pile in on risky speculation. Considering scale, the US-dollar daily forex turnover is almost $10 trillion. The question is when, not if the bubble will burst.

Two Different Worlds

There appears to be two worlds as stocks reached record highs, whilst the real economy is slowing, replicating the Roaring Twenties. Amid the euphoria of the artificial intelligence boom, there are new strains in the derivative market. Derivatives were at the source of the recent collapse of First Brands, the car parts supplier, defaulting on a whopping $12 billion of exotic private debt, following US subprime car lender, Tricolor Holdings’ default. Cryptos lost over $1 trillion in the past six weeks. Shadow finance worries are also haunting regional US banks, reigniting concerns about the US banking system’s plumbing. Then there is deepening anxiety over the economy, as cardboard box demand for everything from takeout to flat screen TVs have slumped.

Then there is the creeping politicization of the Fed which threatens the outlook in a familiar case of déjà vu all over again. These days, central bankers seem to be handmaidens to governments using inflationary monetary financing to cover fiscal deficits. Consequently they cannot be trusted because history shows that Wall Street’s financial alchemy and loose central bank standards, eventually lead to collapse. Markets today have too much leverage, too little liquidity and the belief that it is “different this time,” was said in 1929.

And, as before the world has become less stable and more divided in an era of division and polarization, with a split-screen US economy, fueling a capitalism crisis. The divided fortunes of the rich and poor in the US is age-old, but now the wealth gap has widened, creating a two-tier economy which is more susceptible to a downturn. Politically, there are red states and blue states, with the chasm even wider with MAGA viewing the traditional left as “the radical left,” and some of MAGA itself, the “far left.” And that is not exclusive to the United States, with right wing populists popular from Sweden to Greece to Austria. In the UK, Farage’s Reform Party would form a majority if an election were held today. In France, Ms. Le Pen still prevails. In Japan there is a new leader of the ruling Liberal Democratic Party (LDP), Sanae Takaichi, the first female and hawkish nationalist.

Divisions Illustrate Deep Fractures

At home, Mr. Trump’s tax cuts have benefited the top 400 wealthiest Americans who paid a total tax rate of about 24 percent of income from 2018 to 2020. With Trump’s sweeping tax cuts in his One Big Beautiful Bill Act, the federal corporate tax rate was reduced to 20 percent versus the wider population rate between 30 percent and 45 percent for higher income workers. At the root of all this is the electorates’ sense of loss of control and the growing insecurity of failure of the government. Part of the problem is that consumer spending is weakening as housing and wages soften, while the stock market trades at all-time highs – two different worlds. We believe the common denominator is excessive government spending, crowding out the private sector and of course Trump’s growing control of everything. In a dramatic shift to state capitalism, the government has taken stakes in key industries and even set up a sovereign White House Opportunities Fund. What’s needed is more control, over government spending because spending has surpassed war-time levels.

Six years ago, the UN audience laughed at Mr. Trump’s speech. This time at the UN General Assembly his harsh message was, “your countries are going to hell”. Unlike his inaugural address in 2017, when everyone thought he was kidding, no one was laughing this time. Mr. Trump’s chaotic assault has rattled countries as he launched a global trade war on friends and foes, sparking concern about a slowdown in trade and economic growth. And this time, domestically he has punished foes, using his office and wielding more power than any of his predecessors. Bit by bit criticism is silenced, followed by punishment and/or self-censorship on threats of retribution, allowing him to issue rounds and rounds of executive orders that seemingly gives him power over everything and everyone.

Europe comes next. What happens if Putin prevails? Poland and Estonia are facing that reality. Three years later Russia still wages war in the Ukraine. This time there are no US security guarantees with his tariff victories more of a strategic downpayment for Washington’s military protection. The Middle East has also turned into a geopolitical battlefield as Mr. Trump promises to resume nuclear testing for the first time since 1992. Saudi Arabia, Pakistan, Iran, and India now discuss the possibility of an Islamic bomb. The world has become more dangerous, a house of dynamite.

Inflation is Back

The problem is that politicians today have gained control of money and the days of Fed independence appears limited. Inflation has become entrenched, notwithstanding that it took almost a decade to erase the Great Inflation of the 1970s, built up by Lyndon Johnson’s “guns and butter” in the mid-60s. In the 70s, it was a matter of historical record that money supply could foretell inflation which forced then Chair Paul Volcker to jack up the Fed fund rate from 12 percent to 22 percent in 1979 to bring inflation down to 2 percent.

In 2019, former Fed Chairman Paul Volcker warned about America’s trajectory. He said, “Today we have something very different and far more sinister. Nihilistic forces are dismantling policies to protect our air, water, and climate. And they seek to discredit the pillars of our democracy, voting rights and fair elections, the rule of law, the free press, the separation of powers, the belief in science, and the concept of truth itself. Without them, the American example that my mother so cherished will revert to the kind of tyranny that once seem to be on its way to extinction – though sadly, it remains ensconced in some less fortunate parts of the world.”

No one listened then, nor now. The pitfalls are in plain sight. Milton Friedman, a renowned American economist and Nobel laureate, once referred to inflation as a "hidden tax," or taxation without representation. The historic record shows once loose, it is difficult to contain. Today’s stock market boom is a result of asset inflation everywhere. According to Friedman, an increase in the money supply causes inflation and price increases. Inflation is "always and everywhere a monetary phenomenon." Governments and the banking system are responsible for money growth. Banks lend that money, and the central bank encourages the creation of new money. In the past decade the Fed and other central banks were able to create money with a single click by purchasing large amounts of their government's debt, thanks to quantitative easing. And now the fiscal impact has supported asset prices, resulting in multiple asset bubbles, with money misappropriated on consumption rather than investment.

For almost a half century, money supply was the key determinant of inflation. Recently the broad money supply (money’s stock) measured by M2 has grown at an exponential rate hitting record $22.1 trillion in September with prices above the Fed’s target. Revered by Conservatives, President Ronald Regan in 1982 said about government spending, “all of this government spending and red ink can only spawn higher taxes and whopping deficits” which for nearly two decades led to inflationary increases in the money supply.

The White House on the other hand believes that Trumponomics can reduce the cost of living, yet policies from tariffs, to tax cuts, to immigration only serves to boost inflation, at a time when the government’s profligate spending reinforces the existing trend. Goldman Sachs estimated that US business bore about half of the increased costs of Trump’s trade war. America’s importers and consumers have absorbed an estimated $350-$400 billion cost. Mr. Trump has already rolled back tariffs on dozens of food products as his administration faces mounting pressure over rising prices. While Mr. Trump's extravagant One Beautiful Spending plan of tax cuts adds to the nation's debt, there is pressure to lower rates even though inflation is higher than the Fed's target. Consequently, his efforts to keep borrowing costs low, on hopes to grow their way out of debt, ensures that the real damage lies ahead. Mr. Trump has become the biggest spending president in history with his government finances in ruins. America is the victim here.

US Borrows, Borrows and Borrows

Some twenty-five years ago, the US government ran a surplus and the Congressional Budget Office (CBO), the nonpartisan scorekeeper projected that the Treasury would have enough revenues not to run deficits. They were wrong. The CBO projects fiscal deficits of roughly $1.8 trillion in 2026 or 8 percent of GDP, risking fueling inflation with debt costs exceeding $1 trillion. The non-partisan body expects that federal debt will be over 200 percent of GDP in less than 10 years. The US government now runs the highest deficits in the developed world and public debt is at an unsustainable 120 percent of GDP.

The problem is that the Fed has accommodated this spending by printing ever larger sums of borrowed money. The US is stuck in a debt trap but they are not the only ones. Internationally, dysfunction in Europe’s second largest economy has France’s debt at 113 percent of GDP and a deficit to GDP of 5.4 percent and again, the UK too is in crisis. Meantime the US dollar has slumped 9 percent as dollar usage declines. In a Trumpian world, fewer dollars are being used. Further, foreign banks are repatriating funds, in a reduction of risk to US assets as investors fear institutional damage with a political paradigm shift is now underway.

The federal budget deficit is projected at $2 trillion a year over the next decade such that the supply of treasury debt will reach bubble-like levels. When the government runs a budget deficit, it relies on borrowed money to fund itself. As deficits accumulate, the supply of new bonds grows exponentially, adding to the supply of debt. Of course, Trump’s tariffs are supposed to bring in revenues, but even today with US importing some $14 trillion, the incoming tariff revenues at $500 billion are not enough to finance the deficits. And despite the Roaring Twenties-type economy, budget deficits should be shrinking but instead are growing. True, revenues grew last year, but spending was even faster at more than $7 trillion. America’s deteriorating fiscal situation raises the risk of contagion and a depression.

Trump vs Xi

The US has paused its trade war with China, declaring a transactional truce after China weaponized their agricultural purchases and diverted soybean and canola orders to Latin America, resulting in a 53 percent collapse in exports in the first seven months of this year. Retaliatory tariffs also hurt US exports of the agricultural and technology sectors, America’s global strengths. Ironically in rolling back its tariffs, Trump’s “10 out of 12” China détente is simply a return to the status quo. The United States in turn suspended its blacklist on Chinese businesses, while China promised to resume purchases of agricultural products and postponed new controls on rare earth minerals. The trade détente however is to be reviewed on an annual basis, so the high-stakes rivalry will carry on.

The era of globalization under a US-led order is over and disruptive change is the new constant and more dangerous. We believe that the disruption age has generated risk, not reflected in the stock markets. The outlook has become more unstable, more dangerous, and riskier.

China’s global hegemony wasn’t built overnight, as they spent decades developing new technologies, green energy and products in a decarbonization effort. China makes more money exporting green technology than the US makes from exporting fossil fuels. The Financial Times also noted that China controls about 70 percent of rare earth mining, 90 percent of refining capacity and 93 percent of world’s rare earth magnet manufacturing which underpins technologies from smartphones to electric vehicles, fighter jets and most important semiconductors. During that time, the West’s indifference and cumbersome regulations hollowed out their mining industry. America’s attempt to stockpile critical minerals, build new supply chains, and processing facilities to reduce its dependency on China is overdue, but will take decades, billions and price floors. The US risks falling further behind, handing China another advantage but at least the face-saving one-year détente gives both countries time to come back another day.

Ironically, China has adopted America’s old time mercantilist approach, using trade, investment and economic dependency. While Mr. Trump borrowed from Beijing’s playbook, taking positions in Intel, TikTok and even financing Canadian mines. China’s choice of winners and losers led the way in decarbonization and by reducing its reliance on fossil fuels, led to supremacy in the electric vehicles, trucks, solar panels, and batteries supply chains. Today over 30% of the world's manufacturing comes from China, surpassing the combined production of Germany, Japan, South Korea, and the United States. Technology is a flashpoint. China was an early planner and shaped ecosystems within, and rather than subsidies, built up high-tech sectors such as semiconductors, robotics, quantum competing, and of course clean energy. The US only accounts for about 10 percent of Chinese exports. Who is in need of whom? That dominance makes the country bullet-proof against Mr. Trump’s tariffs and because of his view that climate chain is a hoax, fossil fuels have returned in a “back to the past” carbon move that will ultimately force the nation to become more dependent on expensive fossil fuels.

The decline of America is not one-off. Rome was once a superpower that ruled for centuries, until the military losses and profligate spending around 410 AD helped the demise of the republic. Great Britain too, once a superpower in its day, but World War I and spending bankrupted the country and after Churchill's death, the empire vanished. Today America is the superpower of this century, and after the collapse of that other superpower Soviet Union, both are attempting to become great again. But now, China has emerged as a strong competitor controlling everything from manufacturing, critical minerals and technology, yet in weaponizing their economic power, both superpowers risk falling into the Thucydides Trap.

Organizations like the Shanghai Co-operation Organization and BRICS have filled the void left by the US's retreat from its global position. China has boosted the renminbi involvement in trade and investment, reducing the country’s exposure to the dollar. China’s Belt and Road has extended China’s soft power, at the expense of “fortress America.” This transition is fueling trade, usage of the renminbi and reinforcing China’s supply chains and critical minerals dominance. Trade finance is only the beginning as China issued dollar bonds at rates equivalent to US Treasuries, accessing the US dollar system at will. A new monetary order has emerged, exposing America's vulnerability. As Mr. Trump reshapes global commerce, the US currency which formerly supported the global financial system and its institutions could trigger a global financial crisis with the risk of contagion not seen since the Great Depression.

New Gold Rush

Most dangerous is that Trump’s worldview is rooted in political change and world power competition. We think that past boom periods with easy money and lax lending criteria was the cause of past financial catastrophes and the problem is that the growing number of risks could cause as before, a systemic financial crisis. Trump’s tariffs are a start. US exceptionalism is taking many forms. The impact of tariffs to date is muted primarily because business absorbed the bulk of the increase, and importantly America’s largest importers such as Canada and Mexico have yet to sign a deal. Leverage too can lead to financial losses and with the largest debt in the world, America is a threat to the financial system. For years, it was assumed that debt does not matter but the scale of escalating risks, increases the volatility of the financial system, particularly when a good part of America’s population is exposed to the stock market. Gold will be a good thing to have.

The only certainty is uncertainty.

Consequently gold, the classic hedge against inflation and general chaos reached record highs at $4,400 per ounce, before pulling back, consolidating recent gains. Gold has taken a defensive rule, particularly with US – China tensions, and after years of deficit spending, investors and central banks have sought refuge in the metal.

After all gold's role has been a store of value for thousands of years. Gold was pivotable in the establishment of the US dollar as a reserve currency. In 1944, in Bretton Woods New Hampshire, the Federal Reserve promised to buy and sell gold at a fixed price of $35 per ounce and foreign banks pledged to keep their currencies tied to the dollar. The dollar was as good as gold since they could always be converted into gold, held at the Federal Reserve.

The economic order forged at Bretton Woods brought massive benefits to the US and the West, but then in the Fifties, the United States ran persistent balance of payments deficits with other countries, hollowing out America’s industrial base. The French complained about America's “exorbitant privilege” which allowed the US to pay for imports with dollars. Foreign central banks soon were left with surplus dollars even after they invested in America’s capital markets or debt. Then President De Gaulle from France, concerned of America’s deteriorating finances, demanded that their surplus dollars be converted into gold. The US resisted but a two-tier system emerged that allowed the price of gold to trade in the free market, with the official gold price pegged at $35 an ounce. However that agreement proved temporary, as the French swapped their official dollars for more gold and sold that gold in the open market at higher prices.

Consequently to stop a run on the dollar on August 15, 1971, President Nixon closed the gold window, defaulting and established a fiat currency (backed only by the good faith of the United States) in order to halt the panic. The gold price went from $35 to $800 an ounce in 1980 or 2,300 percent and as the free price of gold soared, the US dollar devalued further against the price of gold, losing its purchasing power. Since then, gold has topped $1,000 during the financial crisis of 2008-2009, $2,000 during the Covid pandemic, followed by a new peak at $3,000 on Mr. Trump’s Liberation Day. Risk? Gold is simply a barometer of investor anxiety. In all cases gold was a store of value. The currency of choice is trust. We believe that in a de-dollarized world, America’s dysfunctional finances and weaponization of the dollar will power gold even higher. The best lies ahead.

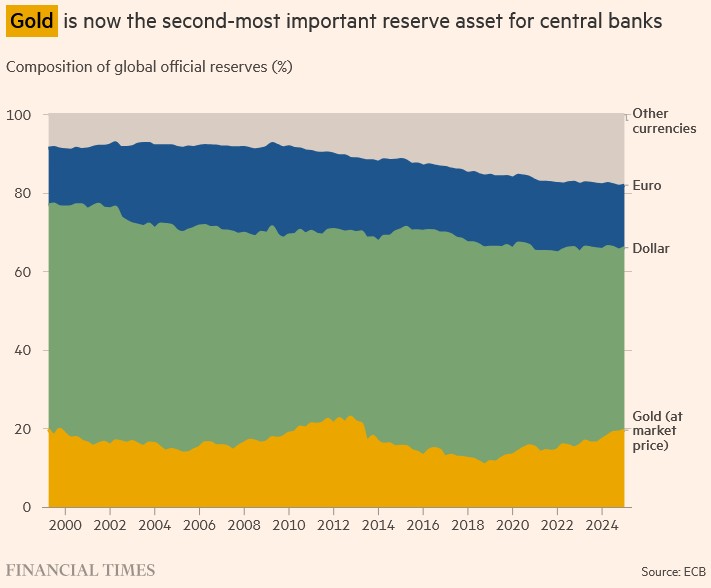

Meantime, geopolitical uncertainties have fueled a new gold rush. Central banks have purchased huge quantities of bullion, accumulating about 25 percent of the world’s supply in the last three years, reducing their reliance on the US dollar, rendered untrustworthy by strained government finances. Over the past decade, gold holdings have now surpassed US Treasuries as the second largest held in central bank reserves. We believe that geopolitical risks today is greater than ever and faced with these uncertainties, gold will record newer highs. Gold is the canary in the coal mine.

Meantime China keeps buying gold amid a fragile world economy and fears of a repeat of the beggar-thy-neighbor currency protectionism. At the same time, there is concern over the massive Keynesian stimulus from Mr. Trump’s fiscal remedy of lower interest rates which has unleashed the animal spirits in the stock market, increasing the risk of a bad ending. Amid trade tensions, China once held more than a trillion of US Treasuries and have been selling down their holdings for the fifth month in a row to $700 billion, resulting in higher bond yields and more costly for the federal government to finance its deficits. America is vulnerable, needing help to finance its deficits because at more than 8 percent to GDP, the country requires capital inflows every business day to pay its bills. China, the largest creditor in the world holds the Trump card.

Recommendations

Gold miners have been among the best performers this year as retail demand and M&A activity heats up. Third quarter profits have resulted in increases in returns to shareholders through share repurchases and dividend increases. Yet the stocks are still cheap, particularly when compared to the artificial intelligence sector. To be sure, gold’s recent pullback was overdue and is the pause that refreshes – a new trading range has been established. We continue to expect gold to reach $5,000 an ounce.

Gold’s record highs contributed to record cash flows for the gold producers. Nonetheless, gold shares have lagged bullion’s performance. While we expect gold to consolidate, gold shares will edge higher as investors increase their exposure to the gold miners. Reserves are declining and thus we expect a continuation of the hectic M&A activity. The gold miners’ free cash flow remains strong and unlike previous cycles, the gold producers have very little debt. Coeur Mining announced a $7 billion acquisition of mid-tier gold producer New Gold. The acquisition vaults Coeur into the senior category with almost 1 million ounces production but bigness is not necessarily best, particularly since New Gold’s assets are mature and high cost. The deal follows Fresnillo of Mexico surprising acquisition of Probe for almost $700 million that establishes a base in Canada. Nonetheless, not all acquisitions work. Newmont is still working out from its acquisitions. Barrick which resisted acquisitions for ages has seen its shares lag due to concerns of the lack of near-term growth outlook – that will change.

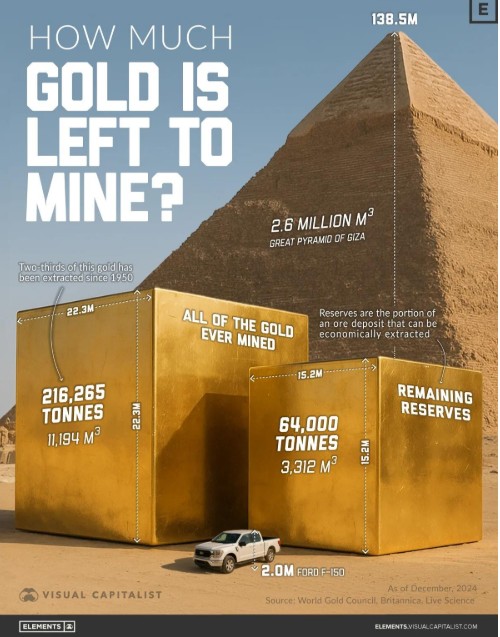

The issue is that as mines go deeper, grade in many cases have declined. To be sure the low hanging fruit has been plucked. In addition, there are fewer and fewer new deposits being found and given the fact that it could take up to 10 years from “first pick” to “first pour”, there is a dearth of discoveries and lack of new production coming to the market. However, the gold lining for the industry is that robust cash flows means an increase in exploration budgets, and eventually discoveries.

Consequently, we prefer the developers which have already discovered their deposits and are in different stages of production. We follow a group of 20 developers who have completed either PEA or feasibility studies and only need financing. Osisko for example has already arranged financing for Cariboo in the buildup stage. Others like Omai Gold Mines are completing an updated PEA that will make it an attractive acquisition tidbit. Concerning the senior producers, we like Barrick and Agnico Eagle. We continue to recommend the developers like B2Gold, Eldorado and Endeavour. Gold is the new critical mineral.

Agnico Eagle Mines Ltd.

Agnico reported record revenues of $3.1 billion and earnings of $2.16 per share. Canada's largest gold miner produced 867,000 ounces at a cash cost of $994/oz and AISC of $1,400/oz. Free cash flow was $1.2 billion and as a result, Agnico has a net cash balance of $2.2 billion. Agnico paid down $400 million in the quarter and the company focused on derisking its pipeline at Detour underground. Upper Beaver, Hope Bay and San Nicolás which could add an additional 1.3 million to 1.5 million ounces of potential production. Agnico also established an Underground School of Mines at Macassa to train local miners. Agnico should produce 3.4 million ounces at AISC of $1,300/oz among the lowest of its peers. Agnico is going ahead with underground development at Malartic and at Detour, the ramp’s portal is built. At Hope Bay, Agnico will release plans early next year for the mine to produce 400,000 ounces a year. Agnico has an extensive exploration program with 29 drills turning at Malartic, 9 at Detour, 12 at Macassa and 6 at Hope Bay. We continue to recommend the shares here.

Barrick Mining Corp.

Barrick reported operating cash flow for the first nine months of $3.5 billion, beating expectations. Production was up due to higher grades at Kibali, higher throughput at Cortez, Turquoise Ridge in Nevada and record high output at Pueblo Viejo. Barrick has outlined a “back to North America” strategy particularly with almost half of Barrick’s production from the Nevada Joint Venture, the world’s largest mining complex. The emphasis downplays Barrick's higher risk exposure at Reko Diq in Pakistan and West Africa. Mali remains an unresolved problem and priority, however. Barrick sold Tongon and Hemlo which were deemed non-core assets. Of note was that Barrick focused on 100 percent owned Fourmile, a potential Tier I asset which is outside the Nevada Joint Venture. Fourmile will be a significant company builder and after a feasibility study there is the option to vend into the Nevada Joint Venture of which Newmont has a 39 percent interest. We speculate that a vend-in could help consolidate Barrick's overall stake in the Joint Venture. Newmont also shares the Pueblo Viejo joint venture with Barrick and could be part of putting both companies under one roof, a dream of Peter Munk. We like Barrick for its long-term assets in particular for the outcome of Fourmile. Mark Hill, interim CEO has replaced Mark Bristow who spent nearly seven years consolidating and pruning, after Barrick bought Randgold Resources, an African focused miner that brought some Tier 1 assets and free cash flow. We continue to view the shares as a buy.

B2Gold Corp.

B2Gold reported earnings of $0.14 a share, and operating cash flow of $171 million in the quarter. Major contributions came from Fekola in Mali, Masbate in Phillipines and Otjikoto in Namibia. B2Gold commissioned Goose in Nunavut which is running close to its design capacity at 4,000 tons per day, producing between 50,000 to 80,000 ounces this year. Goose should produce about 250,000 ounces next year and 330,000 ounces in 2027. Goose will be a major contributor. At Otjikoto production, Antelope will increase gold production to 110,000 ounces over the life of the underground. B2Gold is in a strong cash position with $367 million at the end of the quarter. Fekola underground is wrapping up and this time B2Gold does not appear to have problems dealing in Mali with respect to permits. We like B2Gold here for its rising production profile.

Centerra Gold Inc.

Intermediate producer Centerra produced 80,000 ounces of gold and 13 million pounds of copper in the quarter. Mount Milligan in BC produced 10,500 ounces of gold and 13.4 million pounds of copper, generating $45 million in free cash flow. At Öksüt in Türkiye, the miner produced 49,000 ounces. Because of Mount Milligan's “life of mine” extension will take time, the company has dusted off the PEA for Kemess which is to be filed in the first quarter 2026. Goldfields in Nevada however is an exploration or early development play which is the problem because Centerra needs a flagship asset. Mount Milligan in the last quarter was disappointing due to lower gold recoveries as metallurgy was an issue as the company’s recoveries were surprisingly low due to higher ratios of pyrite. Meantime at Öksüt which is a heap leach operation, the results were affected by lower material on the pads. Meantime the restart of Thompson Creek is sucking cash. Centerra’s Molybdenum Business Unit (MBU) continues to be a drag on cash having a free cash flow deficit of $54 million. MBU produced 2.1 million pounds of molybdenum in the third quarter but contributed to the free cash flow deficit of $4 million. Consequently we prefer Eldorado here.

Eldorado Gold Corp.

Eldorado produced 190,000 ounces in the quarter, generating free cash flow of $77 million, with contributions from Lamaque and Kışladağ in Türkiye. Efemçukuru had a solid quarter. However Olympia in Greece had a disappointing quarter. Kışladağ also had fewer ounces due to sequencing. Importantly, Eldorado’s big development project, Skouries in Greece will come on stream the first quarter next year with full production by mid-year. Skouries is about 73 percent complete. Eldorado has advanced capital investment between $440 million and $470 million accelerating the work. Noteworthy was that the earnings reflected an unrealized loss of $22 million on derivatives due to swaps. Nonetheless, underlying free cash flow was positive. Eldorado's balance sheet remains strong with liquidity of $1.1 billion. Lamaque delivered 46,823 ounces at a cash cost of $767/oz due in part to the processing of a bulk sample at Lamaque. Overall Eldorado should produce between 470,000 and 490,000 ounces this year. Eldorado’s new president Christian Milau will replace George Burns later this year. We like Eldorado here.

Endeavour Mining PLC

Endeavour Mining came out with robust numbers due to strong cash flow generation and increased production. The company reported free cash flow of $680 million for the first three quarters of the year. Gross debt was reduced by $678 million after repaying the revolver. The sterling results came despite that production was lower due to lower grades. Contributing to results were Sabodala-Massawa. Endeavour reported that its flagship Sabodala-Massawa is under the mining code back to 2013 which extends to 2040. Endeavour's pipeline includes the underground potential at Sabodala-Massawa and Assafou in Côte d’Ivoire. Endeavour will reach the top end of their production guidance producing 911,000 ounces at an all-in sustaining cost of $1,362/oz. Endeavour is the largest gold producer in West Africa and we continue to like the shares.

IAMGOLD Corp.

IAMGOLD had a strong quarter with free cash flow of $293 million, allowing them to reduce debt by $210 million to $813 million at the end of the third quarter. Adjusted earnings per share was $0.30 with Côté Gold producing 106,000 ounces due to increased throughput. Westwood produced about 43,000 ounces but costs remain a problem. Essakane in Burkina Faso produced 108,000 ounces on a 100 percent basis. IAMGOLD expects to achieve its guidance this year with Côté producing 360,000 to 400,000 ounces on a 100 percent basis. Westwood will produce around 125,000 ounces for the year, but all in cost is almost $1,900/oz. Mine grade at Côté was 0.96 g/t in line with expectations and the company’s maintenance shutdown in August went well. IAMGOLD plans to add an additional compressor for the quarter which should improve operations. Significantly, IAMGOLD made a $267 million acquisition of Northern Superior whose primary asset is a deposit about 8km northeast of IAMGOLD’s Nelligan and Monster Lake assets. The acquisition gives them more land and Nelligan with a 3.1 million indicated resource and Monster Lake 15km north of Nelligan could assist in Nelligan’s development plan. Although IAMGOLD should produce 775,000 ounces this year, yet we prefer B2Gold here.

Kinross Gold Corp.

Kinross produced 504,000 ounces generating free cash flow of almost $700 million for the quarter. Kinross has approximately $1.7 billion in cash and a strong balance sheet. Paracatu in Brazil will deliver 600,000 ounces this year and produced 150,000 ounces in the quarter. At Tasiast in Mauritania, the mine produce 121,000 ounces in line with guidance and La Coipa produced 58,000 ounces. Fort Knox and Manh Choh produced 96,000 ounces. The strong results enabled Kinross to repay $700 million. Of note, the Great Bear project in Ontario remains on schedule for first production in 2029 but two important permits could delay the start. Total capex is $1.1 billion. Near-term, Kinross is working on Curlew, Redbird2 and Phase X. At Round Mountain, underground development is progressing to extend Round Mountain’s life. Kinross has a resource base of 26 million ounces but the company is looking for a near-term boost with its array of mature mines. Great Bear is still too far off and given its flat outlook, we prefer B2Gold here.

Lundin Gold Inc.

Lundin Gold had a strong quarter producing 122,000 ounces at an robust average grade of 8.9 g/t. Both mining and milling set records with record throughput at 5,300 tpd. Lundin is on track to meet guidance. Importantly with one of the highest grades in the world, all-in cost was under $1,000/oz. Importantly Fruta del Norte generated $216 million in cash flow. Company shed some light on its copper/gold porphyry discoveries at Sandia, Trancaloma and Castillo suggesting that the area is developing into a mining district. In addition, the company has plans to add two levels of underground development to support FDN South, with a maiden resource of over 2 million ounces. Lundin’s exploration program was boosted from 80,000 meters to 120,000 meters. We continue to like the shares here. Buy.

McEwen Inc.

Developer McEwen reported a small loss in the quarter, due largely from a net loss at subsidiary McEwen Copper in Argentina. McEwen Copper is being developed with a feasibility study planned for next year. Los Azules is one of the world’s largest underground copper deposits that could produce 204,000 tons of copper per year in the first five years. McEwen ended the quarter with $51 million in cash and $24 million in marketable securities which is sufficient to finish the Stock ramp and heap leach pad expansion at Gold Bar. McEwen also announced the acquisition of Canadian Goldcorp with the company planning to develop the former Tartan Lake mine in Manitoba next year. McEwen also made an investment in Paragon Geochemical Labs a photo-assay technology company that will turnaround assays in minutes rather than the days or weeks to get assays.

New Gold Inc.

New Gold had a strong quarter generating record cash flow of $205 million and earnings of $0.18 per share. Rainy River produced 100,000 ounces of gold for a 63 percent increase over the second quarter and New Afton generated $30 million in free cash flow. The steller results allowed the company to repay $260 million in debt and New Gold expanded the C-Zone at New Afton and K- Zone at Rainy River. Both investments will take time and money which will now fall to Coeur Mining which has made an all stock $7 billion takeover bid for New Gold. While Coeur hopes to produce over 1 million ounces which will elevate them to “senior producer” category, we caution that does not necessarily make sense in this case. We believe the combination is probably 1 and 1 makes 11/2 as New Gold's assets are sub-prime and require funding to achieve optimum. Not all takeovers are alike – ask Newmont. Sell.

Newmont Corp.

The world’s largest miner, Newmont reported record cash flow of $1.6 billion, ending the quarter with near zero debt after retiring $2 billion. Production was largely in line with the second quarter and improvements from Cerro Negro helped results. However Peñasquito has its best behind, as mine sequencing will see less gold due to projected polymetallic recoveries next year. Ahafo South also declined in production, offset by bringing on Ahafo North. Simply Newmont is a company in transition after attempts to clean up the mess created from the acquisitions of Newcrest and Goldcorp. Nonetheless Newmont has a strong balance sheet with $5.6 billion of cash against $5.4 billion in debt. Tom Palmer will retire to be replaced next year by Natascha Viljoen who faces the task of bringing down high costs, disparate mines and a flat mining profile. We prefer Barrick here.

*******