Gold & Silver: Correlations That Matter

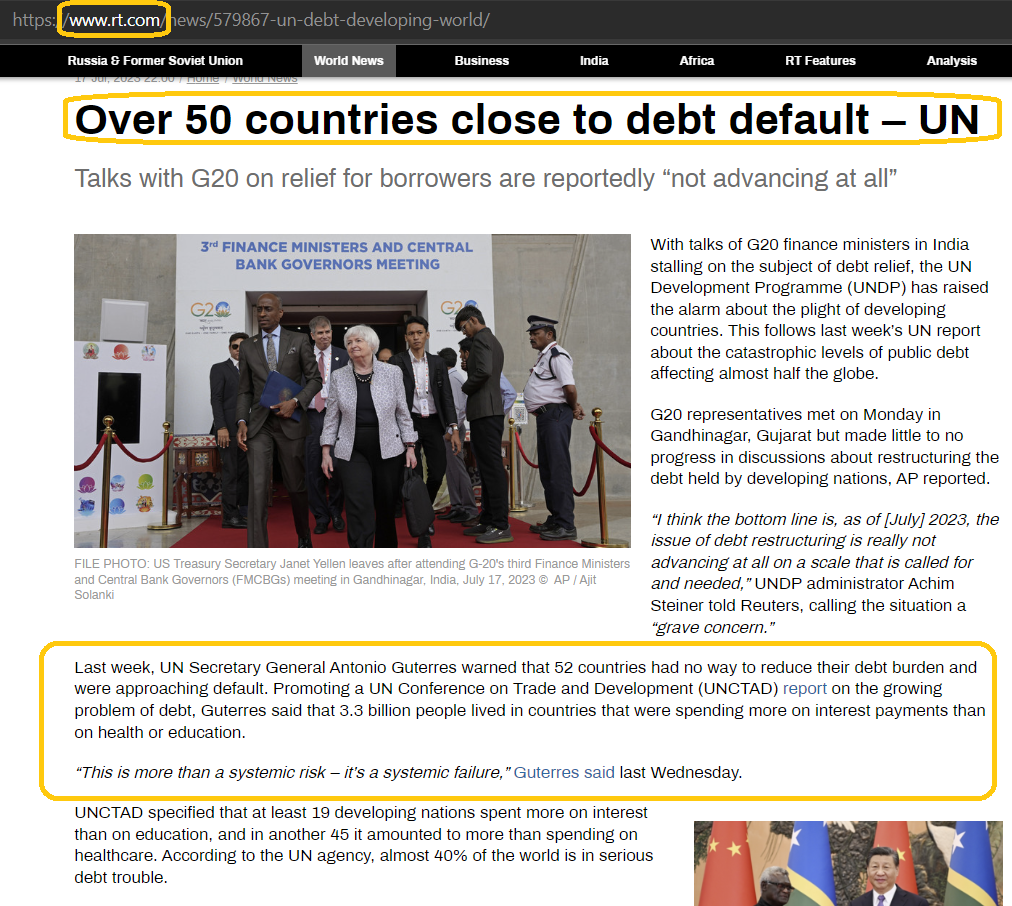

Are fiat and debt planet Earth’s two main pillars of evil?

They likely are, and for a look at this evil in detail:

While billions of citizens grovel for food, medicine, and education, their greedy governments inject themselves, and the citizens, with fiat heroin and debt cocaine.

The wages of fiat and debt are the impoverishment, sickness, and ultimately the death of citizens, in an array of nations around the world.

American citizens are told by their government that this horror can’t happen to them. They are promised that they are, “The Greatest!” and “Number Fiat One!”. They are told to shout these ego-infested slogans at the rest of the world, and a few of them are silly enough to do it.

If the stock market goes up and the carnage from their government’s wars stays out of the homeland… gullible citizens of the late-stage American empire believe the “Everything is awesome, and anything bad that happens is not our fault!” gibberish that they are spoon fed by their government.

In the global gold community, these silly logans don’t mean much. It’s gold versus fiat trench warfare.

Double-click to enlarge this US fiat chart.

While many analysts are excited about the “break” of the key 100 support zone, basis Edward/Magee, minor trend rallies often begin right after a new low is made…

And that could be the case with the dollar right now.

Double-click to enlarge this weekly chart. Note that the dollar went to a new low, but gold didn’t go to a new high.

Double-click to enlarge. The dollar index is mainly about the dollar and the euro. Sometimes it correlates perfectly with the gold price… and sometimes not.

Double-click to enlarge. Gold and US interest rates are much more correlated than gold and the dollar.

For another look at gold and rates:

Double-click to enlarge. It appears that Fed boss Jay wants to do one hike next Wednesday (July 26), and then a couple more later in the year.

If Jay holds to that path, gold likely continues its current rally against fiat until around September or October.

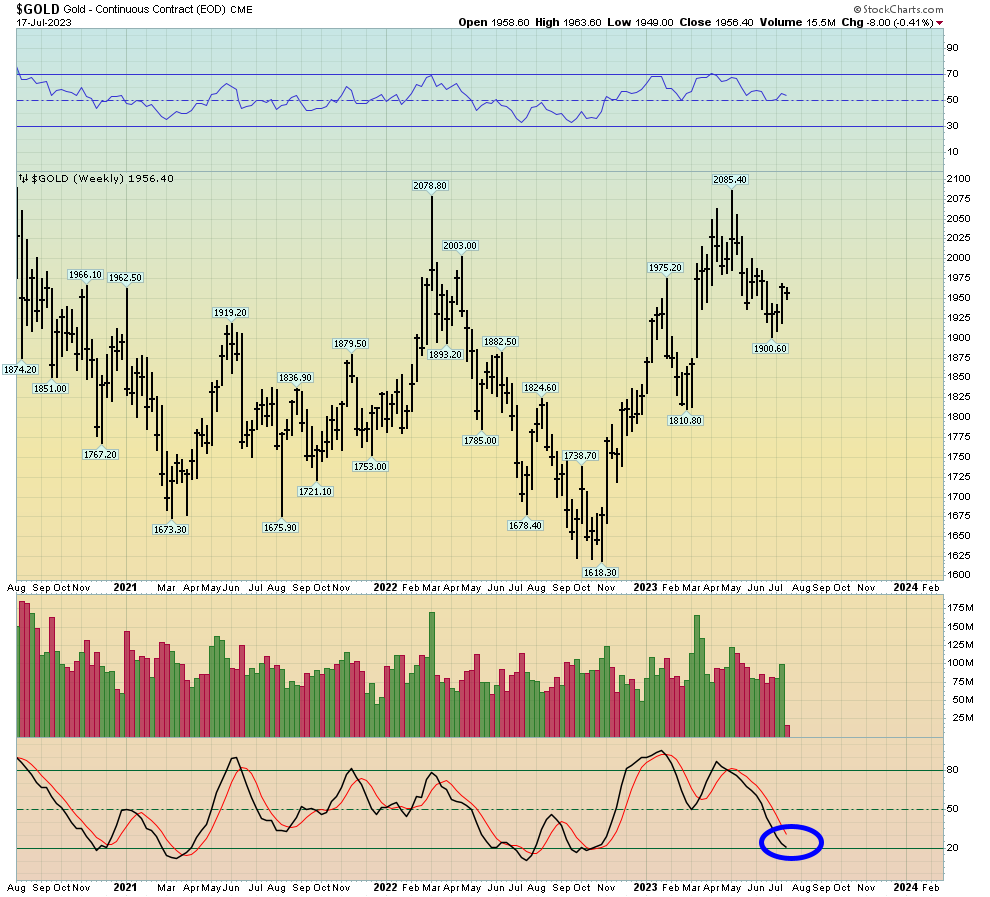

Double-click to enlarge this important weekly gold chart.

I would urge all gold bugs to focus on my 14,5,5 Stochastics oscillator at the bottom of the chart… and on next week’s announcement from Jay.

Gold is vulnerable in the short-term, but if Jay announces a significant pause in his hikes (as this chart suggests he will), a Stochastics crossover buy signal and a barnburner of a rally for gold is highly likely.

Double-click to enlarge this weekly T-bond chart. Note the fabulous position of the Stochastics oscillator. It’s in perfect sync with the gold chart and my suggested path for Jay!

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week with updates like this one, in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about the miners?

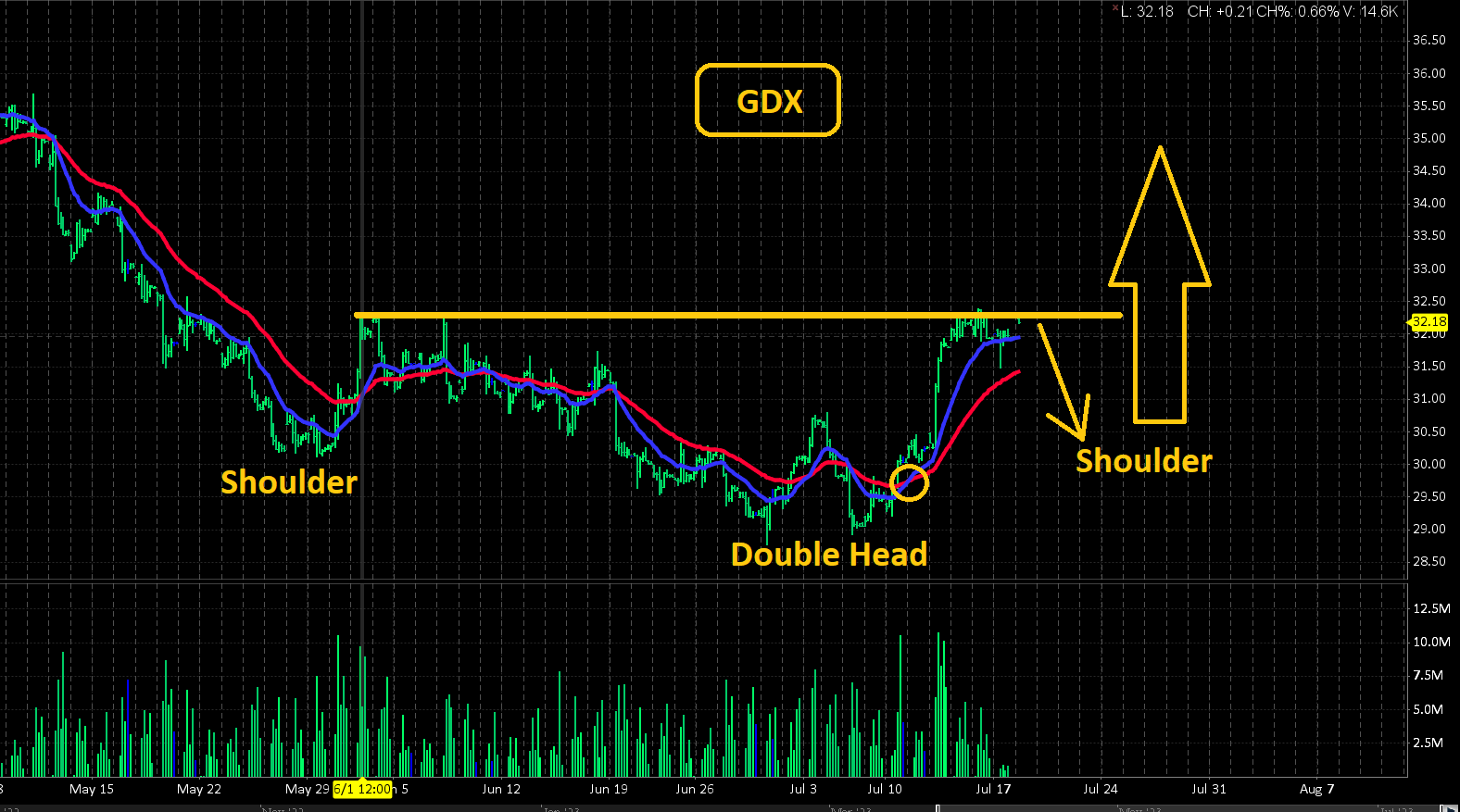

Double-click to enlarge this magnificent short-term GDX chart.

The miners could keep rallying from here, but a pullback is likely either before or as Jay makes his announcement.

The good news is that the pullback would create a right shoulder of a very nice inverse H&S bottom pattern.

Also, note the solid position of the 10,25 Wilder moving averages. The current buy signal would likely hold as a right shoulder forms.

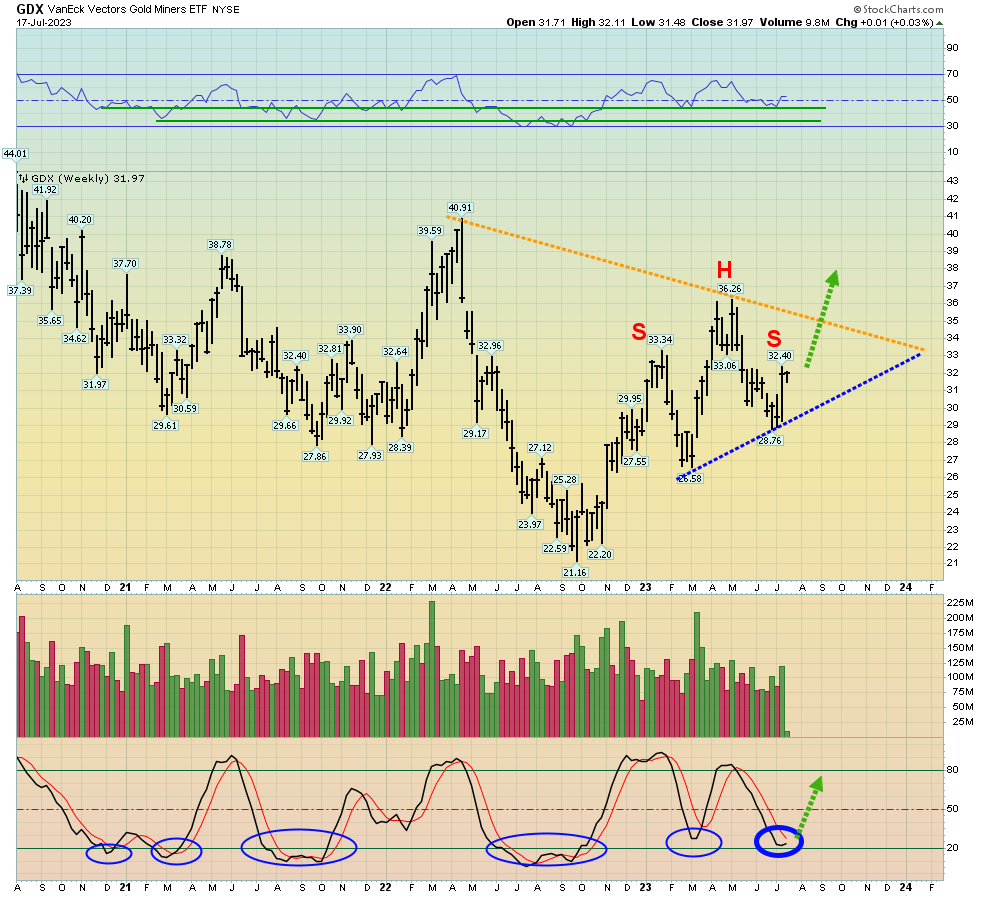

Double-click to enlarge. The weekly GDX shows the Stochastics oscillator in the same fabulous position as for gold, and arguably a bit better.

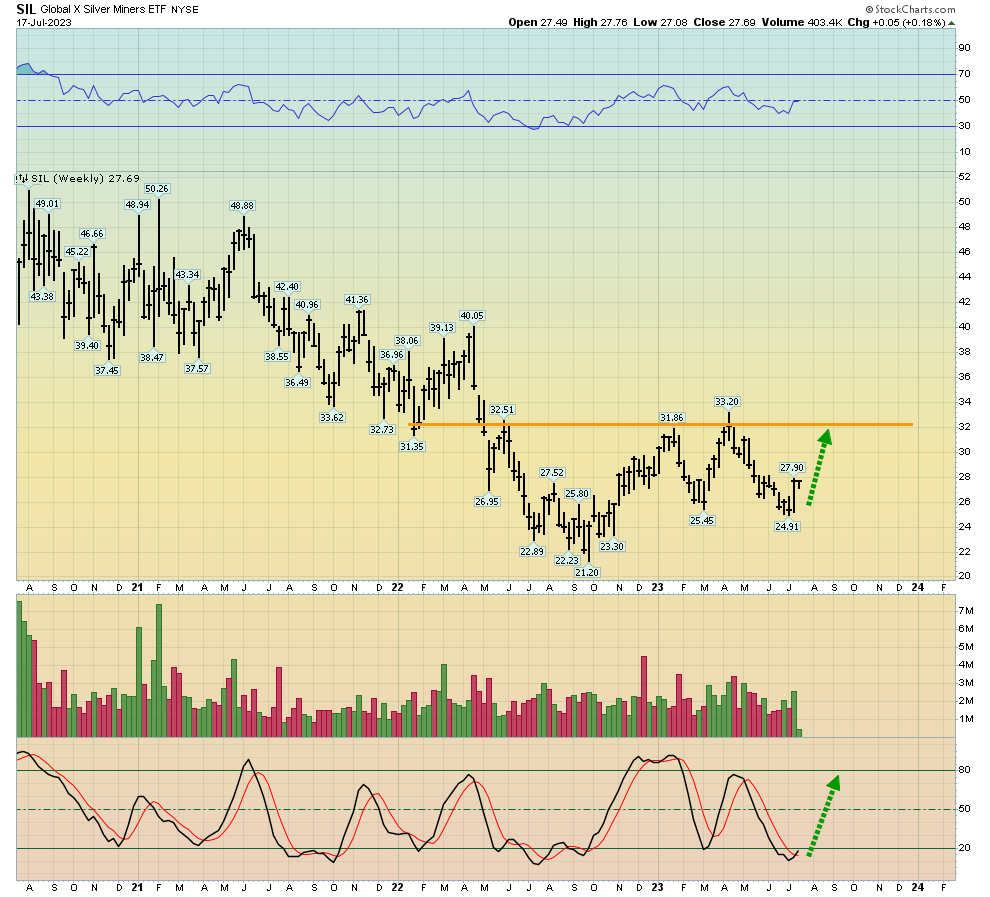

What about the silver miners?

Double-click to enlarge. The weekly SIL chart is the best of the bunch. A Stochastics oscillator cross is already in play, and it makes sense… as silver bullion has recently been even stronger than gold!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: