Gold Speculators Pushed Bullish Bets Higher Last Week

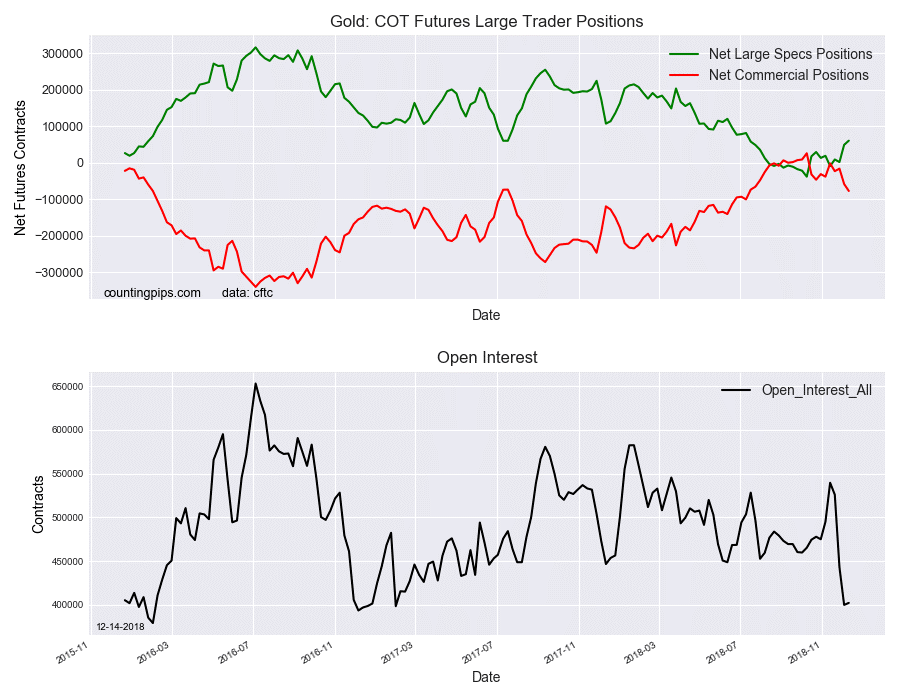

Gold COT Futures Large Trader Positions

Gold Non-Commercial Speculator Positions:

Large precious metals speculators raised their bullish net positions higher in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 60,499 contracts in the data reported through Tuesday December 11th. This was a weekly rise of 11,498 net contracts from the previous week which had a total of 49,001 net contracts.

This week’s net position was the result of the gross bullish position sliding by -3,419 contracts to a weekly total of 169,600 contracts compared to the gross bearish position which saw a decline by -14,917 contracts for the week to a total of 109,101 contracts.

The speculative net position rose for a second straight week and by a total of 58,628 contracts over that period. The current standing is now at the highest bullish position since since July 10th when the net position totaled 81,434 contracts.

Gold Commercial Positions

The commercial traders’ position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -77,368 contracts on the week. This was a weekly drop of -19,119 contracts from the total net of -58,249 contracts reported the previous week.

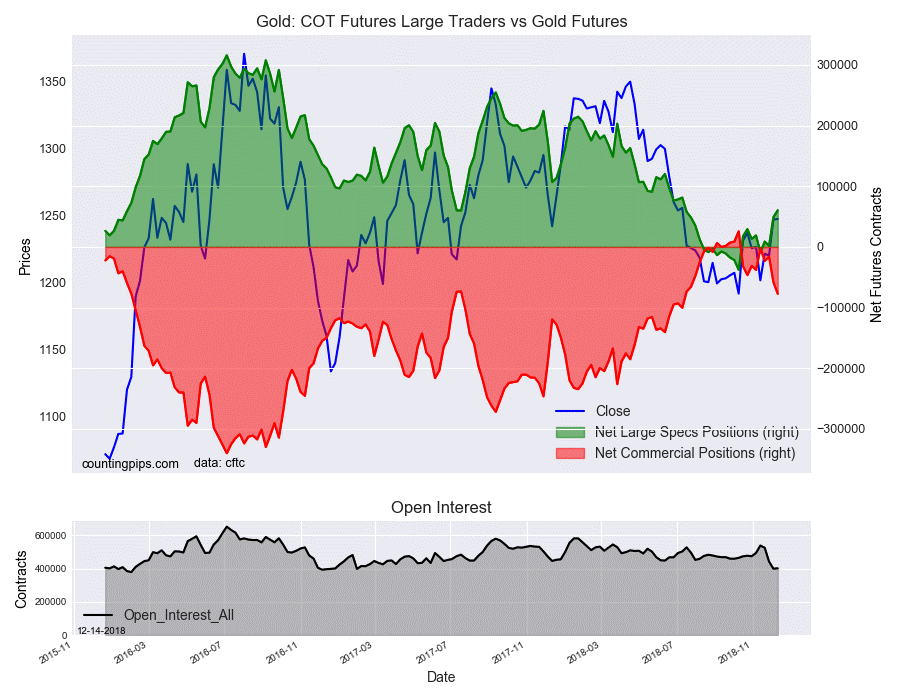

Gold COT Futures Large Trader Vs Gold Futures

Gold Futures

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1247.20 which was an increase of $0.60 from the previous close of $1246.60, according to unofficial market data.

*********