Gold Stock Outrageously Bullish ETFs

Global fundamentals for gold are bullish. Let’s do a quick review of the facts.

Global fundamentals for gold are bullish. Let’s do a quick review of the facts.

Narendra Modi has been elected to build gold-obsessed India into the world’s largest economy.

In China, the government’s plan to transition the economy from export-based to consumption-based is proceeding well, with only a tiny drop in GDP occurring.

In Europe, Mario Draghi is considering implementing QE, and he’s committed to doing “whatever it takes” (money printing) to increase growth there.

In America, Janet Yellen is a dovish Keynesian. Her important 2007 research paper links higher inflation with higher real employment. To review it, please click here now.

In Iraq, Exxon is evacuating personnel. The Kurds, ISIS, and the national government are all fighting each other, while America’s government says they are “monitoring the situation”. The Ukraine situation seems to be worsening on a daily basis. Clearly, the geopolitical price drivers for gold are bullish.

With almost all fundamental and geopolitical lights for a higher gold price flashing green, I’ll argue today that the technical lights are just as green.

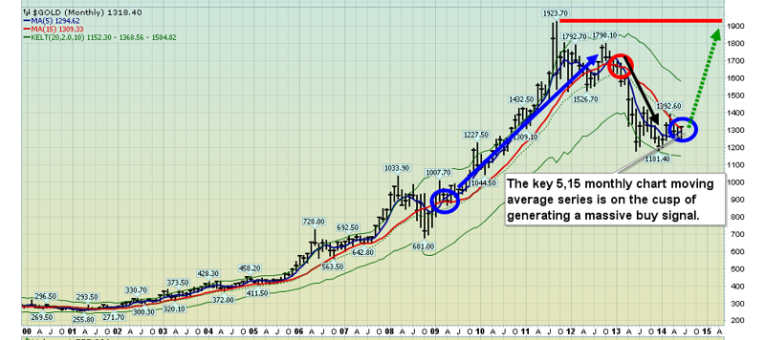

Professional investors don’t make a lot of predictions. They lay out possible and likely scenarios, and allocate risk capital only on serious price weakness. This monthly chart, and the HSR zones on it, should be the foundation of all technical analysis about gold.

What is HSR? Well, HSR is horizontal support and resistance.

Gold declined into key buy-side HSR in the $1228 area twice in 2013, where I immediately “ordered” my subscribers to buy, regardless of the pain threshold. I often refer to my subscribers as financial marines.

I use the 5,15 MA (moving average) series to project possible price trends of size, but not to place capital. Substantial capital has been placed by myself and my subscribers in the $1228 area, with an emphasis on gold stock rather than bullion, and now the key 5,15 MA series is on the verge of flashing a massive uptrend signal.

The above chart is my professional opinion, for the most likely big picture scenario for gold.

In 2009, I suggested that a huge inverse H&S bull continuation pattern was forming on the gold chart. It had “outrageously bullish” implications. I believe a much bigger inverse H&S bull continuation pattern is forming now on the monthly gold chart.

If I’m correct, the “bare minimum” arithmetic target is: $2663. I think my target price is absolutely justified by the global fundamental and geopolitical price drivers.

What about the shorter term picture? A bullish flag pattern is in play for gold on this daily chart. That follows a powerful upside breakout from the sizable (and bullish) green wedge pattern.

If the flag pattern fails, I think that failure would create a bullish inverse H&S bottom pattern.

Rather than bullion, my buy-side emphasis in the $1228 area has been gold stock. This weekly ZJG-TSX chart shows the price action of junior gold stocks. The chart is “over the top” bullish. Note the sizable bullish non-confirmations taking place on almost all the technical indicators and oscillators.

Volume is immense, and it’s increasing with the rally from the right shoulder low, something that Edwards and Magee outline as highly significant, in their “Technical Analysis of Stock Trends” handbook.

This weekly GDXJ chart has a record-size bullish volume bar. All of the technical indicators and oscillators suggest that the key highs in the $46 and $54.56 areas will be exceeded.

This Global X Gold Explorers ETF, GLDX, suggests that gold exploration companies are poised for a spectacular upside breakout, targeting the $37.64 area highs of 2012.

Companies that have minimal hedging programs, or none at all, seem to be leading all gold stocks, from the standpoint of relative strength. This Pure Gold Miners ETF weekly chart (GGGG-NYSE) is important. The rally from the head of the base pattern to the $14 area exceeded the rally to $13.84, from the left shoulder.

Gold stocks attract momentum-oriented hedge funds, when they trend with higher highs and higher lows, and so the Pure Gold Miners fund is already technically in an uptrend.

Note the bullish blue wedge pattern that formed the right shoulder. If unhedged gold stocks are poised to do best in the coming months, does that mean gold itself is likely to move much higher in price? I think so.

The Western gold community loves junior gold stocks, and the charts of key junior gold stock ETFs suggest that substantial financial rewards for loyal shareholders, are now on the way.

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Silver Super Stars” report! I’ll show you which silver stocks appear poised to substantially outperform their golden brethren!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: