Gold Stocks, What to Do Now?

Introduction

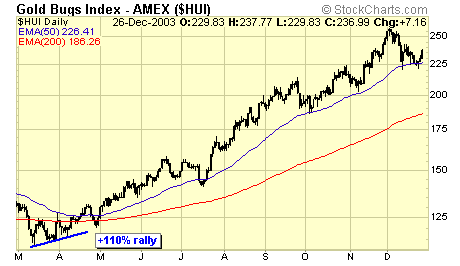

We have just witnessed one of the biggest crash in the stock market and yet nobody is talking about it. No, you won't see it on CNBC. Because, frankly, who cares about the gold bugs. The $HUI has lost 30% since Dec, almost equal to the Nasdaq meltdown of 2000 when it lost 40% during that fateful spring. It made headlines across the globe. But gold bugs are suffering in silence, and there is no support group or therapy available....... Amazingly, many of my colleagues are defiantly bullish, suggesting to their readers to hold, or even buy more, in anticipation of a resumption of the bull market. I'm afraid that is not my style. If there is one thing I can promise you, it is that I will never allow my subscribers to suffer a huge drawdown, or taking major losses in double digits. I don't mean to sound bearish, but technically, there is absolutely nothing bullish about the current metals market. A lot of damage has been done, and it will take time to turn this market around. Of course, I'm alert to take a trade if we have a potential tradable rally, and that is what this 2 part series on my approach to the $HUI is about.

The tops down approach

The tops down approach allows us to see the market as is, and not to get excited about the intermediate and long term prospect. Yup, no more "to da moon" for a while.

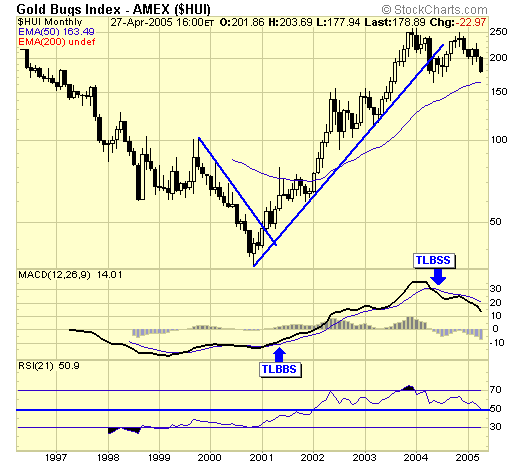

Long term

Sure, nobody trades off the monthly chart, but it clearly shows the three year uptrend is over. Its been over since spring of 2004.

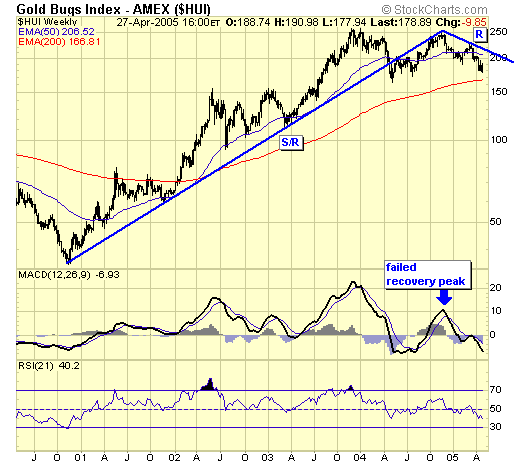

Intermediate term

Weekly chart shows the break of the uptrend clearer, with the subsequent "kiss" of S/R (support becomes resistance), resulted in a failed recovery in Nov, and its been down hill since. As a technician and a gold bull, I cannot be excited until the R is broken at the minimum, and will keep the champagne on ice until a new high. But that could be a long time away, what do we do now?

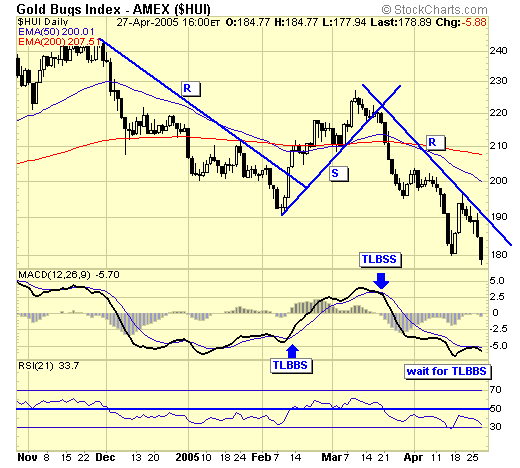

Short term

From the short term perspective, a simple way to trade is to simply trade: buy (long) the TLBBS and sell (short) the TLBSS. Use a tight stop and trade ETFs such as GLD, ASA, and XGD.TO. Avoid individual stocks as stock picking in a down trend could be disastrous, we will never know which stocks blow up and which do not. Picking a bottom of a tradable rally requires precision, and the bottoms up approach will help to recognize them.

The bottoms up approach

I have made some clear observation these past four years in the metals market, and can recall distinctly each intermediate bottoms, and would like to share these observations with you. The bottoms up approach allows us to take some tradable rallies, by recognizing them early so that we can be more agressive and defensive at the same time, meaning cutting losses early, and taking profits early. And this requires flawless execution, a great learning experience for those who are relatively new to trading.

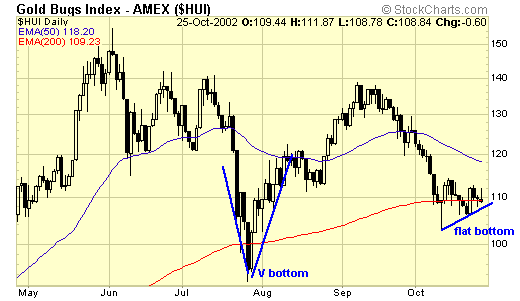

Flat bottoms

Well, they are not exactly flat. When the market bounces up sharply at an oversold level, likely to be triggered by short covering, then pulls back and corrects about 50 to 62% of the gain, and rallies from there. These flatter bottoms provide excellent support, and low risk since a break of this new support will invalidate the trade and we are out flat (puns intended) or with a small loss. But often, these flat bottoms result in significant rallies and profits.

The "V" bottoms

V bottoms are sharp rallies off oversold levels, without a pullback like the flat bottoms, until after a significant rally. Traders end up chasing these V bottoms, and subsequently get whipsawed as these sharp and fast rallies are unsustainable, thus ended up with little or no profits, and often losses.

Summary

Technical analysis can be very simple and effective, if we only know what parameters to use, and what to look for. Unfortunately, it takes years and years of actual losses, endless research and studies, and many sleepless nights before a decent working model is borne and profits begin happening. And the most unfortunate thing is, most traders have either given up, or have lost most of their trading capital before success is found. The meltdown in tech has destroyed many promising careers, and the current metal stocks meltdown are incurring some heavy damages to the industry, far more than our eyes can see. As my subscribers, I cannot promise you double digit return every year, but you have exclusive access to everything I do everyday, and my guidance to help you enter and exit the markets, whether it is for a profit or a loss. The current condition of the metals market certainly does not allow "buy and hold", simply because we don't know how low it will go, or even if we are still in a bull market. By approaching the market from both the top down and bottom up, we know what the limitation is, and how we can quickly seize those short term tradable rallies, and take profits aggressively, and not in hope that the market can only go higher.

Jack Chan at www.traderscorporation.com

28 April 2005