Gold SWOT: According To UBS, Diamond Fundamentals Are Improving

Strengths

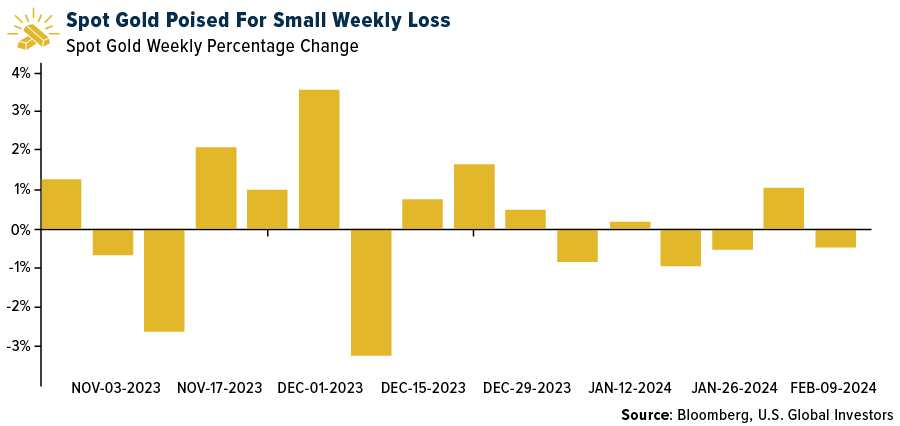

- The best performing precious metal for the week was gold, but still down 0.69%. Gold has found friends with central banks around the world. China added nearly 300 tons of the yellow metal in its fifteenth consecutive monthly purchase. Iraq’s central bank increased its gold reserves last month and plans more purchases this year, according to a senior official. The country bought nearly 2.3 tons of bullion at the end of January at an average price of $2,037 per ounce, bringing total holdings to 145 tons, said Mazin Sabah, director general of the central bank’s investments department. Future purchases will take Iraq’s holdings to a record, he said, as reported by Bloomberg.

- Platinum costs more than palladium for the first time in over five years, driven by its growing use in auto catalysts for gasoline-powered cars. Both metals have come under pressure this year as consumers drew down stockpiles built following the invasion of Ukraine, but palladium has suffered the most, sliding almost 20%. Its longstanding premium to platinum has caused automakers to increasingly substitute it for the cheaper metal, as reported by Bloomberg.

- According to UBS, diamond fundamentals are improving after the mid-stream destock in the second half of 2023 and prices are stabilizing following the Indian import freeze in Oct/Nov-23; prices are expected to remain stable during the first half of this year, while rough producers destock and lift in the second half. Jewelry retail sales growth is expected to normalize in the U.S. in 2024 with India to remain strong and China weak.

Weaknesses

- The worst performing precious metal for the week was palladium, down 8.85%, as it now trades just below platinum. Analysts expect the supply of palladium to rise relative to a less certain growth profile for platinum, as reported by Bloomberg. Gold dropped as Federal Reserve Chair Jerome Powell said that investors may have to wait beyond March for the U.S. central bank to cut interest rates, aiding Treasury yields and the dollar. Spot bullion dropped below $2,030 an ounce after CBS aired a 60 Minutes interview with Powell, which was conducted Thursday, in which he again signaled that a move to ease policy in March was unlikely, although reductions later in the year were on track.

- According to Bank of America, the World Gold Council (WGC) released its fourth quarter 2023 and full-year 2023 Gold Demand Trends report on global gold market demand and supply. Gold consumption demand declined 11%, or 140 tons to 1,190t in Q4. Exchange traded fund (ETF) outflows continued for the seventh quarter in a row with Q4 totaling 56 tons. Retail investment was also down 7% or 23 tons to 582 tons.

- Some Russian banks appear to have maneuvered around a ban on shipping dollars and euros to the country by trading gold in the United Arab Emirates and Turkey, according to research from a financial-intelligence company. The sanctions on the export of banknotes were introduced after the Kremlin’s invasion of Ukraine. The report, compiled by Sayari, found that in the first quarter of 2023, the financial institutions — which include Lanta Bank JSC, whose owners control gold miner GV Gold, and at least one lender that is not sanctioned — imported more than the equivalent of $82 million in euros, dollars, and UAE dirhams. The data shows that several of the same entities used to ship cash to Russia also imported gold from Russia within similar timeframes.

Opportunities

- Kalamazoo Resources says that an option agreement was signed with De Grey Mining to acquire its 1.44Moz Ashburton Gold Project by the payment of an option fee of A$3 million cash. Kalamazoo has granted De Grey exclusivity for 12 months, with the right to extend it for a further six months.

- Scotia anticipates most miners to post slightly stronger fourth quarter 2023 financial results driven by a meaningful improvement in operating performance as commodity price changes were muted. Although guidance risks remain skewed to the downside given the challenging operating environment, most miners have already pre-released 2024 guidance, limiting potential disappointment.

- Red 5 (RED) and Silver Lake Resources (SLR) have agreed to merge via Scheme of Arrangement, subject to SLR shareholder approval. RED will acquire 100% of SLR, with SLR shareholders to receive 3.434 RED shares for every one SLR share. Resultant ownership in the merged entity will be RED shareholders 52% and SLR shareholders 48%. Assuming the merger completes, RED (the surviving entity) would have a market capitalization of $2.2 billion and be a top 5 ASX gold company in terms of production, resources (12.4M ounces) and reserves (4M ounces) and have a net cash position of $235 million.

Threats

- According to UBS, lab-grown diamonds supply for jewelry has doubled every two years since 2015 reaching 20M carats in 2023 (versus natural 120 million carats); the expert expects it to double again over the next two years, value penetration will likely reach 20% of global diamond jewelry demand; of this $10 billion is expected to take sales from natural stones with the remainder creating new sales. Lab-grown diamonds generally carry higher merchandise margins relative to natural diamonds and other precious metals jewelry given a lower production cost.

- De Beers expects any recovery in the beleaguered diamond market to be slow and gradual as the industry continues to suffer from weak economic growth in key markets such as China and the U.S. The sector almost came to a complete standstill in the second half of last year as De Beers and Alrosa PJSC — the two biggest miners — all but stopped supplies in a desperate attempt to stem a slump in prices.

- According to Morgan Stanley, President Andres Manuel Lopez Obrador (AMLO) of Mexico presented Congress with a draft of 20 proposed reforms to the Mexican Constitution. The proposals include two reforms for the mining industry and three for the railway sector. On the mining side, the proposed changes call for the prohibition of concessions i) for open pit mining and ii) in areas that suffer from a scarcity of water.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of