Gold SWOT: Is Gold’s Record-setting Rally Starting A Consolidation Phase?

Strengths

- The best performing precious metal for the past week was palladium, up 1.85%. Senators Steve Daines and Tim Sheehy, along with Montana's congressional delegation, have introduced the bipartisan Stop Russian Market Manipulation Act (S. 808) to ban imports of critical minerals—including palladium, platinum, and copper—from Russia. This legislative move aims to counteract Russia's market manipulation tactics, which have led to a significant drop in palladium prices and subsequent layoffs at Montana's Sibanye-Stillwater Mine, the only primary producer of platinum and palladium in the U.S. By promoting domestic mining and reducing reliance on foreign sources, the bill seeks to bolster national security and support American jobs.

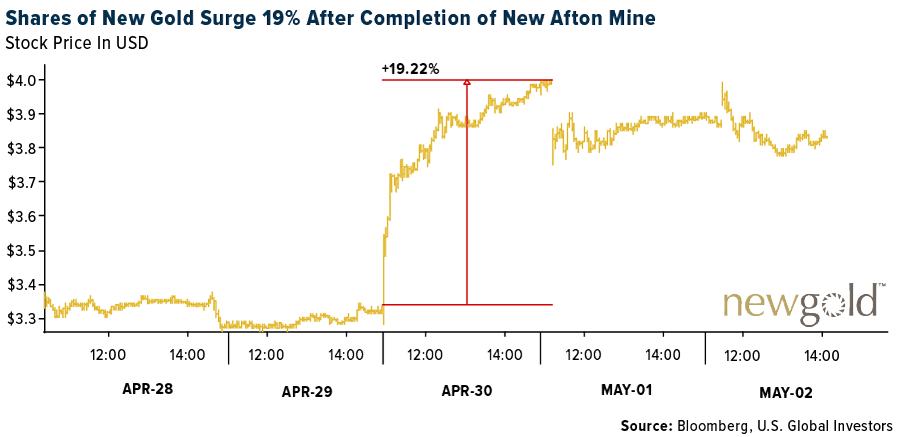

- New Gold’s shares surged as much as 19% this week after completion of the $300 million acquisition of the remaining 19.9% free cash flow interest in its New Afton mine, consolidating 100% ownership and eliminating dilution risk. The move came alongside solid first quarter results, including $25 million in free cash flow and strong copper by-product credits, reinforcing how earnings quality and cash flow generation are driving investor confidence. Analysts at RBC and National Bank reaffirmed their “Outperform” ratings, citing the strategic consolidation and improved financial outlook.

- Gold’s record-setting rally appears to be starting a consolidation phase that often happens after big surges. After investors poured cash into gold-backed ETFs this year, there are early signs that they have now built heavy positions and there may be less buying power to drive further moves, according to Bloomberg.

Weaknesses

- Silver was the worst-performing precious metal this past week, down 3.43%, as banks including Macquarie and BMO initiated a record 58-million-ounce physical delivery against May Comex futures, reflecting a major unwind of arbitrage positions sparked by earlier tariff fears. With silver given a carve-out from new tariffs, premiums collapsed, triggering a wave of position closures and depressing short-term demand sentiment. The sheer volume of deliveries and softening of U.S. price premiums weighed heavily on market prices, pushing silver lower despite broader metals market resilience.

- China Gold Association notes that “In the first quarter of 2025, China's gold consumption was 290.492 tons, down 5.96% year-on-year. Among them: 134.531 tons of gold jewelry, down 26.85% year-on-year; gold bars and coins were 138.018 tons, up 29.81% year-on-year; industrial and other gold demand was 17.943 tons, down 3.84% year-on-year.”

- Gold fell further from last week’s record high, as easing trade-war concerns curbed demand for a haven. Bullion slid as much as 1.6% and is down about 6% since topping $3,500 an ounce, when the metal’s rally had taken it into overbought territory. Wild financial market moves stirred by President Donald Trump’s April 2 tariff announcements have eased, and investors are watching for any signs of progress in U.S. trade negotiations after Trump suggested another delay to his higher tariffs was unlikely, explains Bloomberg.

Opportunities

- Gold Fields Ltd. reported a surge in profit in 2024 and is now back at the table trying to consolidate the remaining 50% of the Gruyere mine now controlled by Gold Road Resources Ltd. for which Gold Fields has already tried to secure but was rebuffed. Gold Road has now gone into a trading halt, so details of a deal may emerge over the weekend. Last year, Gold Fields acquired control of Osisko Mining in a $1.6 billion deal. Gold Fields has been unashamed to pursue nondilutive growth through acquisitions with cash to reinvest in new capital for growth.

- A year after China and other mainly Asia-based retail investors in ETFs ramped up their gold purchases, buying of U.S. gold ETFs has picked up too. Retail demand can often mark the last stage of a bull trend. Central banks kick-started the gold bull run that started in 2022. DM central banks were behind much of the move, with the value of their gold holdings rising to $1.3 trillion from just under $700 billion since 2022, versus $370 billion for EM central banks, according to Bloomberg.

- Alkane Resources and Mandalay Resources have agreed to combine in a “merger of equals” transaction and have executed a definitive arrangement agreement, reports Bloomberg. Mandalay shareholders will receive 7.875 ordinary shares of Alkane for each ordinary share of Mandalay.

Threats

- The gold rally has outshone other asset classes this month — even drawing some comparisons to bitcoin — as President Donald Trump’s tariff war reshapes the global economic order, pushing investors to look for safety. As bullion hit a record last week, the trading of options on the SPDR Gold Shares ETF surpassed 1.3 million contracts, explains Bloomberg, a level never reached before.

- Barrick Gold's subcontractors at its Loulo-Gounkoto complex in Mali are laying off hundreds of employees as a two-year dispute between the company and the Malian government drags on, Reuters reported Monday, citing documents and unnamed sources. In addition, Barrick Gold announced the company would change its name to just Barrick and its new stock symbol would be B and the company would drop GOLD as its stock exchange ticker.

- The World Gold Council noted there was a sharp 19% year-over-year drop in jewelry demand, so total gold demand was up only 1%. The jewelry sector drop was a bit higher than Bank of America anticipated.

*******

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of