Gold SWOT: Gold Bullion Now Makes Up 20% Of Global Reserves

Strengths

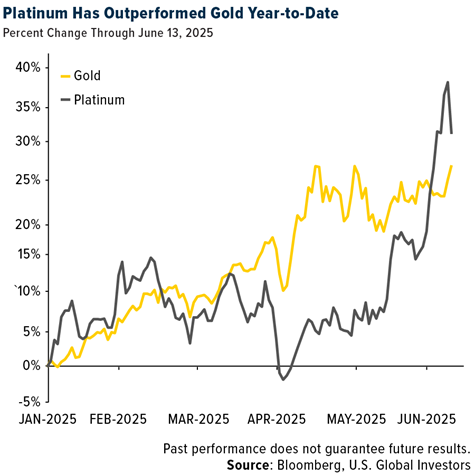

- Platinum was the top-performing precious metal last week, rising 3.62%. It's up over 35% year-to-date, with spot prices near $1,226 per ounce and briefly hitting $1,300 on Thursday. Gold is up about 30% in the same period. Bank of America analysts attribute platinum’s rally not just to gold’s rise but also to a supply deficit and strong demand, particularly in jewelry.

- Gold bullion now makes up 20% of global reserves, surpassing the euro as the second-largest reserve asset, thanks to years of central bank buying. Yet holdings remain around 35,000 tons—unchanged since the Bretton Woods era—suggesting room for more accumulation. Meanwhile, Chow Tai Fook reported better-than-expected earnings, with strong margins, indicating rising gold prices haven't hurt demand. Some retail buyers are even purchasing because prices are rising.

- The start of a gold-futures contract in Singapore has put the spotlight on a flurry of moves in Asian financial hubs to capitalize on rising interest in the commodity as demand increases. The BlackRock-backed Abaxx Exchange began offering a U.S. dollar-denominated contract, sized at 1 kilogram (32.15 troy ounces) and locally deliverable, on Thursday. The move will be among developments highlighted at an industry conference organized by the Singapore Bullion Market Association to be held in the city-state over three days from Sunday.

Weaknesses

The worst performing precious metal for the week was palladium, down 2.44%. ETFs sold 601 ounces of palladium as of Wednesday this week, purchasing back 1,914 as of Thursday. Palladium has been the strongest net buying activity for precious metals from ETFs this year, up 7.5%, compared to 6.8% for gold, 5.7% for silver, and platinum, with a 5.6% change in buys over sells. This net buying effect, combined with being down for the week, signals that larger players may be taking a bit more speculative position on the short side of palladium, which also faces threats from decarbonization efforts.

- Petra Diamonds announced the results of the combined Tender 5 & 6 sales, which were lower than BMO’s estimates on volume sold, product mix and pricing. The continuing challenges in the diamond market and the weaker sales do not bode well given the ongoing negotiations to refinance Petra’s debt obligations, in their view.

- Hochschild Mining provided an update on production at its Mara Rosa mine in Brazil. Heavy rains and contractor issues have resulted in the mine producing only 25,000 ounces of gold year-to-date. Guidance will be revised down in due course, according to Bank of America.

Opportunities

Gold stays in a consolidation phase, with focus shifting to U.S. economic data for cues about the dollar’s direction and the Federal Reserve’s next policy moves, according to Kotak Securities. Bullion may reach $4,000 an ounce early next year due to central bank buying and geopolitical risks, it said.

- Gold, as well as some non-U.S. equities, may offer protection for portfolios amid concern about U.S. assets, including potential fallout from tax changes being considered, according to Citigroup. “We recently added to gold along with European and Chinese equities to diversify portfolios against a potential reduction in appetite for U.S. assets,” Kate Moore, chief investment officer at Citi Wealth, said in a note.

- Paul Tudor Jones predicted this week that he expects to see the dollar drop by 10% over the next year as short-term interest rates fall. This would be extremely bullish for the price of gold, as the dollar has already declined nearly 8% in 2025 amid the tariff chaos and the dramatic shift in diplomatic relationships. Jeffrey Gundlach sees the yield curve threat coming from the long end of the yield curve rising due to demand for compensation for taking on the risks of America’s debt burden and an interest expense that has become “untenable.”

Threats

- According to Canaccord, Equinox pro forma 2025 guidance is 11% lower than previously issued guidance on a consolidated basis, while all-in sustaining costs (AISC) have increased 23%. The decline in production was largely attributable to a slower ramp-up at Greenstone, while the cost increase is also attributed to Greenstone, as well as the Brazilian mines.

- Tanzania plans to make it compulsory for large-scale miners to refine and trade at least 20% of their gold output domestically as the East African nation seeks to benefit from a rally in the bullion price and control a larger share of its resources, according to Bloomberg.

- On Friday, Mali’s government noted that it will establish a state-controlled gold refinery in partnership with Russia’s Yadran to boost bullion revenue. Specifications require the refiner to have a capacity of 200 metric tons. It is not known yet if the refinery will require artisanal miners and or international miners to refine their gold within Mali.

Visit the awarding winning Frank Talk CEO Blog and US Global Investors.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of