Gold SWOT: Palladium and Silver are Doing Well

Strengths

- The best performing precious metal for the week was palladium, up 9.51%. All the precious metals rose this week, except for gold. Palladium rose 4.17% and silver gained 3.90%. Barrick Gold over the weekend said that the Nevada Gold Mines is "strongly positioned for growth." The company said the Nevada Gold Mines have "come a long way" since 2019 when Barrick and Newmont pooled their assets in the state. The Nevada Gold Mines are "now making a strong start to the new year on the back of performance improvements and new growth prospects."

- Zimbabwe’s central bank accumulated 793 kilograms (25,000 ounces) of gold reserves since introducing a law that compels mining companies to pay part of their royalties using the metal. The reserves were collected after mines in the southern African nation produced 30.1 tons of gold last year, compared with a record 35.3 tons a year earlier, Reserve Bank of Zimbabwe Governor John Mangudya said by phone from the capital, Harare, on Tuesday.

- Royal Gold reported fourth quarter earnings of $0.95 per share, ahead of consensus of $0.76 per share, with fourth quarter gold-equivalent ounces (GEOs) of 77,100 ahead of consensus of 73,900, with key positive variances at Penasquito and Xavantina, as well as from taxes.

Weaknesses

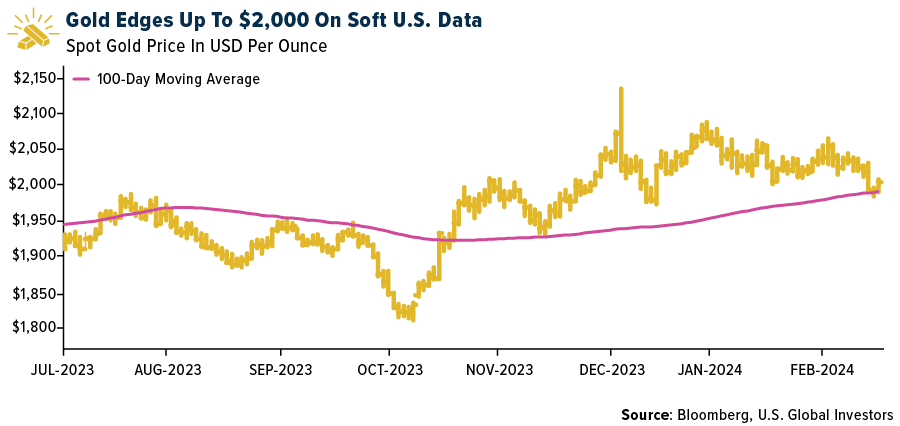

- The worst performing precious metal for the week was gold, down 0.66%. Bloomberg reported U.S. January retail sales and weekly jobs claims came in softer-than-expected and gold got a nice lift at the end of the week, but not enough to flip in a positive rise in price like the other precious metals. According to Morgan Stanley, the volume of India's rough diamond imports in January increased by 63% year-over-year (YoY) and remained flat month-over-month (MoM); their value increased by 43% YoY (-11% MoM). The data came in above the five-year average for the first time since August. Rough prices during the period declined by 13% YoY and 11% MoM.

- Shares of precious metals producer SSR Mining Inc. plunged as much as 59% Tuesday after the U.S. company halted operations at its flagship Turkish gold mine following a landslide — its second incident at the site within two years. SSR said it suspended operations at Çöpler Mine in eastern Turkey after a “large slip” on the mine’s heap leach pad — a pond where metals are extracted from ore — Tuesday morning.

- South Africa's gold production fell 3.4% YoY in December versus revised -2.9% in November, according to Statistics South Africa. Mining production rose 0.6% YoY versus revised up 6.9% in November.

Opportunities

- Barrick Gold Corporation announced that it plans to undertake a new share repurchase program for the buyback of its common shares. Barrick’s Board of Directors has authorized a new program for the repurchase of up to $1.0 billion of the Company’s outstanding common shares over the next 12 months. Barrick Gold Corp. will consider buying back debt on an opportunistic basis, said the top executive of the world’s No. 2 gold producer. Barrick would consider debt tenders if market conditions became attractive, Chief Executive Officer Mark Bristow said Wednesday in an interview.

- Share and debt buybacks are rare in the mining industry as mining is a capital-intensive industry and assets and equipment must be acquired or purchased. Interesting to note that Barrick’s gold production has sunk to its lowest level in 23 years, as highlighted on Bloomberg this week. Mine closures, expansion work and maintenance have taken their toll on annual output and Barrick is addressing this in part by addressing corporate structure, and perhaps waiting for higher prices to reinvest.

- According to RBC, for the GDXJ, they highlight the potential addition of Emerald Resources following inclusion in the GDX in the second quarter of 2023. They also see as a potential re-addition AngloGold Ashanti, which has fallen within the junior universe threshold, and would be consistent with prior re-additions back into the junior ETF including Fresnillo (Q3/23) and Kinross (Q2/22).

Threats

- One month after their historic launch, ETF insiders and crypto proponents alike say Bitcoin spot funds are proving an unequivocal success on key trading measures. Some 21 trading days in, the funds have raked in about $2.8 billion in total net inflows, data compiled by Bloomberg Intelligence show. That considers the $6.4 billion investors yanked from the Grayscale Bitcoin Trust after it was converted from a trust into an exchange-traded fund.

- According to Morgan Stanley, the value of rough lab-grown diamond imports increased by 5% YoY and 2% MoM, coming in above their four-year average and showing similar restocking trends as the rough stone market. Similarly, polished lab-grown exports increased by 10% YoY and 36% MoM, coming in above their four-year average, pointing to a better dynamic versus polished stone.

- According to Bank of America, for 2024, SSR Mining is guiding to gold equivalent ounce (GEO) production of 540-600k at all-in sustaining costs (AISC) of $1,575-$1,625 per ounce (/oz). This compares unfavorably to Bloomberg consensus at around 592k GEO and $1,577/oz, and Visible Alpha (VA) consensus at around 601k GEO and $1,582/oz.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of