Gold SWOT: The People’s Bank of China Increased Its Gold Reserves in July

Strengths

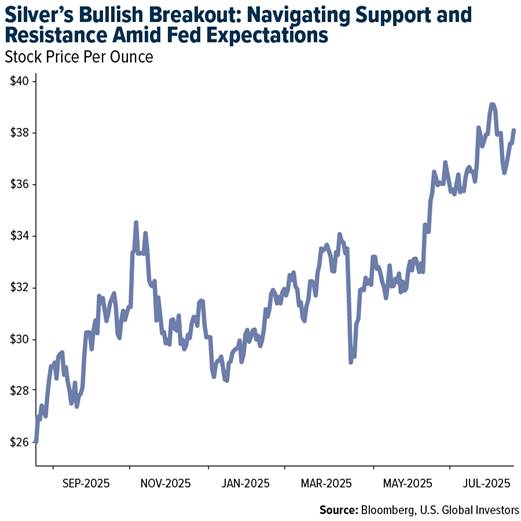

- The best performing precious metal for the week was silver, up 4.34%, snapping a three-week losing streak with six consecutive days of gains. The People’s Bank of China increased its gold reserve in July, marking nine straight months of purchases that are helping it diversify its holdings away from US dollars. Gold held by the central bank increased by 60,000 troy ounces to 73.96 million troy ounces last month, according to data released on Thursday.

- SSR Mining reported second-quarter 2025 results with adjusted earnings per share of $0.51, beating the consensus estimate of $0.23, according to Scotiabank. The company produced 120,200 ounces of gold at an all-in sustaining cost of $2,068 per ounce. The stock surged 17.32% on the earnings beat.

- OceanaGold reported second-quarter 2025 adjusted earnings per share of $0.51, beating both BMO’s and the consensus estimate of $0.41. The share price rose 10.23 percent on the day of the announcement. Gold production totaled 119,500 ounces, surpassing both BMO’s and the consensus estimate of 108,000 ounces. The all-in sustaining cost of $2,027 per ounce also beat expectations, which had been $2,380 per ounce.

Weaknesses

- The worst-performing precious metal for the week was palladium, down 6.74%. Precious metals refiner Heraeus noted that “China joins India in reducing gold jewelry consumption as prices remain high.” The Chinese Gold Association reported that total gold consumption declined 3.5% year-over-year in the first half of the year, to 505 tons. The largest drop was in the jewelry sector, which contracted 26% year-over-year to just under 200 tons.

- A gold miner with operations in Peru and Mongolia had to offer a higher yield and a considerably smaller bond than expected to complete its debut deal—signaling how selective investors have become in the sector. After a two-week marketing process, Singapore-registered Boroo Investments Pte. raised $300 million from its seven-year bond offering, well below the anticipated $500 million to $600 million, according to Bloomberg.

- Allied Gold reported adjusted earnings per share of $0.14, missing CIBC’s estimate of $0.24 and the consensus estimate of $0.29. The shortfall was driven by the timing of gold sales, higher operating costs, and a $17.2 million share-based expense. Allied Gold’s share price fell 11.91 percent on the news.

Opportunities

- Minera Alamos announced it is acquiring Calibre USA Holdings from Equinox Gold for total consideration of US$115 million, subject to adjustment. Calibre USA holds the Pan Gold Mine, Gold Rock Project, and Illipah Project, all located in Nevada, United States, according to Canaccord. The transaction is expected to be funded through a Subscription Receipt, which will convert upon closing into a share and a full share warrant to help sweeten the deal.

- Royal Gold announced that it has entered into a streaming agreement on First Quantum's Kansanshi copper-gold mine in Zambia for an advance payment of $1.0 billion. Royal Gold expects to receive 12,500 ounces of gold in 2025, averaging 35,000 to 45,000 ounces annually over the next 10 years, with the mine life projected through 2049. This deal follows closely on the heels of Royal Gold’s recently announced acquisition of Sandstorm Gold Ltd. just a month ago.

- A years-long supply crunch in platinum has come to a head, with banks scrambling for dwindling stocks in London as buyers in China and the United States scoop up much of the available metal. The market tightness has made platinum one of the best-performing commodities this year and has fueled sky-high borrowing costs for the precious metal, according to Bloomberg.

Threats

- Royal Gold reported production 4% below consensus expectations, despite previously releasing stream production figures. According to RBC, the operator has revised 2025 targets for the Mt. Milligan mine lower due to ongoing grade challenges.

- The trade imbalances that prompted President Donald Trump to impose significant tariffs on Swiss imports are largely driven by a small but crucial industry at the heart of the global gold market. Switzerland is the world’s largest gold-refining hub, renowned for its quality and discretion. Billions of dollars’ worth of gold flows into and out of the country—from mines in South America and Africa to banks in London and New York—according to Bloomberg. There was initial confusion over whether imported physical gold bars would be subject to the new tariffs, but it now appears they are exempt.

- Following a reported pit wall failure at its Camino Rojo mine on July 23, Orla Mining has revised its 2025 guidance for the site to 95,000–105,000 ounces of gold production (down from 110,000–120,000 ounces) and raised the all-in sustaining cost (AISC) to $850–$950 per ounce from $700–$800. According to Scotiabank, this brings Orla’s full-year 2025 consolidated guidance to 265,000–285,000 ounces of production at an AISC of $1,350–$1,550 per ounce.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of