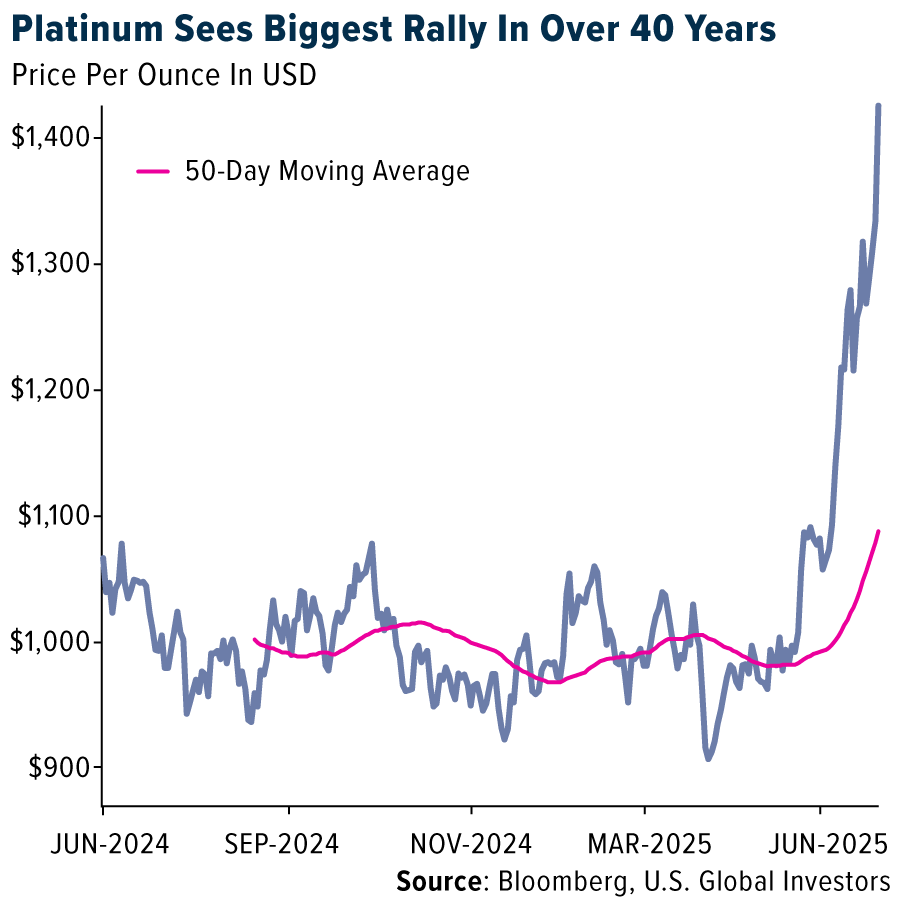

Gold SWOT: Platinum Is Experiencing Its Biggest Rally In Over 40 Years

Strengths

- The best-performing precious metal for the past week was palladium, up 8.78%, as it had significantly lagged the recent surge in platinum prices over the past six weeks. However, this is now contributing to the strength in the palladium market. Auto manufacturers have been substituting platinum for palladium, but that trend could begin to reverse, with palladium now trading nearly $400 per ounce cheaper than platinum.

- Platinum has been on its biggest rally in 40 years, rising more than 38% since the end of May. Two major beneficiaries are Sibanye and Impala, whose platinum mining operations have pushed both stocks above their 50-day moving averages. This type of move highlights how the market values operational leverage to rising precious metal prices, a trend also seen in other PGM companies during rallies in their respective metals.

- Exchange-traded funds added 161,178 troy ounces of gold to their holdings in the last trading session, bringing this year's net purchases to 7.53 million ounces, according to data compiled by Bloomberg. Total known ETF holdings of gold have climbed for nine consecutive days, the longest winning streak since April 21, before investors made net redemptions on Thursday, followed by net additions on Friday. With the strongest drop in the gold price this week, there appears to be renewed buying interest.

Weaknesses

- The worst-performing precious metal for the past week was gold, down 2.99%, in response to the ceasefire in the Middle East and the prospects of new trade deals being announced. According to Raymond James, Mexico will not approve any new mining concessions. President Sheinbaum's restriction on concessions marks a continuation of the policy set by her predecessor, former President Andrés Manuel López Obrador. "There is not going to be another new concession—no, there are no new mining concessions," Sheinbaum said at a press conference.

- According to RBC, looking across all operating multiples today (i.e., P/CF, EV/EBITDA, FCF/EV, P/E), royalty companies are trading close to their average valuations across nearly all metrics over the past 10 years (i.e., within ~5%). Conversely, producer valuations have meaningfully compressed across all metrics and are trading at a 10–40% discount to 5-year average metrics.

- The cash-strapped government of Mali has announced that the state is working on restarting production at Barrick’s Loulo-Gounkoto gold complex. Barrick shuttered the mine when a court ruled the state could take over management for six months. The government now wants to keep the workers employed and produce gold to support the national economy.

Opportunities

- The head of one of the world’s most valuable gold miners believes there’s only one reason to buy a gold mining stock — and too few companies in the industry are offering it. “The only reason you want to buy an equity is if it gives you a better return than just buying gold,” Agnico Eagle Mines Ltd. CEO Ammar Al-Joundi said in an interview with Bloomberg.

- Gold prices could surge 20% by 2026, according to Bank of America — and geopolitical conflict isn’t the reason. BofA sees further upside driven by the "Big Beautiful" plan, which is expected to significantly increase the U.S. deficit in the coming years, reports Bloomberg.

- The U.S. Treasury has a new buyer of T-bills: stablecoins. Treasury Secretary Bessent said dollar-linked stablecoins could exceed $2 trillion, potentially boosting demand for short-term debt and the dollar’s global role — though concerns remain about handing over real dollars to largely unregulated issuers.

Threats

- Ecuador’s President Daniel Noboa aims to make the country “as predictable as possible” for investors. However, the government is starting talks this week on a controversial new mining fee that could raise $229 million annually—even from exploration companies—to boost the mining regulator’s budget. No final decision has been made, though the industry views the fee as a “shake-down,” said Deputy Mining Minister Javier Subia.

- Peru’s copper production faces growing threats from informal and illegal mining, which risks enabling criminal groups and encroaching on concessions. Proposed legislation (the MAPE Law) could legitimize informal miners, undermining formalization efforts. This has impacted companies like Southern Copper and First Quantum, putting billions at risk, according to Bloomberg.

- More than $15 billion of Chinese jeweler Laopu Gold Co.’s shares will be unlocked this Friday, potentially weighing on gold amid recent price weakness. The shares have surged over 2,000% since the company’s Hong Kong IPO a year ago, Bloomberg reports.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of