Gold Traders Bullish For 11th Straight Week

Strengths

- In what has been a rather rare occurrence, silver was the best performing metal this week, up 2.64 percent despite a steady trickle of silver out of the physical metal ETFs on a near daily basis. Gold traders are bullish for an 11th straight week, as surveyed by Bloomberg, on the heels of a declining dollar and speculation of a U.S.-China trade war standoff. Gold briefly rose 1 percent to the $1,300 mark on Friday, a seven-month high, as the dollar fell ahead of the Federal Reserve meeting next week, writes CNBC. The world’s largest ETF backed by gold, SPDR Gold Shares, saw holdings jump to a six-month high. George Gero, managing director of RBC Wealth Management, said that he thinks “the gold rally is going to continue as global worries escalate.”

- Turkey continues to boost its gold reserves. Holdings rose $56 million from the previous week and now totaling $20.4 billion, according to official weekly figures from the central bank in Ankara. Ray Dalio, billionaire investor and founder of Bridgewater Associates, chastised monetary policymakers for an “inappropriate desire” to tighten faster than capital markets could handle, reports Bloomberg.

- Cardinal Resources announced drilling results of 14 meters at 7.0 grams per tonne from just 69 meters from surface at the Ndongo East discovery in Ghana, only 24 kilometers from their 6 million-ounce gold discovery at Namdini. This further enhances the attractiveness of Cardinal’s region land package.

Weaknesses

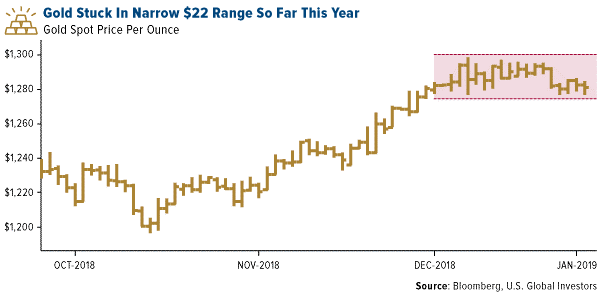

· The worst performing metal this week was palladium, down 1.29 percent . Palladium is set for its biggest weekly loss in two months on concerns that demand might slow, reports Bloomberg. The U.S.-China trade tensions could be worsening, as Secretary of Commerce Wilbur Ross said this week that the two nations remain “miles and miles” apart on trade. Gold has been stuck in a narrow trading range of $22 so far this year, remaining at or below the $1,300 an ounce level.

· Sixteen people died in an explosion at a Shaanzi Mining-operated mine in Ghana this week. The Chinese mining company was carrying out scheduled blasting at the mine. However, a group of people illegally entered the mine before knowing what was going to happen. Shaanzi shut down its operations temporarily.

· Freeport-McMoRan stock fell this week after reporting lower-than-expected profits and rising costs. Goldman Sachs says that traders are less willing to buy and sell long commodity futures because of uncertainty surrounding the trade war and other geopolitical events, writes Bloomberg’s Sebastian Pellejero.

Opportunities

· UBS analysts Giovanni Staunovo and Wayne Gordon wrote in a report this week that gold’s reaction to the stock market volatility in late 2018 has confirmed its role as a safe-haven asset. They write that gold “served investors well as a diversifier… and helped reduce portfolio swings,” and that “these qualities should remain highly relevant for investors this year as the business cycle matures further.” According to SkyBridge Capital, gold could become even more attractive in 2020, as a possible U.S. recession could lead the Fed to loosen monetary policy. Troy Gayseki, senior portfolio manager, told Bloomberg that “it is plausible that the next great monetary easing starts in later 2020, which of course would be very supportive for precious metals.”

· With the recent mega gold miner mergers (Barrick-Randgold and Newmont-Goldcorp), many are speculating what might come next. BMO Capital Markets writes that we could see more mergers to form larger gold miners. Meanwhile, Credit Suisse writes that asset sales are more likely, as Newmont-Goldcorp likely plan to divest non-core assets over the next few years. Additionally, rising gold prices might hinder further gold deals, as this makes valuations less attractive, writes Bloomberg’s Aoyon Ashraf.

· Continuing M&A news, some were speculating that Gold Fields might merge with AngloGold. However, Gold Fields responded a day later saying that news was incorrect. Kinross Gold appears to be open to asset buying opportunities, telling analysts at a conference this week that “we’ll just have to wait and see what comes out” of the two big mergers. JPMorgan wrote this week that it is positive about the recent Newmont-Goldcorp merger, saying that it creates a large “gold miner that should appeal to generalist investors looking for liquid, low drama gold exposure.”

Threats

· Investor Mark Mobius said in a Bloomberg interview this week that he expects gold to stay relatively flat this year due to the Fed potentially raising interest rates. However, Mobius did say that “everybody should have gold, no question about that” and that investors should maybe have “10 percent of their assets in gold.”

· The Bank of England has denied Venezuelan President Nicolas Maduro’s request to pull $1.2 billion worth of gold out of the bank. This comes at a time when the U.K., along with the U.S. and other countries, recognized opposition leader Juan Guaido as the legitimate president of Venezuela. Some are speculating whether or not the bank will eventually allow Guaido to withdraw the gold, as Venezuela’s economy has been struggling.

· Open interest in gold futures reached an over-five-year high on the Multi Commodity Exchange of India, reports Business Standard. Previous years when the open interest ratio hit highs, gold has pulled back, according to data from Seaport Global.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of