Has Gold's Moment Finally Arrived?

Summary

-

The pieces are lining up for a confirmed gold price breakout.

-

Silver, gold's close cousin, has already confirmed a bottom.

-

Only a higher close above the 15-day MA is needed for gold price.

Several weeks into a corrective decline for the gold price and investors are asking the question featured in the above headline. Their hopes have been buoyed by the dollar’s latest slip, along with an impressive rally in the silver price. In today’s commentary, we’ll examine the technical evidence which suggests that gold can indeed benefit from these recent developments.

Thursday was another subdued trading session for the yellow metal. While the dollar remained weak, spot gold only managed to rise 0.24 percent to $1,299. The August gold futures price meanwhile settled 0.14 percent lower for the day to close at $1,301. On the geopolitical front, tensions surrounding North Korea have been somewhat supportive of gold lately, although not enough to push prices decisively higher and off their 6-month lows.

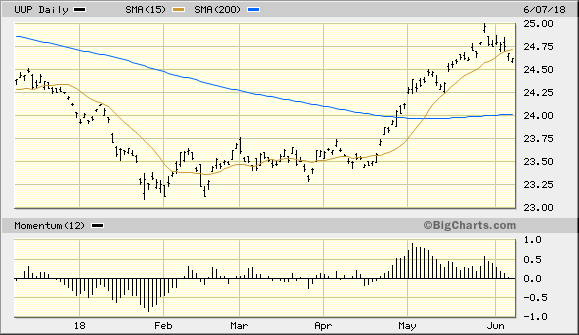

Providing a measure of hope for gold investors, however, isn’t what’s happening to the gold price. It’s what’s happening first and foremost to the U.S. dollar index. Shown below is the daily graph for the Invesco DB US Dollar Index Bullish Fund (UUP), which is my favorite proxy for the dollar. This highlights why gold’s chances for a recovery rally have suddenly increased.

Source: BigCharts

As I suggested in previous commentaries, now that UUP along with the dollar index has closed under its 15-day moving average, there is a good chance that this loss of immediate-term momentum will result in additional correcting of the dollar and dollar ETF. This increases the likelihood that UUP will move closer in line with its 200-day moving average in the weeks ahead - even if it means the UUP price line simply moves sideways until the 200-day MA catches up. But regardless of whether the dollar moves sideways or lower, as long as it doesn’t resume its upward trend for a while, this should allow the gold bulls an excellent chance to seize the advantage and regain control of the immediate-term trend.

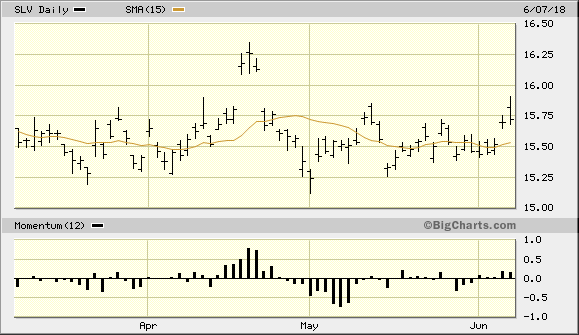

An even bigger stimulus of hope for the gold bulls is the latest activity in the silver market. The following graph of the iShares Silver Trust (SLV), my silver proxy, shows the impressive technical rally in the silver price this week. SLV has in fact confirmed an immediate-term (1-4 week) breakout signal per the rules of my technical trading discipline. This means that SLV has closed at least two days higher above its 15-day moving average and as such is now poised to recover all or most of its losses since the mid-April peak.

Source: BigCharts

This breakout signal in the silver ETF is significant for gold due to the historical tendency for silver to lead gold at important junctures. While silver rallies haven’t always produced turnarounds in the gold price, this has been the case more often than not. Thus gold traders have at least one more reason for believing that there is finally some light at the end of the tunnel. After the somber mood of the precious metals market in the last two months, gold is facing its first significant opportunity to rally since April.

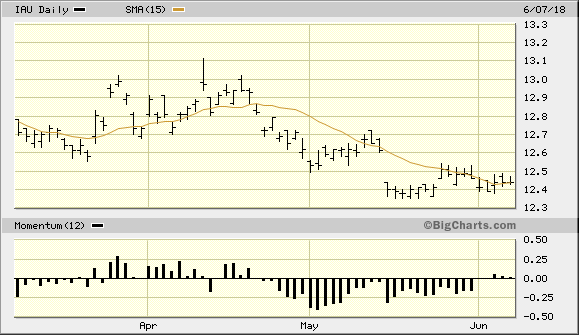

All that is needed to galvanize an immediate-term relief rally for gold is a decisively higher close in the gold price. Shown here is the iShares Gold Trust (IAU) in relation to its 15-day moving average. Under the rules of my trading discipline, a 2-day higher close above the 15-day MA is required to confirm an immediate-term breakout for the gold ETF. This signal has often resulted in short-term rallies for IAU, particularly when the ETF is rebounding from an oversold technical condition (as is presently the case).

As it stands now, the IAU price line is just hugging the 15-day MA and hasn’t yet closed decisively enough above it to confirm a bottom. If the latest rally in silver is any indication, though, we should see additional improvement in IAU in the coming days.

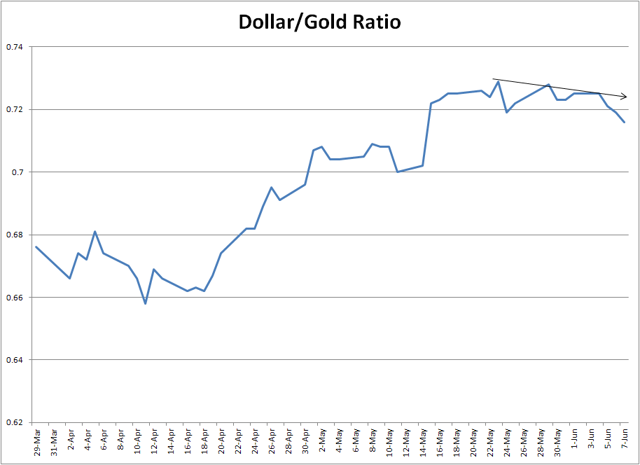

Moreover, the dollar/gold ratio which we’ve been looking at in recent reports continues to weaken in gold’s favor. This important indicator of relative strength is tilting lower by the day, which increasingly favors gold over the dollar. If this ratio continues to weaken next week, we should definitely see a meaningful gold rally commence.

Source: BarChart

All that is now required is a simple higher close in the gold ETF price, which would confirm an immediate-term bottom signal per the rules of my technical trading discipline. A decisively higher close in the gold ETF (NYSEARCA:IAU) on Friday would suffice to confirm the latest low. For now, no new trading positions in the IAU are recommended.

********

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.