Has Inflation Peaked?

Annual core CPI jumped 2.4 percent, the fastest pace since September 2008. Is it the peak – or just the beginning of inflation? And what does it mean for the gold market?

What Happened?

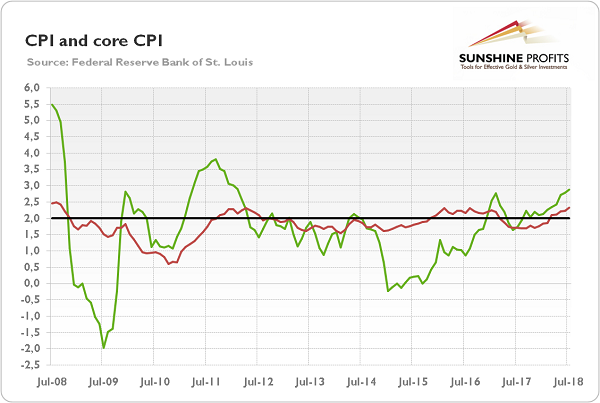

On Friday, the BLS released its latest report on inflation. It showed that the Consumer Price Index increased 0.2 percent in July, following a 0.1 percent uptick in June. The core index, which excludes food and energy, rose 0.2 percent for the third month in a row. Over the last 12 months, the CPI rose 2.9 percent, the same as in the previous month. But the core CPI accelerated and jumped 2.4 percent. This was the largest annual increase since September 2008, as one can see in the chart below.

Chart 1: U.S. CPI (green line, annual % change) and core CPI (red line, annual % change) from July 2008 to July 2018.

This indicates that inflationary pressures strengthened in July. Interestingly, monthly inflation remained unchanged despite that 0.5 percent fall in energy prices. The 0.3 percent rise in the shelter index, which is a dominant component of the CPI, offset the decline in the energy index. This is also why the core index accelerated.

Although some people see rising inflation as a sign of a healthy economy, it is worth noting that it undermines the consumers’ purchasing power. Indeed, real wages have stagnated recently.

Have We Seen the Peak?

After the core CPI accelerated to the fastest pace of growth since September 2008, some experts started to worry about rising prices, while other claimed that it was likely that we had just seen the peak in inflation. Who is right?

Well, take a look at producer prices. On an annual basis, the PPI jumped 3.3 percent in July, the highest level since 2011. Importantly, the tariffs on Chinese goods should support the price pressure in the coming months. Hence, a further increase in inflation wouldn’t surprise us, but it should be temporary and moderate, unless we see a full-blown trade war. If we avoid such a conflict, trade patterns should adjust to the new reality and then new capacity would spring up in new places, keeping prices under control.

Implications for Gold

What does it all mean for the Fed’s policy and the precious metals market? Well, the Fed should become more hawkish in the face of rising inflation, shouldn’t it? Not necessarily. Investors should remember that the inflation target of the U.S. central bank is symmetric. On the one hand, it means that the Fed is symmetrically concerned about too low and too high inflation. But it also implies that the FOMC members will not overreact to deviations from the target, no matter whether to the downside or the upside, at least as long the medium-run path of inflation converges to the target. As Charles Evans has recently said in an interview:

Inflation moving up to, say, 2.25% would not be troubling at all, and even 2.5% as long as that is expected not to accelerate, could well be consistent with symmetry of our 2% objective.

He also stated that:

We don’t have to win the war on inflation over again because we did that in a very difficult costly and arduous fashion in the eighties and into the nineties.

Thus, the Fed should remain on track to gradually raise interest rates. It tolerated - read: it was unable to do something about it – subdued inflation rate for years, so it shouldn’t overreact to the CPI rate above the target, at least unless the overshooting becomes really big. As a reminder, the Fed expects that the PCE inflation will be 2.1 percent this year. In June, that index rose to 2.2 percent, not very far above the Fed’s forecast.

Hence, we would not expect a rally in gold prices. The yellow metal needs high and accelerating inflation, not slowly creeping inflationary pressures. Without runaway inflation, the sideways trend may remain in force. And if we get higher interest rates, as they should finally return to more normal levels, it may transform into a more bearish pattern. The current Fed tightening is unusually gradual, while the unemployment rate is very low. More hikes are possible. The combination of higher rates, as the Fed’s actions could finally transmit into higher long-term yields, and moderate inflation is nothing but negative for gold prices. Stay tuned!

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.