Huge News! The Fed’s Tapering Is Finally Here!

The Fed has announced tapering of its quantitative easing! Preparing for the worst, gold declined even before the release - will it get to its feet?

Ladies and gentlemen, please welcome to the stage the one and only tapering of the Fed’s quantitative easing! Yesterday was that day – the day when the FOMC announced a slowdown in the pace of its asset purchases:

In light of the substantial further progress the economy has made toward the Committee's goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities. Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month.

It’s all but a bombshell, as this move was widely expected by the markets. However, what can be seen as surprising is the Fed’s decision to scale back its asset purchases already in November instead of waiting with the actual start until December. Hawks might be pleased – contrary to doves and gold bulls.

How is the tapering going to work? The Fed will reduce the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities each month:

Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.

So, instead of buying Treasuries worth $80 billion and agency mortgage‑backed securities worth $40 billion (at least), the Fed will purchase $70 billion of Treasuries later this month and $35 billion of MBS, respectively. Then, it will buy $60 billion of Treasuries and $30 billion of MBS in December, $50 billion of Treasuries and $25 billion of MBS in January, and so on until the last round of purchases in May 2022. This means that the quantitative easing will be completed by mid-year if nothing changes along the way.

The announcement of the tapering was undoubtedly the biggest event; however, I would like to point out one more modification. The sentence “inflation is elevated, largely reflecting transitory factors” was replaced in the newest statement with “inflation is elevated, largely reflecting factors that are expected to be transitory”. It’s not a big alteration, but “expected to be” is weaker than simply “is”. This means that the Fed’s confidence in its own transitory narrative has diminished, which implies that inflation might be more persistent than initially thought, which could support gold prices more decisively at some point in the future.

The Fed also explained why prices are rising: “Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors”. Unsurprisingly, the Fed didn’t mention the surge in the money supply and the unconventional monetary and fiscal policies, just “imbalances”!

Implications for Gold

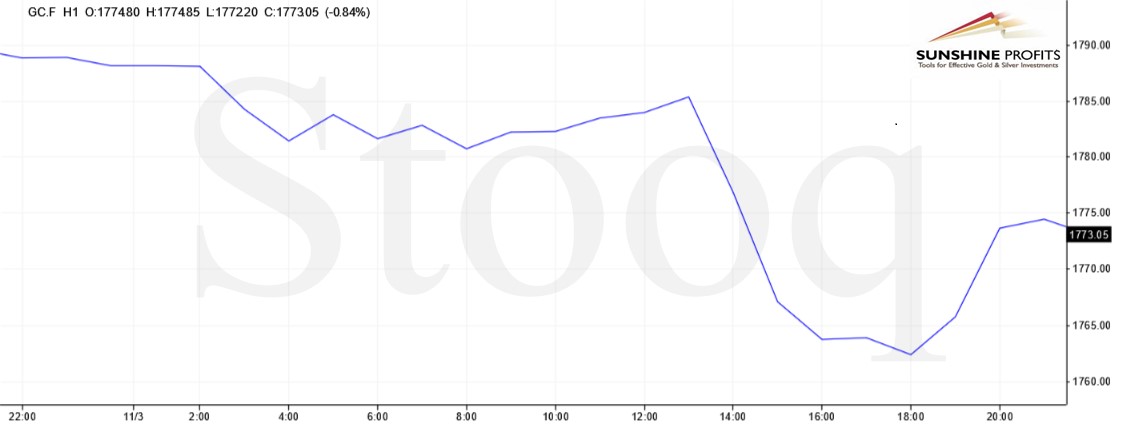

What does the Fed’s announcement of a slowdown in asset purchases imply for the gold market? Well, the yellow metal showed little reaction to the FOMC statement, as tapering was in line with market expectations. Actually, gold prices fell to three-week lows in the morning — right after the publication of positive economic data but before the statement. However, gold started to rebound after the FOMC announcement, as the chart below shows.

Why? The likely reason is that both the statement and Powell’s press conference were less hawkish than expected. After all, the Fed did very little to signal interest rate hikes.

What’s more, Powell expressed some dovish remarks. For instance, he said that it was a bad time to hike interest rates: “it will be premature to raise rates today” (…) We don’t think it is a good time to raise interest rates because we want to see the labor market heal more.”

The bottom line is that gold’s reaction to the FOMC statement was muted, as tapering was apparently already priced in. The lack of bearish reaction is a positive sign. However, gold’s struggle could continue for a while, perhaps until the Fed starts its tightening cycle. For now, all eyes are on Friday’s non-farm payrolls. Stay tuned!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care

*********