Irrational Exuberance in the Metals?

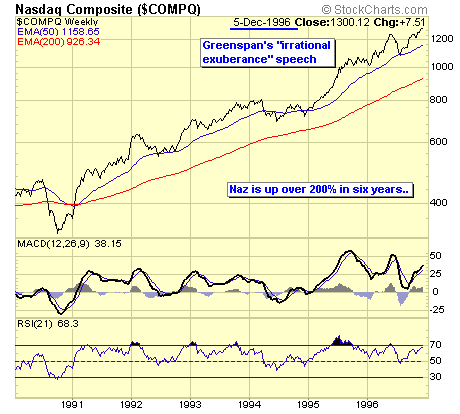

The famous speech made by Sir Alan Greenspan actually took place in Dec 1996, when Nasdaq was at 1300, up a whopping 200% in six years.

Looking at the Naz chart at the time, the technical indicators were not confirming the new high in price, along with Greenspan's hint that the market may be over extended, enticed many early bears and naysayers.

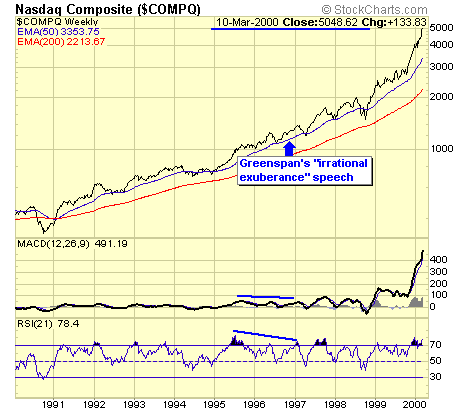

Of course, we all know what happened. Naz went on to gain another 300% in the next three years, giving us one of the most memorable bull markets in modern history.

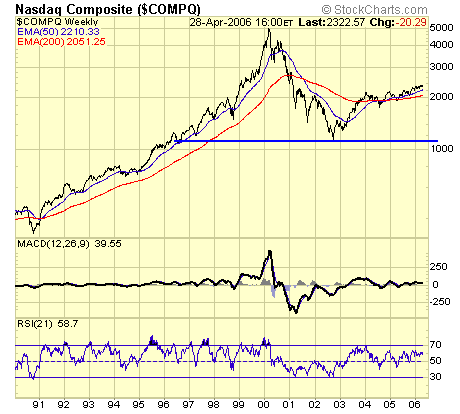

And the bears were correct, the Naz did collapse, but three years and 300% later. The spectacular crash although brutal, never did exceed the low of 96. The moral of the story is, do not get ahead of the markets, follow them.

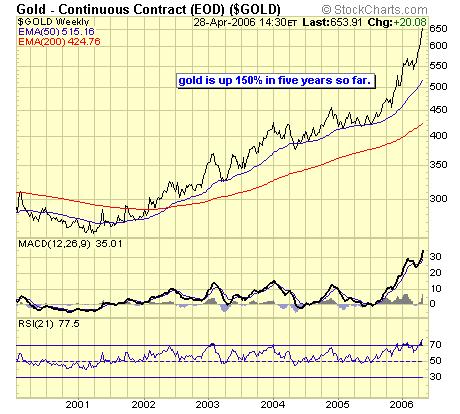

We've been buyers of gold since around $275, and the 150% rise has been great. Having experienced the Nasdaq bubble taught me two things: Nothing goes up forever, when the party is over, move on. But don't try to pick a top, the exuberance of an irrational bull market can last much longer than we are capable of comprehending.

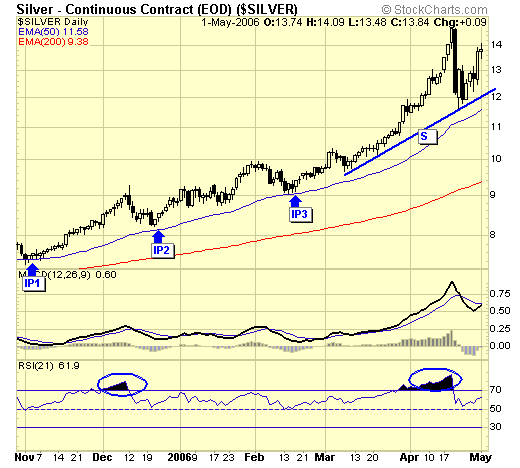

Silver is in an "IP" and subscribers have been advised to sit tight until a violation of support, at which point partial profits can be taken, while holding a core position with stops at breakeven.

Summary

From the emails I have received from both subscribers and public readers the past few weeks, it is my observation that the new highs in metals and mining indices are making many very nervous, which is understandable. But being nervous is not a sell signal. The fact that quite a few prominent analysts have been anticipating a major sell off in the metals since last December which has yet to materialize, leaving thousands of gold bulls behind and out of the current awesome rally, will continue to add fuel to the fire as more and more are fed up waiting and will jump in at any cost. Therefore, while we are enjoying the seemingly endless rally and watching our profits grow nervously, be mentally prepared for the inevitable correction which could plunge the indexes by double digits percentage points. When will this happen, I cannot tell you because I honestly don't know. But we will certainly take partial profits upon a violation of support and buy back when the correction is completed.

Keep it simple, and follow the markets.

End of report

Jack Chan at www.traderscorporation.com

3 May 2006