LBMA Is Looking For A Double-Digit Increase In The Price Of Gold

Strengths

-

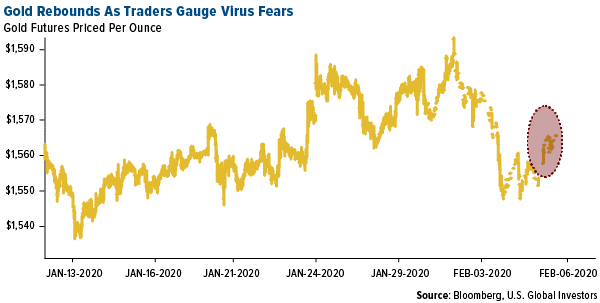

The best performing metal this week was palladium, up 1.44 percent as Jeffrey Currie, head of global commodities research at Goldman Sachs, commented he sees the potential for palladium to test $3,000. With Friday’s gain, gold saw a third straight day of positive momentum as concerns of economic fallout surrounding coronavirus outweighed stronger-than-expected U.S. job gains. Holdings in gold-backed ETFs surpassed the record set in 2012, hitting 2,573.9 tons on Monday, according to Bloomberg data.

-

Russia’s gold reserves grew in January to $562.3 billion, up from $554.4 billion in December. China’s gold reserves remained flat over the same time period. Turkey’s holdings in gold rose $680 million from the previous week to now total $27.5 billion as of January 31.

-

Calibre Mining Corp announced initial drill results from its El Limon project in Nicaragua, including 18.65 grams per ton of gold over 5.1 meters. CEO Russell Ball said in the press release: “We ramped up the program significantly in January and I am confident that our 2020 drilling campaign will deliver positive results in this world-class, low sulfidation epithermal district.”

Weaknesses

-

The worst performing metal this week was silver, down 1.89 percent despite hedge funds boosting their bullish positioning in the metal this past week. The price of gold fell early in the week over fears that the coronavirus would hamper Chinese demand for the yellow metal. Analysts at Citigroup Inc. wrote in a note this week that “retail coin and jewelry demand in Asia is a negative risk for gold markets, particularly in China where gold premiums have started to soften given GDP downgrades and coronavirus risks.” China is the world’s top consumer of gold.

-

India’s gold imports fell to 21.7 tons in January from 45.9 tons a year earlier – a drop of 53 percent. Bloomberg writes that record-high domestic prices and a slowdown in economic growth are behind dramatic decrease. The World Gold Council (WGC) recently showed that full-year purchases fell 14 percent in 2019. Americas Gold and Silver Corp., a North American precious metals producer, said that it has temporarily stopped mining and processing at its Cosala Operations in Mexico due to a blockade by workers at the facility. JPMorgan Chase & Co might face criminal charges and be subject to fines regarding its involvement with alleged manipulation in the precious metals market, reports Bloomberg News.

-

According to a report by law firm Bryan Cave Leighton Paisner, private equity investments in mining fell to $500 million in 2019, down from $2 billion the year prior – a drop of 75 percent. The firm said private equity is now focused on raising additional funds for existing investments rather than looking for new deals.

Opportunities

-

The London Bullion Market Association (LMBA) released its gold price forecasts for 2020 and the consensus is looking for double-digit increases. The average forecast is $1,558.90 an ounce, with the highest at $2,080 and the lowest at $1,300. Analysts are expecting more volatility, as the range between the high and low prices is $780, much bigger than last year’s range of $325.

-

Anglo American Platinum Ltd. CEO Chris Griffith said in an interview this week that the rally in palladium isn’t a bubble because there is still a supply deficit of about 1 million ounces. “That’s a massive shortfall, and that’s making prices rise.” Griffith added that prices will be supported until automakers start substituting palladium with platinum.

-

Bloomberg reports that AngloGold Ashanti Ltd. is moving away from South Africa and instead toward the Americas. The world’s third largest gold producer is looking at projects in Colombia and Nevada, according to CEO Kelvin Dushnisky. “The market will always be receptive to good projects, and there are quality assets. The reason we want to bring them into production is part of our objective to bring new, longer life, lower-cost operations.” AngloGold has just one mine left in South Africa and is looking for a buyer. Angolan state-owned diamond mining company Endiama EP is looking at selling as much as 30 percent of its shares in an IPO in 2022, reports Bloomberg.

Threats

-

Barrick Gold CEO Mark Bristow confirmed that the company is not planning on merging with Freeport-McMoran, but that he is interested in Grasberg mine in Indonesia. Bristow said “if you’re going to be a world-class gold miner, you’re going to have to accept copper. In ten years’ time the most strategic metal on this planet is copper, if you believe the EV story, and I do.” The Freeport Grasberg mine in Indonesia is a tier-one copper asset because it is high grade and has a long life. However, the mine might not be the best potential acquisition, as Indonesia likely would not be considered a tier-one location by the market.

-

Sibanye Gold Ltd. CEO Neal Froneman expressed that South Africa’s president is running out of time to attract investments in the country’s mining industry, reports Bloomberg. “There has been a distinct lack of turnaround, if anything we have gone backward.” Sibanye is increasingly looking at doing business in West Africa, the Americas and Australia due to the risks of weak economic growth and high debt in his home country.

The Commerce Department announced on Monday that the Trump administration is moving ahead with new rules that would clear the way for the U.S. to apply punitive tariffs on goods from countries accused of having undervalued currencies, reports Bloomberg News. The rules would allow the U.S. to impose duties on goods from countries accused of manipulating their currencies, even in cases the country hasn’t been found guilty of doing so by the U.S. Treasury.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of