March Retail Sales And Gold

Americans purchased fewer goods and services at retail stores in March. What does it imply for the gold market?

Americans purchased fewer goods and services at retail stores in March. What does it imply for the gold market?

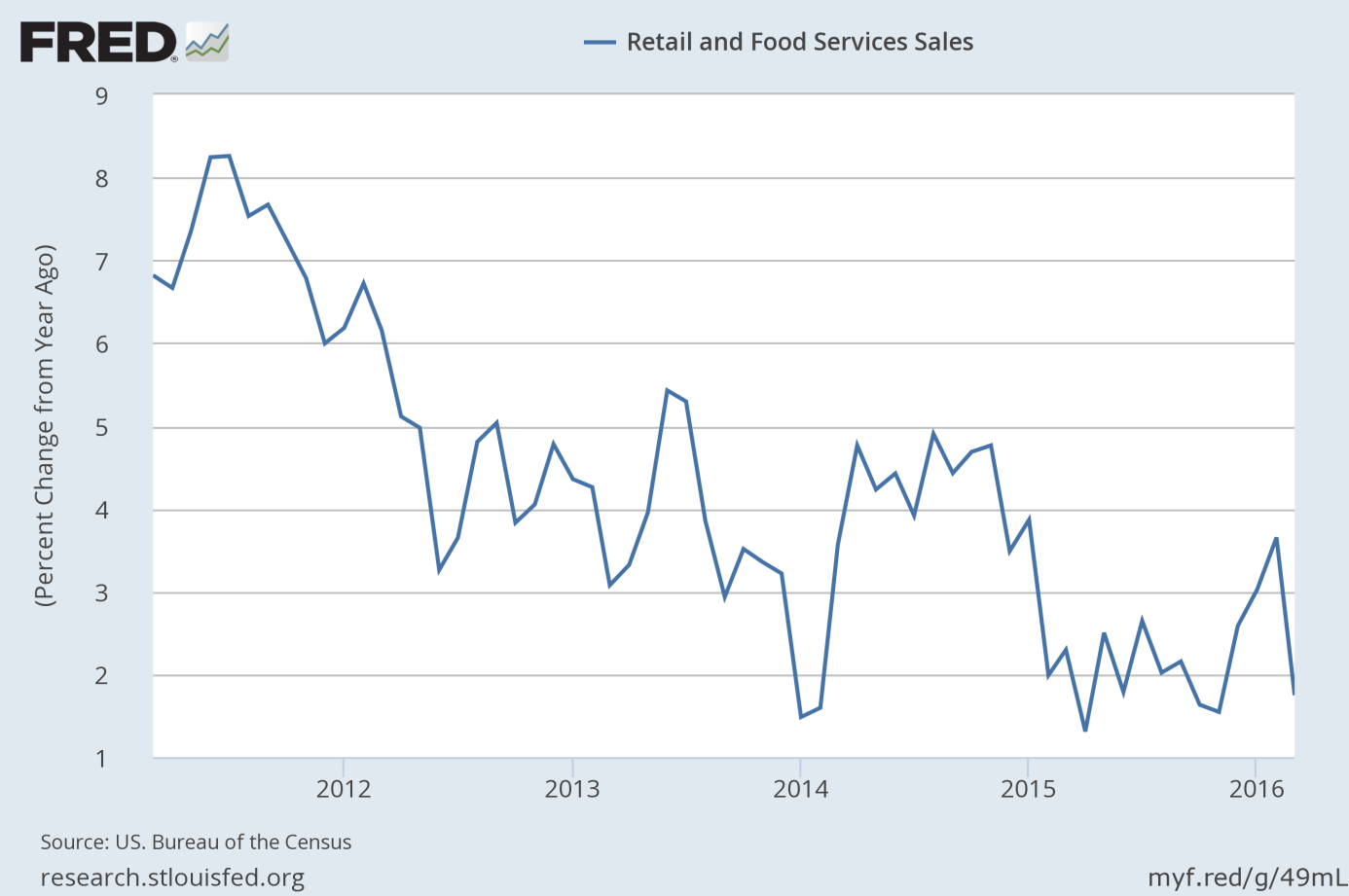

Retail sales dropped 0.3 percent last month, according to the U.S. Department of Commerce. On an annual basis, retail sales and food services increased 1.75 percent, much slower than in February. Indeed, as one can see in the chart below, the annual pace of growth of retail sales continues to slow down.

Chart 1: Retail and food services sales (percent change from a year ago) from 2011 to March 2016.

The March number was below expectations, as economists had forecasted a 0.1 percent increase. Data on retail sales in February were revised up from -0.1 percent to show no change, but this revision definitely does not offset the weakness. Interestingly, the decline in retail sales was mainly caused by a 2.1 percent plunge in vehicle sales – the fourth consecutive decline and the biggest drop in vehicle sales since February last year, which clearly shows the deteriorating situation in the automotive industry. What is important is that the report on retail sales shows wider weakness. Core sales, which exclude automobiles, gasoline, building materials and food services edged up 0.1 percent, below expectations.

To sum up, March retail sales declined 0.3 percent from the previous month. The disappointing dynamics is further evidence that economic growth stumbled in the first quarter of 2016. The report increases the odds of continued caution on the part of the Fed this year in general and a dovish stance in the April statement in particular. Therefore, the report in isolation is positive news for the gold market. Indeed, the price of gold increased after the release. However, gold was generally declining yesterday due to some upbeat economic data coming out of China (Chinese exports rose 11.5 percent in March, the first increase in nine months), a recovery in investors’ risk appetite, and some profit-taking.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium-term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor