Maund On Gold

That was a huge announcement by the Fed yesterday (18th) to keep monetary policy the same and the effect on the markets was immediate and dramatic. To say that this announcement was gold friendly would have to be one of the understatements of the year. Gold soared making its biggest one-day gain for 15-months, silver rose sharply and Precious Metals stocks took off like a rocket. This action marks the start of a major sector-wide uptrend. The dollar tanked as the Fed’s ongoing policy amounts to a continuation of its long-term policy to destroy the currency that has actually been in force with great effect since 1913 – just ask an old timer how much coffee he could buy for a dollar.

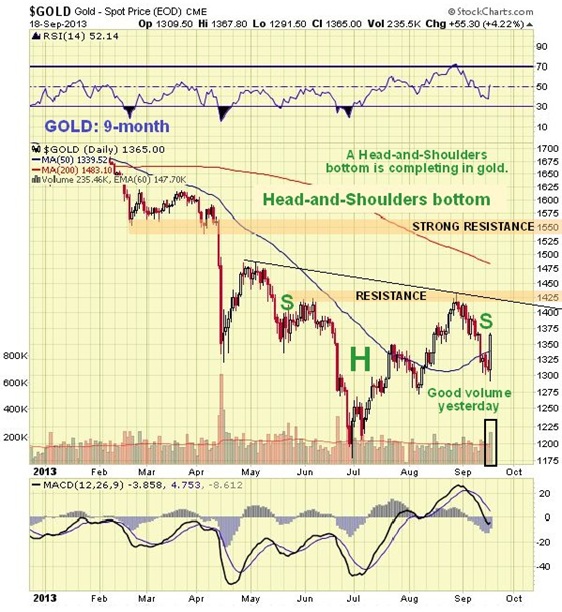

On gold’s chart we can see that the dramatic rise yesterday on the Fed’s surprise announcement means that it is at last about to haul itself up out of the long and tedious Head-and-Shoulders bottom pattern that has been forming for many months. Breakout from this pattern will be signaled by its breaking out above the black “neckline” shown and then above the resistance level a little above that near to the late August highs centered on $1425. Once it breaks out from the base pattern it will be free to advance, but still has to contend with the strong resistance level in the $1550 area at the lower boundary of the large intermediate top area that it broke down from back in April. Volume was good on yesterday’s rally which is another positive sign.

The 13-year chart for gold shown below is an ongoing source of good cheer for gold bulls, as it shows that gold remains in an unbroken long-term uptrend despite the decline of the past 2 years that has had so many rattled and turned into bears. From this chart it is very clear to see that gold is at an excellent to turn up and start a major new uptrend that should take it comfortably to new highs, although it will have to contend with resistance from the earlier intermediate top area on the way up.

Gold COTs (not shown) are still quite strongly bullish, although they have now moderated somewhat following their extremely bullish readings of late June.

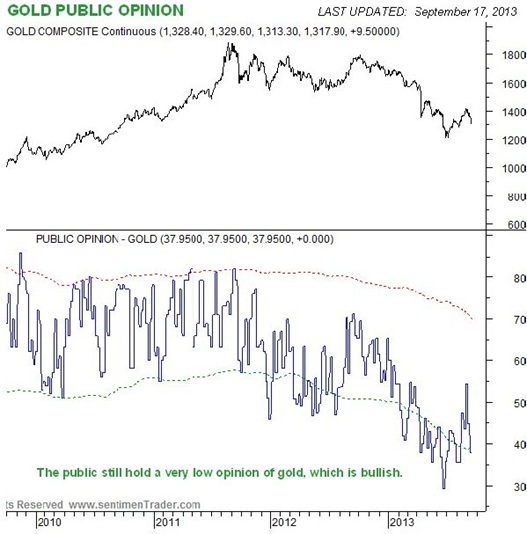

The gold Public Opinion chart shown below makes plain that the public hold gold in low esteem at this time, which is of course bullish, as the majority are always wrong.

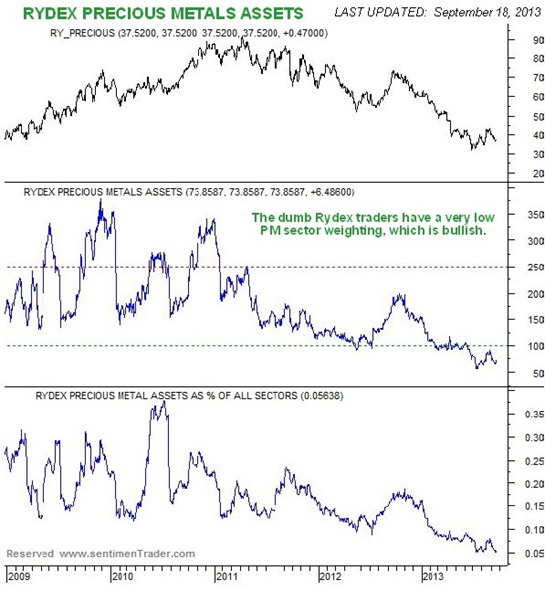

The Rydex Traders have a very low weighting in the Precious Metals now, which is another big positive, as they are a renowned contrary indicator.

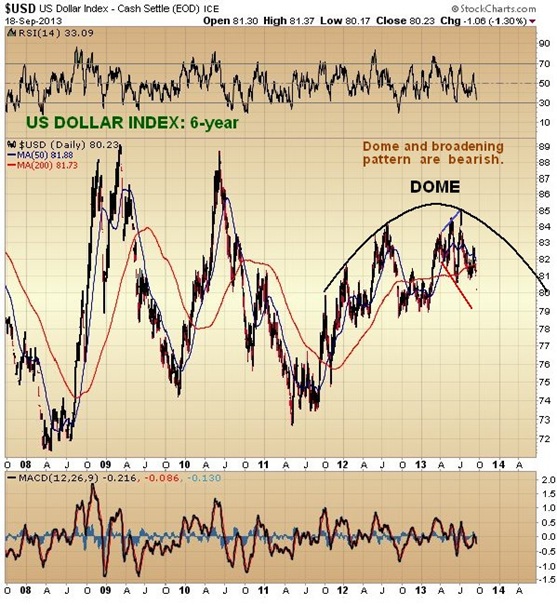

The latest revelations by the Fed are of course very dollar bearish, and yesterday it plunged. They don’t care about that of course as they have been working assiduously to destroy the currency since they started in 1913, and have been spectacularly successful. Our 9-month dollar index chart shows that it crashed a support level yesterday and is headed towards the lower boundary of a bearish “bullhorn” pattern.

The longer-term 6-year chart shows the dollar index descending from a large bearish Dome pattern, and while there some support in the 78 – 79 area, it will probably breach that in fairly short order and head lower towards the 73 – 74 area. This is of course good news for gold and silver.

Finally, Precious Metals stock indices look mega-bullish. The GDX took off like a rocket yesterday (18th) on huge record volume. This is viewed as marking the start of a major sector uptrend. The first hurdle on the way up is the strong resistance level in the 31 area, but yesterday’s action suggests that it will have little trouble vaulting this, and once it gets above that and its still falling 200-day moving average, it will be on its way. There are many who will be put off buying today and in the near future because they missed yesterday’s big jump and consider the sector short-term overbought. They will wait for a pullback, but there is unlikely to be one of significance after the sort of action we saw yesterday. Instead the way to look at it is that this major sector uptrend is still in its infancy, so the fact that prices were lower before Wednesday’s jump is irrelevant.

The Fed’s refusal to change course makes plain that all the talk of tapering is just that – talk. The fact of the matter is that they have passed the point of no return long ago, and given the current debt structure any attempt to wind down market support will result in a systemic implosion, and they know it. This is why they are carrying on as before. While Hot Money obviously likes this state of affairs, someone is going to pick up the tab for all this, and that someone is the guy at the bottom of the food chain, the man in the street. The Fed’s maintenance of its current course will result in the dollar continuing to bleed and this will feed through into accelerating inflation in the US. This is bad news for the ordinary Joe, but good news for Precious Metals sector investors.

********