Midas Touch Gold Forecast

Since my last update gold posted a recovery. So far it´s not very spectacular, but it´s holding above $1,115 as I am writing this. The Mining Stocks (GDX and GDXJ) really exploded higher from their bottom on the 5th of August. However, I don't think that gold already made its final low. The recent price action simply is not encouraging enough. Looking back in history, the bottom usually is a process lasting at least a couple weeks. Therefore, the gold price should fall back below $1,100 sooner or later…and make one more lower low. As you know my bottoming target zone ranges between $1,035 and $980.

Certainly the sentiment has been super bearish. Needless to say, gold is a wonderful contrarian play here, but typical final weeks in any large movement (up & down) are usually characterized by extreme irrationality and exploding volatility. Furthermore, I think the market simply wants to see the $1,000 level - no matter whether this makes sense or not - it´s pure psychology. Therefore I remain optimistic that we will see the final low within the next couple of weeks. Nevertheless, if gold instead continues to recover (i.e. signal would be a daily close above $1,126/$1,130) the bear market will very likely extend into next year.

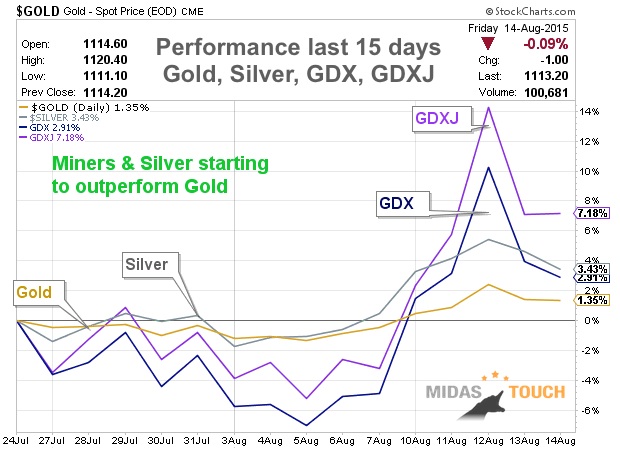

During the last 15 days the Mining Stocks as well as Silver have been starting to outperform Gold. That is a positive sign, which increases the probability that we have seen an important bottom in the sector. I personally believe that the miners have already bottomed, while Gold still has unfinished business on the downside. It´s up only 1.35% from the lows on July 24th. Not a very encouraging price action... The miners instead posted five strong up-days with impressive gains and are about to close the gap they had opened on the 12th of August.

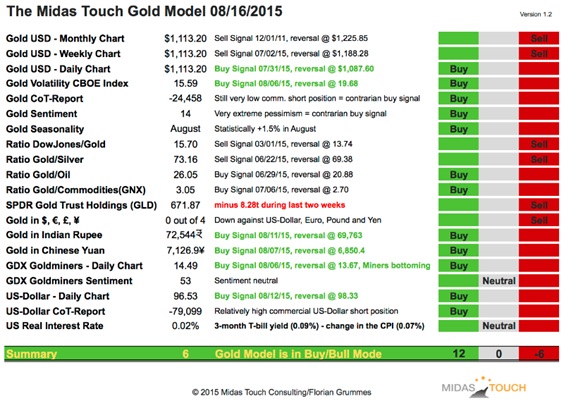

On the 12th of August, my model went into a buy mode for the first time since mid-March. It is still a weak and slow buy signal…but it is a buy signal.

The change in the US-Dollar Daily Chart was the final trigger. But the trend in the US-Dollar is not really clear at the moment. This signal is changing back and forth showing no sustainability here. Besides that we have a new buy signal for Gold USD-Daily Chart, Gold in Indian Rupee, Gold in Chinese Yuan and the GDX Goldminers Daily Chart.

The SPDR Gold Trust on the other hand continues to lose its holdings.

Overall the model is in Buy/Bull Mode.

Gold Daily Chart

My expectation of a more or less immediate continuation down to $1,035 has been wrong. Instead Gold posted a recovery towards $1,126, but failed to regain the "flash-crash" level above $1,130. Overall Gold is still in a bear market and below most of its downtrend lines and below the 50MA ($1,141) and the 200MA ($1,187). The stochastic is already overbought, while the MACD has posted a new buy signal. The RSI has recovered to neutral levels. Generally all indicators do not stand in the way for another down-wave.

In my opinion the recent price action does not look like the start of a new bull market yet. Instead the market is doing everything to confuse everyone. Overall Gold is lingering around $1,115…not being able to make any significant progress. A daily close below $1,106 will confirm the start of the final down wave.

Traders should wait on the sideline here as there is no clear bullish setup, while the more likely bear-side does not deliver any reasonable risk/reward ratio. Instead continue planning how to act once Gold goes below $1,050 to build a long-position, which you can ride for at least a couple of months into a larger bounce/recovery/start of a new bull market.

My recommendation for investors is to buy more physical Gold below $1,050 and below $1,000 (should we get there). The risk/reward is already outstanding. However, you will need to be patient for at least 3-5 years to maximize profitability.

It is also recommended to start buying Mining stocks on any pullback in the next couple of days/weeks. The preferred vehicle should be an ETF like GDX or GDXJ. Once the turnaround becomes more evident, I might start publishing interesting stocks that have great fundamentals, an outstanding management and a very good technical setup. As you know mining stocks tend to rise only 20% of their time. Therefore I prefer buying into an uptrend instead of catching a falling knife. One might miss the first 10-20%, but you reduce the downside risk dramatically.

Long-Term View

The return of the precious metals secular bull market is moving step by step closer…and should lead to the final parabolic rising phase. A new bull market will probably begin this autumn…and could last for 3-8 years or even longer.

Before this can start, Gold will need a final sell-off down to the $1,050-$980 area.

Long-term price target DowJones/Gold-Ratio remains around 1:1.

Long-term price target Gold/Silver-Ratio remains around 10:1 (for every ounce of gold there are 9 ounces of silver mined, historically the ratio was at 15:1 during the Roman Empire).

Long-term Gold Forecast remains at US$5,000 to US$8,900 per ounce within the next 5-10 years.

Fundamentally, as soon as the current bear market cycle is complete, Gold should start the final 3rd phase of this long-term Secular Bull Market. The first stage saw the miners closing their hedge books, the second stage continuously presented us news about institutions and central banks buying or repatriating gold. And the fourth-coming third and finally parabolic stage will end in the distribution to small inexperienced new traders and investors, who will be subject to blind greed and frenzied panic.

********

Disclaimer & Limitation of Liability

The above represents the opinion and analysis of Mr Florian Grummes, based on data available to him, at the time of writing. Mr. Grummes' opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Grummes is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in the Midas Touch. As trading and investing in any financial markets may involve serious risk of loss, Mr. Grummes recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Florian Grummes is not a Registered Securities Advisor. Therefore Mr. Grummes' opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. The passing on and reproduction of this report is only legal with a written permission of the author. This report is free of charge. You can sign up here: http://eepurl.com/pOKDb

Hinweis gemäß § 34 WpHG (Deutschland):

Mitarbeiter und Redakteure des Midas Touch Gold Newsletter halten folgende in dieser Ausgabe besprochenen Wertpapiere: physisches Gold und Silber, sowie Gold-Terminkontrakte.

Imprint & Legal Disclosure

Anbieterkennzeichnung gemäß § 6 Teledienstgesetz (TDG)/Impressum bzw. Informationen gem § 5 ECG, §14UGB, §24Mediengesetz

Herausgeber und verantwortlich im Sinne des Presserechts / inhaltlich Verantwortlicher gemäß §6 MDStV

Florian Grummes

Hohenzollernstrasse 36

80801 München

Germany

E-Mail: [email protected]

Website: www.goldnewsletter.de

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: