The New Gold Myth

Actions have consequences. In the market for any physical good (i.e. a commodity), though the laws of supply and demand can be warped, and their corrective dynamics delayed – through brute-force manipulation – they can never be permanently resisted.

For this reason, the Banksters themselves know they are fighting a losing battle with respect to the price-suppression of gold (and silver). They can delay the rise in their prices to fair market value (even to the point of keeping them permanently undervalued), but they cannot eliminate the relentless upward pressure which, one way or another, must result in higher prices.

An important part of permanently keeping prices below any rational valuation is to keep market participants ignorant of the actual fundamentals which are producing this upward pressure. In the jargon of the mainstream propaganda machine; this is known as Controlling The Message. If you cannot prevent market participants from forming the view that “bullion prices should be higher”; ensure that this belief is based upon the wrong reasons.

With respect to precious metals (and nearly every class of “hard asset” except real estate); these assets are ridiculously undervalued for one absolutely predominant reason: the insane over-printing (and relentless currency-dilution) of our fiat paper currencies. The simple fact that all assets are priced/denominated in this paper is, alone, strongly suggestive that this will be the dominant variable in market pricing for any asset.

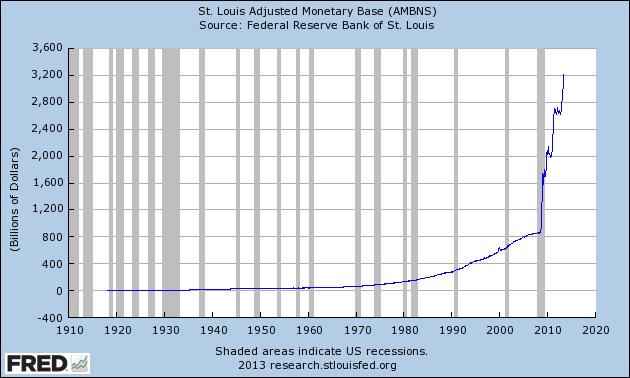

What elevates this money-printing from merely one of the drivers of precious metals markets to the absolute driver of bullion prices – and the prices of all hard assets – is the sheer magnitude of this money-printing insanity. At the risk of boring regular readers; nothing communicates this point like a picture:

A vertical line. U.S. money-printing going straight up, which in the realm of mathematics can only be expressed one way: infinite money-printing (i.e. infinite currency-dilution). “Infinity” as a multiplier, renders all other variables mathematically irrelevant. The money-printing is going straight up, so hard asset prices should be going straight up with it. All other analysis is mere distraction.

This point was illustrated in a recent commentary Three Reasons Why The USD Is Already Worthless ( https://www.gold-eagle.com/article/three-reasons-why-usd-already-worthless ) . There is not merely a single basis for asserting the U.S. dollar is worthless, today. Rather, there are three separate, concrete, fundamental reasons for concluding that the USD should already be priced at zero/near-zero. Naturally infinite money-printing is (and must be) the strongest of those three bases.

This brings us to the latest propaganda campaign on gold from the Corporate Media, on behalf of the bullion banks, who (in turn) are mere tendrils of the One Bank. To properly understand the current message requires first reviewing recent “history” – i.e. what we have been told by the mainstream media about what should or should not be driving these markets.

The Old Myth (pre-Crash of ’08) was that gold and silver were no longer “safe havens”, but were instead “barbarous relics” whose usefulness as financial assets and stores of value had been forever replaced by the Magic Paper of the One Bank. The Crash of ’08 permanently and irrevocably shattered that myth.

The paper of the One Bank was exposed as mere currency, not “money”; meaning that while it could be used as a medium of commerce, it was not money – a vessel for safely storing one’s wealth. “Competitive devaluation”, the official race by our governments to see who can drive their currencies to zero the fastest, was the promise by these governments that we could never trust these paper currencies as stores of our wealth ever again.

Infinite money-printing in the U.S. (and Europe as well) is the fulfillment of that promise: literally rendering all of this paper worthless.

With the old myth shattered; new mythology was needed to replace it. This ad-libbed propaganda (not surprisingly) has ranged from the implausible to the absurd. The most-absurd of this propaganda was (also not surprising) the most successful: gold and silver should not be valued as “safe havens”, but rather as the precise opposite – as “risk assets”.

So, for roughly two years, we saw this surreal synchronization of the bullion banks with the Corporate Media. On days when the propaganda machine gave its “bullish” thumbs-up to the world’s markets (and thus “risk assets” were in vogue) gold and silver prices would rise. Meanwhile on all the “bearish” days, the One Bank’s trading algorithms programmed all the Sheep to sell the world’s foremost safe-haven assets.

Inevitably, this flimsy anti-logic has also (finally) unraveled; and so once again the Corporate Media is forced to concede that gold (at least) is a bona fide safe haven. But here again we see the endless bait-and-switch operations which are all a part of Controlling The Message.

As just alluded to, part of the current operation is to assert that only gold – but not silver – is a safe-haven asset (a natural property of all precious metals). Silver is merely an “industrial metal.” The idea is that you can start with a precious metal, add a component of “industrial demand” to it; and somehow reduce its value: 2 + 2 = -4.

This anti-logic is just as ridiculous as labeling the world’s premier safe havens “risk assets”, yet it was precisely what we saw in our markets on Labour Day Monday: the price of gold was flat as (supposedly) its need as a safe haven had momentarily waned, while silver surged 2% based on (supposedly) brightened prospects for “industrial demand”. Obviously that message (and pricing) can just as easily be reversed.

This brings us to the other half of this latest bait-and-switch operation: promoting gold exclusively as a safe haven for geopolitical risk, and avoiding (at all costs) any mention of gold as a safe haven for economic risk. The purpose of this equally clumsy operation should be obvious.

We have one absolutely dominant variable which rules these markets: infinite money-printing, and based on that fundamental alone; gold, silver, and other hard assets should be priced at (more or less) “infinity dollars”, today. As previously pointed out, in comparison to this all other drivers are trivial. If you can get the Sheep focused on one of those other, trivial drivers; then (for the moment at least) you remove the infinite pressure pushing gold and silver prices higher.

Thus we have the propaganda machine now obsessing about the Syrian melodrama unfolding before us, and the endless stream of implausible and/or conflicting events being reported in that milieu. “Syrian tensions price”, so the price of gold should rise – a mere 1% or 2%. “Syrian tensions fall”, and so on that basis alone, there is (magically) “no reason” for bullion prices to rise at all.

It’s like telling a Snowman in the Sahara Desert that there is no reason for him to obsess about “air temperature” (as the sun beats down upon him), all he needs to do is concentrate on wind direction. And, in the twisted logic of the mainstream media (and the One Bank); as long as the Snowman remains focused upon wind direction, he won’t melt.

The moral of the story is obvious: one must avoid being a Snowman in the Sahara, distracted by the trivial drivel from the mainstream media as Competitive Devaluation melts/evaporates any and all paper wealth at an exponentially increasing rate.

The Magic Paper of the One Bank is already worthless, in fundamental terms. However, thanks to the saturation-manipulation from the Banksters’ trading algorithms and the blissful ignorance of all the Sahara Snowmen populating our markets; this paper remains temporarily (and extremely) overvalued.

No mythology (Old or New) can rebut the economic tautology that infinite money-printing renders these paper currencies worthless any more than deception alone can prevent a Snowman from melting in the Sahara. Those who lose sight of this “big picture” do so at their own peril.

Jeff Nielson

Jeff Nielson is co-founder and managing partner of Bullion Bulls Canada; a website which provides precious metals commentary, economic analysis, and mining information to readers/investors. Jeff originally came to the precious metals sector as an investor around the middle of last decade, but soon decided this was where he wanted to make the focus of his career. His website is

Jeff Nielson is co-founder and managing partner of Bullion Bulls Canada; a website which provides precious metals commentary, economic analysis, and mining information to readers/investors. Jeff originally came to the precious metals sector as an investor around the middle of last decade, but soon decided this was where he wanted to make the focus of his career. His website is