Obama And Yellen Are Giving Me The Heebie-Jeebies! Higher Gold And Silver Prices To Follow

When I last published this Bear’s Eye View of the Dow Jones Index a few weeks ago, it appeared the Dow Jones Index would be making a new all-time high sometime in early May. On April 20th it was only 1.18% from last May’s BEV Zero, or the Dow’s last all-time high. From there the bulls could have easily taken the index up to a new all-time high in a single trading session. However that didn’t happen. Instead the index began a little correction, the first since the market bottomed last January. So what now? Well the market was due for a correction, but why start one when the Dow Jones Index was so close to taking out its last all-time high?

As you know I haven’t liked the stock market for a long time. So I’m in Mr Bear’s camp expecting further claw backs in market values as we count down from April’s -1.18% in the chart above, down to the -5% BEV line and below. But I wouldn’t be shocked if in the next week or two the Dow Jones did make a new all-time high. I just don’t think the bulls in the FOMC want to make the effort because they must fear reigniting the public’s enthusiasm for speculative gains in the stock market. The name of the game they’re now playing is called “market stability.”

Here’s a view of the Dow Jones with its 52Wk High and Low lines going back to 2006. In the past year the Dow Jones made its last 52Wk High on May 19th , but since then it made new 52Wk Lows last August and then again just last January. Since March 2009 the Dow Jones had made a new 52Wk Low only once before in early October 2011, a one day event from which the Dow Jones soon recovered from. Since May of 2015 rebounding to a new 52Wk High from a new 52Wk Low is something that can’t be said for the Dow Jones, though in the past year it’s had two opportunities to do exactly that.

So the question in my mind is whether we’ll see the Dow Jones make a new 52Wk High or a 52Wk Low in the weeks and months ahead. If I were a betting man, I’d say a new 52Wk Low is more likely for the simple reason that the stock market has lost its enthusiasm for soaring to new 52Wk Highs shortly after QE3 was terminated.

There are other problems the stock market is facing. Daily volatility for the Dow Jones has been increasing since December 2014, and since January 1900 that has never been a positive for the stock market. I realize that this is a 200 day moving average that spans back late July of last year, so it currently includes the volatility of last August / September when the Dow Jones was making its first new 52Wk Low since August 2011. However that data is getting pretty stale and in the next six weeks will be taken out of the 200 day moving average. But a lot can happen in the next six weeks.

Another thing that could impact the stock market is the credit quality of less than best grade bonds is beginning to be questioned in the bond market. I say that because this week Barron’s Confidence Index (CI) just hit a new 3 year low of 66.8.

All bull and bear markets have a theme. We had the High-Tech bull market during the 1990s, and then the “Tech Wreck” bear from 2000-02. There was the Mortgage Mania bull from 2002-07, and then the Sub-Prime Mortgage bear market from 2007-09.

I really don’t know what to call the seven year bull market from March 2009 to May 2016. Maybe just recognizing it for what it was; the “policy makers” absolutely refused to face the consequences from their decades of “injecting liquidity” into the financial markets, and public, corporate and private balance sheets. So since 2007 when the mortgage bubble began to deflate, the “policy makers” just plugged the holes in the credit bubble and re-inflated it with their Zero Interest Rate Policy and as many trillions of dollars as it took to achieve “price stability.”

Who today isn’t struggling with the burdens of ill-considered consumptive debt, cheerfully extended to them at “attractive interest rates?” Seeing Barron’s CI (below) heading towards its critical 65 Red Line tells me the bond market is now beginning to see wisdom of distancing itself from the bonds of companies that have burdened themselves with debt taken on corporate balance sheets for the frivolous purpose funding their share buyback or dividend programs.

So what should we call the pending bear market? Let’s call it the Great Deleveraging, when the world once again recognizes that debt is just another dirty four letter word. And as all money today is debt, the massive deflation that must occur during the Great Deleveraging just may turn our debt backed cash into trash; just one more reason to like investments in gold and silver.

Gold (Blue Plot below) is holding up pretty well under the selling assault it’s seen in the past few weeks. Looking at its step sum (Red Plot) I may have closed the bull box to soon as its once again heading down, though with little effect on the price of gold.

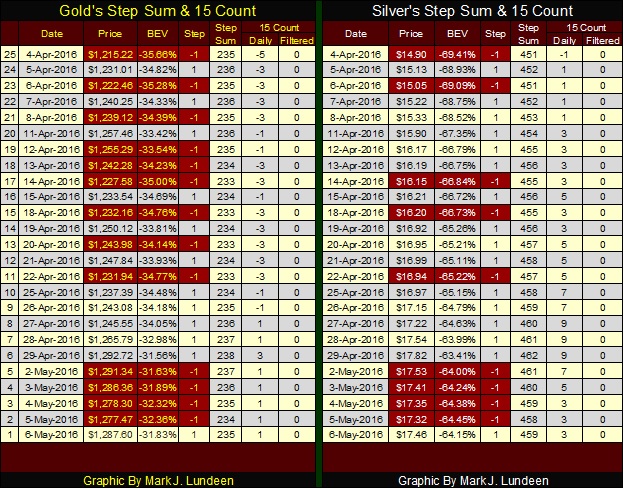

To really understand what is going on in the chart above, take a moment to study the table below. In the past twenty five trading days, thirteen have seen gold close lower. I highlighted the down days in Red. This is typical as in bull or bear markets there are about as many down days as up. Yet since April 4th (a month into the bull box that began on March 7th) the twelve advancing days have taken gold up from $1215 to $1287. It’s a bullish thing when twelve up-days cancel out the losses from thirteen down-days by a good margin.

Silver too is doing well, but Geeze Louise with up days overwhelming down since April 4th, I would have thought the price of silver would be higher. Still it’s advanced by $2.56 in the past 25 trading days, so I’m not complaining.

COMEX gold open interest is becoming interesting. We’re approaching the point where the price of gold is either going to collapse with Open Interest (OI), or (knock on wood) take off towards the wild-blue yonder as OI collapses.

Here’s a chart plotting COMEX gold’s OI and price from 2013 to present. I placed a star on March 23 where OI peaked at 510,501 contracts, from where it then dropped to 447,708 on March 31. The Commercials may be largely short, but they do have significant long positions too. Obviously what we see when OI takes a dive, as it did last March, the Commercials begin selling their long positions on the cheap expecting to create a selling panic with the Spec Longs. If so…they were disappointed with the results. They then decided to flood the market with even more paper gold. As of the end of the week OI has expanded to 568,069 contracts; or 56,806,900 ounces of fictional gold.

Expect the big banks to flood the market with even more fictional gold in the days to come. This is an effort to get the longs to over leverage themselves as they are forced to absorb the new supply of fictional gold to support current prices. By flooding the COMEX paper market with their insincere promises to deliver millions of ounce of gold they don’t have, the banks are expecting the next time they engineer a collapse in OI they’ll have more success in creating a selling panic with the longs.

How many more contracts will that take? Since the beginning of the bull market in gold (2001), COMEX gold’s Open Interest peaked in November 2010 at about 650,000 contracts (Blue Plot below). As seen from November 2010 to August 2011 we see the makings of a Commercial Signal Failure; rising gold prices in the face of collapsing OI. But after August the longs were overwhelmed and the price of gold (Red Plot) began a decline that didn’t bottom until just this January.

I’m not an expert in the gold futures market, and I expect there are lots of activities I’m unaware of influencing the price of gold occurring beyond what we see above. However, using the information I do have, and assuming the big banks are feeling the heat from the rising price of gold, I would not be surprised if COMEX gold’s Open Interest increased to a new bull market high before this is done.

This will be the big banks attempt to lure in weaker Spec Longs into the paper-gold market…so when they engineer their next collapse in Open Interest, it will force the longs to dump their long positions at a loss, creating a selling panic in the process. If the price of gold is to rise up to its last all-time high, the banks will have to fail in rigging this crooked game their CFTC “regulators” have all too long allowed them to play. Why do the Federal Government’s Regulators allow banks that don’t mine, fabricate or sell gold by the millions of ounces, promise to deliver gold by the millions of ounces – gold the banks don’t have and so could never deliver to COMEX exchange warehouses? The Federal Government wants to suppress the price of gold, and yes silver too, to create the appearance that all is well with the US dollar, thus facilitating “price stability” in the financial markets.

But it’s a losing game the big banks, and yes that the Federal Government too are playing. Seeing the expansion in the Federal Reserve’s balance sheet since 2008 is enough to give anyone with a smidgen of understanding the heebie-jeebies when they consider the horrendous inflationary implications the FOMC has exposed the global reserve currency to: the US dollar. Small wonder foreigners have begun to distancing themselves from the dollar. In 1953 CinC was only $23.8 billion dollars. In 2016 both Bill Gates and Warren Buffet are worth more than that.

Ultimately gold and silver will see dollar prices that would shock most people today. But should the price of gold rise to $50,000 an ounce, how many people with an ounce of gold would be willing to make the trade for a currency managed by a central bank that’s capable of doing what we see below?

I’m not a trader looking for short term speculative gains in the futures markets, not that there’s anything wrong with that – if you can do it. But most people can’t. That being the case, and as the current price of gold and silver are incredibly cheap, and there are sure to be yet more bouts of QE to come, purchasing gold and especially silver bullion at today’s prices just may be the * INVESTMENT * of a lifetime.

However if you’re looking for a little excitement in your investment portfolio you may want to consider * SPECULATING * in what is currently the most despised sector in the stock market: precious-metals exploration shares. What makes these companies so exciting is that the major precious-metal miners have done little to replenish their now greatly depleted ore reserves for well over a decade. So, if these mining companies are to survive they must find new ore bodies of precious metals; and where they will find them will be in the exploration sector.

The table above shows the seventeen week performance of the gold and silver mining indexes I follow. Their performance of the past four months has been outstanding! Still, as you can see in the table’s Bear’s Eye View (BEV) values, and in the chart below, they are far below their bull market highs of April 2011. In fact the chart below shows them to be not that far above where they were at the beginning of the bull market that began in 2001. So don’t believe purchasing the big precious metals miners at these levels means that most of the possible gains have passed you by.

Purchasing equal dollar amounts of gold and silver bullion and shares in the big mining companies seems a prudent course of action in today’s market. However, as always in a bull market, there will be corrections coming that will attempt to shake you from your positions.

But the gains seen above are those enjoyed by investors of the big precious-metals mining companies, while shares in the mineral-exploration companies are still near their bear-market lows. Sometime in 2016-17 that should change. And in a world where the financial markets now have tens of trillions of dollars circulating in them daily, an exploration company with a market capitalization in the tens of millions of dollars is very illiquid to a fiduciary of a mutual or hedge fund.

During bear markets illiquidity is a problem as one may not be able to exit from a position without substantial losses for lack of buyers. But during bull markets the dilemma of illiquidity becomes one of not being able to purchase shares at an acceptable price during a sustained advance for lack of sellers, resulting in amazing gains in a hot market. Looking at the chart and table above, we see how last January the gold miners were deflated by over 75% since their bull market highs of April 2011. I expect earlier this year the precious-metals mining sector saw a very hard bottom that will not be revisited anytime soon. That makes this point in the market a logical entry point to speculate in precious metals exploration companies.

An exploration company I like is Eskay Mining (ESKYF: NASDAQ / ESK: TSE).

http://www.eskaymining.com/index.asp

Eskay’s CEO is Mr. Mac Balkam, a position he’s held since 2009. He’s been purchasing shares of Eskay Mining in the open market over the years and currently holds over 10% of the company’s shares making him the largest shareholder in the company. The second largest shareholder is another of the company’s directors who has purchased five million shares. So management holds 15% of the company and stands to benefit from the success of the company along with the other shareholders.

Eskay Mining’s 130,000 acre Cory and SIB properties are located in Northwester British Columbia in an area called the Golden Triangle. The success of Eskay’s neighbors had in discovering economic grades of ore suggests the Golden Triangle contains additional world class metals deposits. Seabridge Gold (SA: NYSE) is developing its Kerr deposit, one of the largest gold/copper deposit in the world and is seeking a partner to build a Five Billion dollar mining complex. Their Kerr deposit adjoins Eskay's claims. Pretium (PVG: NYSE), another of Eskay’s neighbors is building a mine the may prove to be the highest grade deposit in the industry. This mine will be in production Q3, 2017 and is fully funded to production. Eskay's land package is about 3 miles due west of the Pretium property, but they do own a major land package on the north.

Eskay’s management intends to enter into a joint-venture partnership with a major mining company to advance their project. With a huge land package of some 130,000 acres located in a geologic area proven to contain significant precious metals ore bodies, that plus data from $40 million in past exploration work makes Eskay a very attractive JV partner for a major. After all, they own lands less than a half mile from Barrick Gold’s now decommissioned Eskay Creek Mine. During the thirteen year lifespan of the Eskay Creek Mine it was the 2nd largest gold producer in North America and fifth largest silver producer in the world. Production ceased in 2008, but based on previous exploration work the discovery of a second Eskay Creek style VMS gold discovery on Eskay Mining’s property is a possibility.

I need to disclose that I own a significant position in Eskay Mining. My promotion of the company is done without any compensation from the company. Also the company did not contact me expecting that I would promote them, though I sent my plug for the company to Mr. Balkam earlier this week so he could check it for factual errors and omissions. I just believe that as the bull market for gold and silver moves to new highs the potential for Eskay Mining is outstanding. Still it’s a high-risk venture that can offer no guarantees. So * SPECULATING * in Eskay Mining, or any other exploration company should not be the major focus of one’s portfolio.

But at today’s prices a thousand dollars can purchase 10,000 shares. After you have your positions in gold and silver bullion and several major precious-metals miners, reserving 1% to 5% of your capital for speculating in an exploration company seems appropriate.

Currently Eskay Mining is thinly traded on the NASDAQ. You may have to ask your broker to obtain shares from the Toronto Stock Exchange.

Mark J. Lundeen