RCA (1925-1929) and MICROSOFT (1994-1998)

RCA (1925-1929) and MICROSOFT (1994-1998)

A Historical and Fundamental Analysis

Exactly one year ago I did a study comparing the incredible price run of the number one tech-stock of the 1920s (RCA) with the similarly spectacular price increase of unquestionably the best high-tech stock of the 1990s (MICROSOFT).

Following is an update to that study - which should knock your socks off. The first part of this report is merely a review of the original study in order to refresh the information and bring it up to date. The second half provides an in-depth analysis of the fundamentals behind today's MICROSOFT - which lead one to conclude MSFT may be severely over-priced and due for a fall… even more than has already occurred in the early stages of this bear market.

RCA

Radio Corporation of America (RCA) was Wall Street's darling high-flyer tech-stock of the 1920s. It made many investors and speculators millionaires. The RCA stock market symbol was known alike by bankers and barbers from New York to San Francisco. It had a virtual lock monopoly on "wireless" communications for the masses. There was no serious competition in sight.

In essence RCA was the leading-edge of the high-technology of the day. Undoubtedly, it enjoyed the same dominance in its field as Microsoft commands today in Operating Systems and related peripheral software.

In the five years prior to the Great Crash of 1929, RCA stock soared from about $11 to its September 1929 high of $114 (adjusted for the 5 for 1 stock split in February of that fatal year). That's an appreciation of 936% in only five years -- equal to an annual compound return of a monumental 60%. Also unbelievingly incredible was the fact it never paid a cash dividend! Investors didn't care since the stock value increased almost daily. At its 1929 peak RCA boasted an astronomical price/earning ratio of 72:1.

MICROSOFT

During the past five years one would indeed be hard pressed to find a stock with more market appreciation and dominance in its field than MICROSOFT. Many struggling competitors have litigation pending against the software company's near monopolistic hold on its area of endeavor. Even the federal government is challenging MICROSOFT's alleged unfair dominance.

All this has inflamed investors interest in its stock. During the last five years MICROSOFT has soared nearly 1,100% -- equivalent to approximately a compound yearly stock price rise of 64%. Phenomenal! Just like RCA during its early history and meteoric stock price increase, MICROSOFT has never paid a cash dividend since going public. Needless to say, investors could care less. Interestingly, MICROSOFT's price/earnings ratio was a very lofty 56:1 at its all-time high of $119 in mid-July this year. Indeed high by today's standard. Recall the S&P500 had an average PER of about 27 just a few months ago.

THE COMPARISON

Many analysts have already shown that the traditional measures of market valuations are TODAY more over-extended than in 1929 and 1973, just prior to each market crash. In each of the previous Bear markets High-Tech stocks were decimated. But since this writer's analysis began with RCA and MICROSOFT, the comparison is limited to these two stocks.

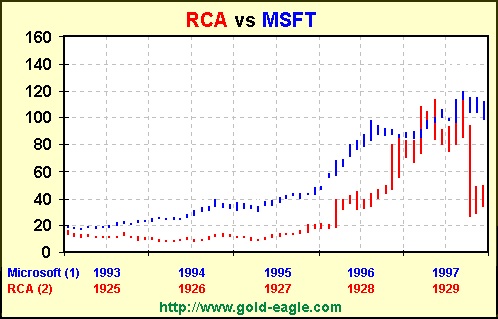

The chart below shows the price movement of each stock. Please recall the RCA prices are adjusted back for the 1929 stock split of 5 for 1. Since the price changes of both stocks were similar, it facilitated super-imposing both curves on the same chart, thus allowing an easy visual comparison OF WHAT HAS HAPPENED, AND MORE IMPORTANTLY, WHAT COULD HAPPEN... in the event of another vicious Bear market like 1929 or 1973.

Note (1): All Microsoft prices reflect stock splits in 1997 and 1998.

Note (2): Radio Corporation of America split 5 for 1 in February 1929.

Therefore, all prices were adjusted backwards to reflect the split.

Multiply all prices prior to split by 5 for historical trading

comparisons.

MICROSOFT FUNDAMENTALS

The following article was authored by analyst Rick Ackerman - which was published in The San Francisco Examiner, Sunday, June 1, 1998.

* * * * * * *

IS MICROSOFT VULNERABLE?

Here is fresh fodder for those who would profess doubts about the supposed invincibility of Microsoft in the marketplace.

I will proffer the testimony of one expert, not as irrefutable evidence that Gates & Company are about to stumble, but as constructive counterpoint to the belief -- likely approaching its apogee on Wall Street right now -- that the Redmond, Washington-based software maker can do no wrong.

Many would have believed the same of RCA -- the Radio Corporation of America -- in the months leading up to the Crash of 1929. At the time, "Radio," as it was called, was the hottest stock on the Big Board.

Its shares, much like those of Microsoft today, were propelled steadily heavenward by strong earnings growth, but also by the seemingly limitless promise of the technologies that the company was thought to have possessed.

In retrospect we know that RCA was neither omnipotent nor impervious. In due time, we shall surely learn that Microsoft is no different.

But before I reflect on why, and seek rebuttal, I should say that I harbor no deep feelings about Microsoft. I use a PC and a Macintosh every day and am not much impressed with either. Although the Mac is somewhat more idiot-proof, if not to say merciful, I curse them both all the time and never without good reason.

You can therefore trust my impartiality when I aver that someone worth listening to thinks that Microsoft is headed into deep and unfamiliar waters that will soon spill over its gunwales.

In fact, my source, a Chicago-based consultant named Richard Finkelstein, is all but certain that the desktop business that has propelled Microsoft's spectacular growth is about to go the way of the blue whale, if not the mastodon.

His argument hits home for any computer user who has struggled to keep up with the frequent changes that Microsoft makes in its Windows operating system and related desktop applications.

This is making profits the easy way, says Finkelstein. The strategy is akin to the fashion industry's trick of altering tie widths and hemlines every couple of years in order to make people change their entire wardrobes.

It is a huge waste of time and money, says Finkelstein. But with the marketing wiles of a Tom Sawyer, Microsoft has somehow managed to convince users that "whitewashing the fence is fun, and that we should even pay for the privilege."

All that is about to change, however. The reason, Finkelstein says, is that in the years to come, a vast library of software applications equal to or better than the ones that Microsoft now sells to millions of users -- one shrink-wrapped package at a time -- will be available on demand via the Internet, as numerous computer applications already are.

And you won't have to buy them, says Finkelstein, since they will probably be included in the package you negotiate with your Internet Service Provider.

Finkelstein and others in the industry agree that all you will need to access such software tools, each tailored to very specific needs, will be a Web browser and a keyboarded display device, not a powerful desktop computer driven by an operating system that almost no one understands, and which runs a suite of applications, many of them superfluous, that requires an inch-thick manual to explain.

Of course, Larry Ellison, the CEO of database giant Oracle, has been saying as much for years -- that the Internet is capable of imbuing a relatively dumb terminal with all the computational power and software applications that a user could possibly need or demand. But to some, Ellison undoubtedly comes off as Captain Ahab, a hypertensive harpoonist whose very passion can sometimes overwhelm the credibility of his premise.

Finkelstein's argument is freighted with no such baggage. Through his firm, Performance Computing, Inc., he makes a living advising large companies -- including Oracle -- on how to get maximum value from their computer systems.

As far as he is concerned, Microsoft has painted itself into a corner by pushing the sale of a computer operating system that few users could ever master and which must be updated every two or three years.

If so, it would be news to at least one Microsoft executive, Richard Tong, the company's vice president of marketing for personal and business systems.

Tong notes that while all companies' software products must be updated periodically, even Oracle's, Microsoft's are flexible enough to facilitate the process not just on the server, but on individual work stations.

Nor is it any challenge for a Windows NT user, say, to update a computer system with thousands of machines overnight. For instance, it is done across 10,000 desktop units at Boeing, using a product called Zero Administration Windows, according to Tong.

Moreover, he says, Windows-based applications are ideal for the many companies whose employees travel with laptop computers and who require lots of computational power on-the-fly.

Tong said one of Microsoft's most potent advantages as the computer industry moves forward is in providing a standard architecture that can be used by small businesses and large alike.

"We want to allow a laundromat to be able to run the same software as the largest corporation," says Tong. In this way, he asserts, Microsoft will be able to provide the benefits of scalability and enterprise performance to small companies that cannot afford the $10 to 20 million they might otherwise have to spend on a mainframe-based system.

Tong rattled off a list of large companies that have deployed Windows NT servers, including Hewlett Packard, Digital Corp., Compaq and Tandem, which sells 90% of the world's transaction-based systems.

But Finkelstein remains skeptical that Microsoft will ever come close to matching the performance of high-end database management systems such as those sold by Oracle. Microsoft may rule the world of desktops, he says, but they aren't even a player in the corporate major leagues.

According to Finkelstein, Microsoft lacks the experience and products to support the large corporations and the millions of users who will be pulling down software and data from vast electronic networks such as the Internet.

Who can do this? Even more than Oracle, IBM, says Finkelstein, and it is one reason the stock recently eclipsed a record high that had stood for nearly ten years, since just prior to the October 1987 Crash.

Finkelstein says that despite the recent strength in IBM's shares, the company's potential is still underrated by Wall Street. Few seem to recognize that the locus of computing work is about to shift from desktop systems, which have been IBM's biggest weakness, back to mainframes, which for forty years have been its chief strength, according to Finkelstein.

With its long experience supporting such large-scale users as airlines, banking and financial networks, IBM will be able to leverage its know-how quickly while companies such as Microsoft will have to learn from scratch, says Finkelstein.

Ultimately, he says, the gap in knowledge and products for these types of networks will prove too large for Microsoft to surmount.

The only chance the company has of sustaining revenue growth -- a long shot, according to Finkelstein -- is to become a successful content-provider. This is why Microsoft has moved so aggressively to partner with such giants of media and entertainment as Disney and NBC.

(end of Ackerman article)

*****************************

Will the Y2K Bug Administer the Coup de Grace to MICROSOFT?

To date I have not seen any media reference about how the MILLENNIUM MENACE might adversely affect computer sales in 1999. Could potential damages to revenues of one of the country's largest industries be so in jeopardy that all are afraid to comment on it?

Firstly, I must tell you all upfront, I am NOT an expert researcher in computer sales. Nonetheless, common sense leads to the following.

Computer and chip industries revenues may well be devastated in 1999 as the millennium draws near - as there are only 447 days remaining. Almost everyone who currently uses a computer - and those who contemplate purchasing their first - must be acutely aware that come mid-night the Eve of the Millennium, most computers will read the next day as January 1, 1900. Certainly confusion will ensue… possibly even chaos in most businesses and all levels of society - globally. All because most computers are not Y2K compliant.

In light of increased media coverage of the looming Y2K Bug, those computer owners contemplating the purchase of an upgraded unit, and first-time computer purchasers will logically postpone buying a new computer, UNTIL AFTER JANUARY 1, 2000. Their common sense reasoning is to simply wait until after the fatal day, thus allowing the computer industry sufficient time to assess the damage in the aftermath - allowing time for suitable adjustments to be made to the hardware.

Simply put, WHY BUY A COMPUTER NOW WHICH MAY HAVE A SERIOUS Y2K DEFECT, WHEN IN EARLY 2000 THE PROBLEM WILL HAVE ALREADY BEEN RESOLVED?!!

Makes sense to this non-computer expert.

In the event my common sense approach to computer purchases during the next 15 months rings with logic and clarity, I predict a dramatic decrease in computer sales for all 1999 - much below what industry analysts are still forecasting. This would kick the bloated air out of MICROSOFT's market price. Under these conditions - and if the bear market drags into 1999 (as I believe it indeed will), then a price to earnings ratio of 20 might be much more appropriate. Moreover, if the Y2K scenario does adversely affect computer sales, MICROSOFT's anticipated 1999 earnings will be reduced accordingly. Consequently, declining earnings and sharply lower PER will translate to a much lower share price for MICROSOFT.

To predict how far MICROSOFT might drop in this scenario would require a great deal more study and analysis. However, I suspect it might decline a great deal. In any case I am haunted by the shadow of RCA - which ultimately dropped from its 1929 high of $114 to less than $3 per share in 1932. This represented a 97% loss from its 1929 peak. Is it really worth the risk?