Shanghai Gold Exchange Gets Shark Teeth

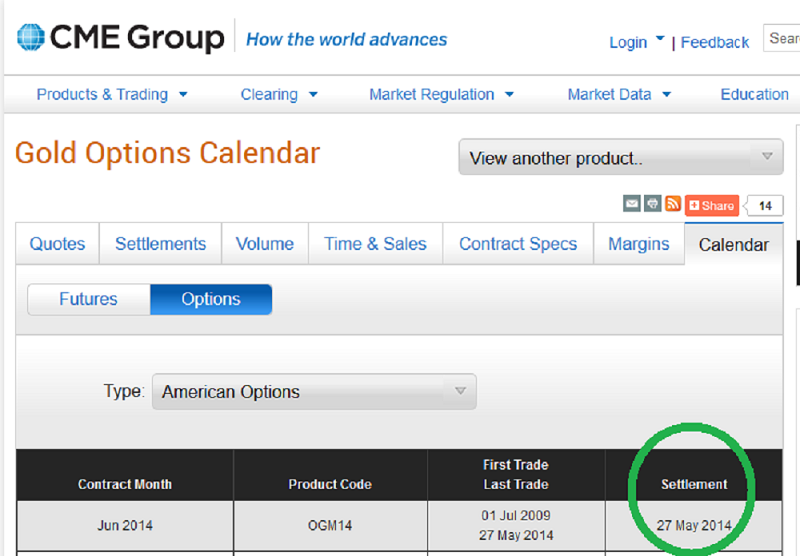

Today is expiry day for gold options. I’ve suggested that gold is unlikely to begin a trending move until options on the June COMEX contract expire.

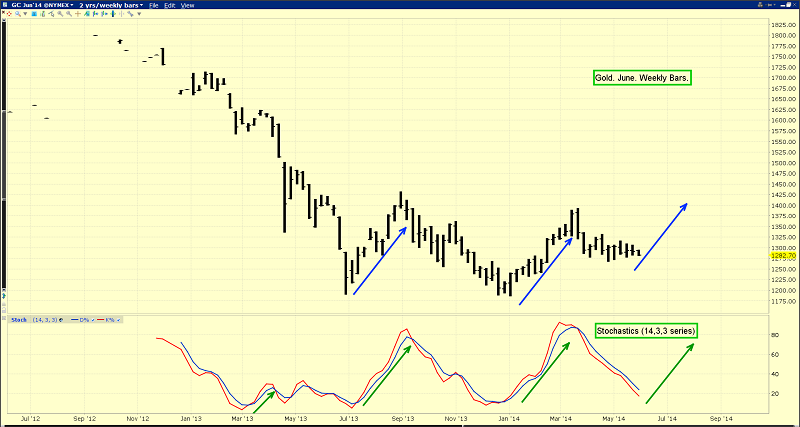

That’s the weekly chart for gold. I’ve highlighted the price action that has occurred after the Stochastics oscillator (14,3,3 series) flashed a buy signal.

While gold is off to a bit of a disappointing start this morning, I think investors in the Western gold community should watch this oscillator closely now. It’s moved into a position where significant rallies have occurred.

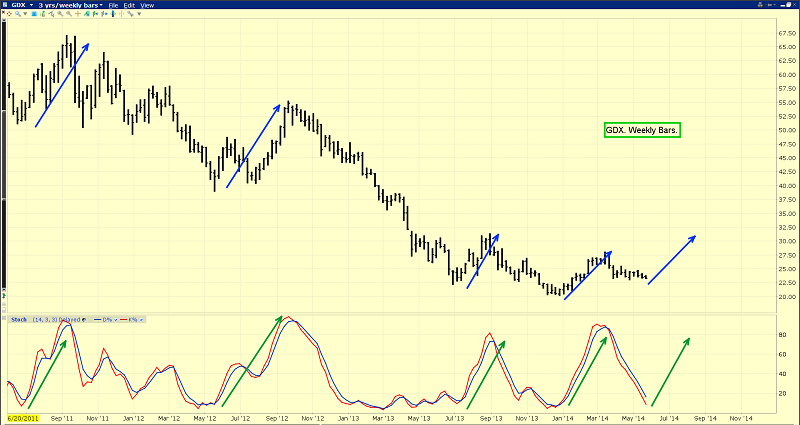

From a technical standpoint, senior gold stocks look similar to gold. This weekly GDX chart suggests senior gold stocks are likely poised to begin a significant rally.

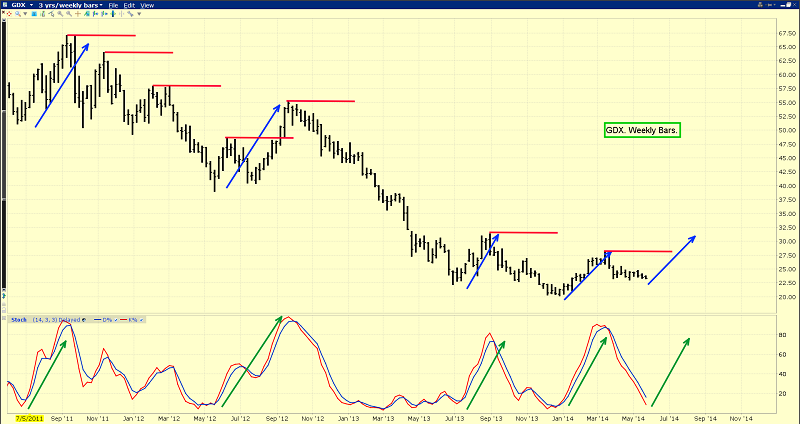

That’s another look at the same GDX chart. I’ve highlighted all the key intermediate trend highs.

Since 2011, only once has GDX managed to rally above any of those highs. The election of the new pro-growth government in India is good news. It's one of two fundamental catalysts that could be behind the bullish technical set-up on the charts.

Another catalyst is the news that the Chinese central bank has granted approval to the Shanghai Gold Exchange (SGE) to launch a global gold trading platform.

In this news release from Scrap Monster, note the words that I’ve highlighted in gold.

Some members of the gold community may be nervous about the ramifications of inviting major Western bullion banks into the Chinese gold market, and rightly so.

While the issue of manipulation on the COMEX and LMBA markets can be endlessly debated, there’s no question that gold in the West gets a lot of bad press.

Jiang Shu’s words that China’s strong gold demand is currently “only a number, not a power” make it clear that the new platform will be designed to put upwards pressure on the gold price.

Gold is entering a new era, centred on gold jewellery demand in China and India.

On the Shanghai platform, the banks will be expected to act with a level of professionalism that perhaps has not existed in their COMEX and LBMA operations. I expect them to consistently endorse gold as an asset of the highest quality. These banks will essentially provide the SGE with a set of gold price discovery “shark teeth”!

That’s the weekly silver chart. From a technical perspective, the Stochastics oscillator looks superb.

Like gold, silver appears to be in the process of gearing up for an intermediate trend rally.

That’s the daily chart of SIL-NYSE (silver stocks ETF).

A bullish wedge pattern has become more apparent over the past few trading sessions, and the Stokeillator (14,7,7 Stochastics series) suggests a rally is imminent.

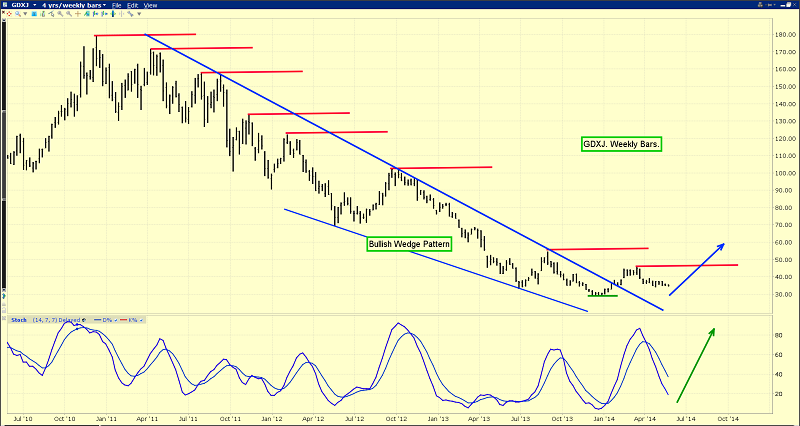

Junior gold stocks are the first love of most investors in the Western gold community. That’s the GDXJ weekly chart.

I labelled the October 2010 period the “loss of sanity” zone, because of the widespread view that the Western world’s financial super-crisis was destined to catapult junior gold stocks into the stratosphere.

Note the red horizontal bars on that GDXJ chart. Those mark intermediate trend highs.

It’s clear that junior gold stocks have not staged a single intermediate trend rally that has exceeded even one of those highs.

The bottom line is that for the past four years, the super-crisis and the “gold fear trade” have failed miserably, as a junior gold stock price driver.

Ironically, the “love trade” (gold jewellery) may be the price driver that creates even higher gold stock prices, in a more stable manner, than anything envisioned by even the most bullish super-crisis analysts!

I’ve highlighted the Stokeillator on this daily chart of GDXJ. When the bullish posture of key oscillators on both the weekly chart and the daily chart are considered alongside the bullish fundamental news about the Shanghai Gold Exchange, I think Western junior gold stock investors are poised for a very positive ending to the 2014 calendar year!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gimme The Big Boys!” report. I’ll show you which key diversified miners I own, and where my next key buy and sell points are!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: