Stock Bears Are Preparing To Run Amok…Worldwide

The world’s richest man is reportedly building a massive hoard of cash. Reliable sources say multi-billionaire Warren Buffett has today more than $50 billion in cash. This seems out of place for this legendary investor, whose long-time successful investment philosophy has heretofore been to BUY AND HOLD FOR THE LONG-TERM. Consequently, it’s logical to ask why market guru Buffett is obviously dumping stocks to accumulate cash? Perhaps market sage Buffett already knows what the charts below are saying.

B

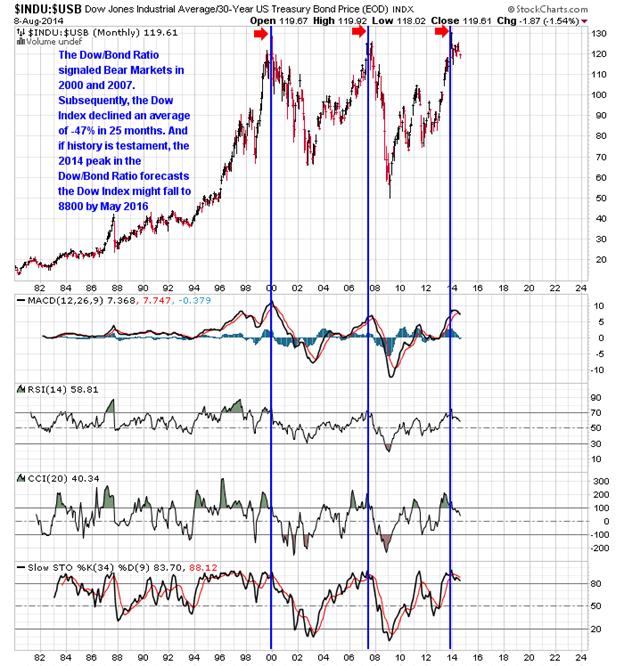

B elow is a chart of the Dow Index/T-Bond Ratio. It shows the Dow Index/T-Bond Ratio peaked in 2000 and 2007, which signaled the beginning of two horrific BEAR MARKETS. Well yet again the Dow Index/T-Bond Ratio appears to have peaked, thus heralding that a new bear market is emerging. And if history is testament, the Dow Index might drop to 8800 by mid-2016.

elow is a chart of the Dow Index/T-Bond Ratio. It shows the Dow Index/T-Bond Ratio peaked in 2000 and 2007, which signaled the beginning of two horrific BEAR MARKETS. Well yet again the Dow Index/T-Bond Ratio appears to have peaked, thus heralding that a new bear market is emerging. And if history is testament, the Dow Index might drop to 8800 by mid-2016.

The theory supporting this is simple. As stocks begin to fall, smart investors dump equities and run to the safe haven of T-Bonds. Thus the Dow Index/T-Bond Ratio rapidly declines. Additionally, any action by the Fed to increase interest rates will necessarily accelerate the rate at which the Dow Index/T-Bond Ratio will fall.

ADDITIONALLY: A Triple Top Death Knell is an ominous omen for US stocks

In early 2000 the Dow/T-Bond ratio peaked, triggering the beginning of a bear market in Wall Street stocks...that lasted more than two years.

Again in mid-2007 the Dow/T-Bond ratio peaked, which opened the door to a devastating bear market in stocks where the Dow lost about -54%. This bear market lasted 20 months.

This bearish triple top forecasts stocks might begin to tank in 2014:

Also notice DOW/US T-Bond ratio peaked yet again in December 2013, which signals a probable stock market crash looming on the horizon.

And in the event the impending stocks crash replicates the 2000-2003 and 2007-2008 crashes, then US stocks may well be hammered down approximately 50 percent during the next 18-24 months.

Understandably, the above scenario may influence the US Fed's tapering policies.

This begs the question: WHEN are the big bad bears going to storm out of their lairs en masse…ergo WHEN will the Financial Tsunami Crash commence?

No one knows with absolute certainty. However, the cavalier complacency of most stock investors today defies common sense…which exposes these naïve souls to grievous financial losses in the event a bear market actually materializes. In fact it is the considered opinion of this analyst that it is indeed ludicrous to be long Wall Street stocks in this unstable environment of grossly over-valued stocks.

AND THERE’S A Bearish Triple Top in the FTSE Stock Index:

Avid stock market historians will recall it was the British FTSE Stock Index that heralded the start of the Great Crash of 1929 in the USA.

Interestingly, the FTSE has recently formed an intriguing bearish triple top. Here's what happened when the FTSE peaked in 2000 and again in 2007.

From its 2000 peak, the FTSE was hammered down -52% in the next 38 months.

From its 2007 peak, the FTSE was hammered down -48% in the next 15 months.

Bears Watching (pardon the pun)

Bears Watching...the 7-years of Feast followed by 7-years of famine…i.e. 2000 to 2007 to 2014.

Bears are stirring from their Lairs in most major markets

In addition to overt bearish stock market signs in the US and UK, bear markets are emerging in Germany (DAX), France (CAC), Euro Union (STOXX600), Japan (NIKKEI) and even the World Stock Index (MSWORLD). Below are charts of all showing undeniable bearish technical indicators suggesting a global bear market is brewing on the horizon.

Germany (DAX)

France (CAC)

Euro Union (STOXX600)

Japan (NIKKEI)

MS-WORLD (ex US)

DOW JONES GLOBAL INDEX

Indubitably, world stock markets are in a bear mode. The only uncertainty is how far stocks will decline before each nation’s central banks will intervene to stem the deluge of tumbling equities. It is imperative to recall that US stock indices crashed more than 50% in the 2007-2008 debacle. In fact the bottom in stocks in March 2009 established by the Fed instituting Quantitative Easing (QE) with a view to vastly increasing financial liquidity to shore up cascading stock values. Had not the Fed intervened, the US (and the rest of the world) might have been plunged into another Great Depression…not unlike 1929.

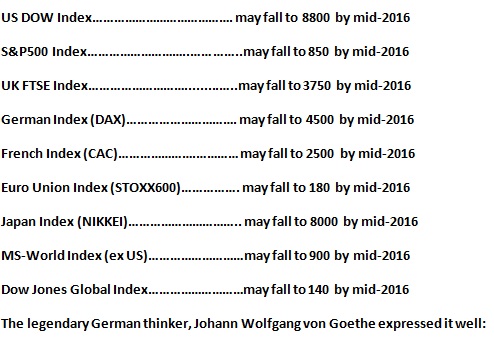

Global Stocks Forecast

The only reliable guide for forecasting the future of stocks is HISTORY. And whereas history does not always repeat, it indeed provides lines of probability. To be sure technical analysis also provides reference points or benchmarks to where stocks might be headed.

Based upon the above technical analysis, and If history is again prologue, we may see the indices fall to the following level sometime in 2016.

“True genius is knowing when to stop.”

********