Understanding the COT data

Introduction

I have received many emails from both subscribers and non subscribers, asking about the COT data, since I have been using my COT model for a few years now. Many analysts have jumped on the COT bandwagon lately, and suggest that because the smart money are now covering their shorts in gold, therefore, a bottom is imminent. This article is not intended for the timing issue, as I have illustrated in previous articles how to enter and exit the markets very simply. There is no such thing as "smart money" or "dumb money" in the commodity futures market. This is a big misconception, and it is due to the recycled information we get on the net these days and analysts who obviously did not do their homework. The commercials, or the "smart money" as they are often referred to, does not represent a single group of people. To understand the commodity futures market, we must understand hedging. The commodity futures market exist for two reasons only: hedging, and speculating.

The hedgers

Most commonly known as the commercials, the hedgers are made up of two distinct groups: the producers, and the consumers. Using gold as an example, the mining companies are the producers, and the jewelers are the consumers.

The speculators

There are large specs and small specs. These folks speculate purely on the price movement of the underlying for profits, period.

Where is the beef?

Lets use a simple illustration on how the commodity futures market works. The commodity is beef. My friend Bob Parker is a rancher, owner of the famous Parker ranch on the big island. So, Bob is a cattle producer, a hedger, a commercial. Bob's job is to get the best price (higher the better) possible for his cattle. My other friend Ted is the purchasing manager for McDonalds. Ted is a consumer, he buys a lot of beef. He is a hedger, a commercial. Ted's job is to get the best beef price (lower the better) possible for his thousands of restaurants.

Lets say, price of live cattle has been between 60cents and 90 cents a pound for the past ten years, therefore, the average price of the past ten years is around 75 cents. Logically, Bob would be a heavy seller when price is between .80 and .90. By forward selling in the futures market, Bob is protecting his future profits by locking in the high prices. Bob is hedging. Ted, on the other hand, would not be a buyer at these price levels unless he absolutely has to, therefore, by combining all of the commercials open contracts, we should see a CNS (commercial net short) situation. Who takes the other side? Specs of course. Speculators are drawn to the increasing high prices, hoping to make some quick profits. OI (Open interests), in the meantime, increases as more speculators are piling in on a "bull market". As prices top and begin to slide, specs fight each other for the exits, thus a down cycle begins as specs close out their positions and leave the market.

Prices are now down to between .60 and .70. Bob is no longer selling forward, while Ted is happily loading up contracts. Ted is hedging also. By locking in at these low prices, profits would be good for the company and shareholders would be very happy. Combining all of the commercial open contracts, we now have a CNL (commercial net long) situation. Who takes the other side? Not many are willing, because many specs have left the market, thus often resulting in OI decreasing, which reflects a typical "bear market". When there is a lack of sellers, bids are increasing and prices begin to recover, specs are slowly entering the market again thus a whole new cycle begins.

Back to gold

Gold is a little different than cattle, nevertheless, the up cycles are similarly driven by excessive speculation, and the down cycles are driven by the lack of speculation. What is important to remember, is that price volatility is largely dependent on the specs. Commercials actually absorb the fluctuations by hedging at both ends. Contrary to common belief, commercials do not manipulate prices, they are simply hedging thus transferring the risks to the speculators.

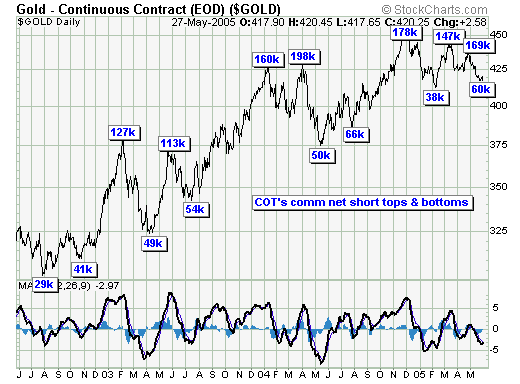

By now, you must have seen this chart or similar from different analysts, and the message is the same: when CNS (commercial net short) drops to double digits from triple digits, it means the commercials have covered many of their shorts and therefore, a bottom in gold price is imminent. That has worked very well in the bull market of the past three years, simply because, like a stochastic, by buying the oversolds, we always make money in a bull market. But what happens in a bear market? Any experienced technical trader can tell you, it would be disastrous buying the oversolds in a bear market, because a bear market can stay oversold for a very long time. Therefore, a prudent trading strategy is to sell short the overboughts of a bear market. Have a look at the above chart again: buying the double digits would be a lot more profitable than selling (short) the triple digits, wouldn't it? Because we've been in a bull market, buy the dips, remember? Until these past three months that is. CNS reduced to 38k this Feb, the lowest since Aug 2002 when gold was at $300, yet this extreme low number failed to move the price of gold, in fact, we are in danger of breaking below the Feb low. If and when this happens, the trading strategy should be reversed, instead of buying the double digits, we should be selling (short) the triple digits.

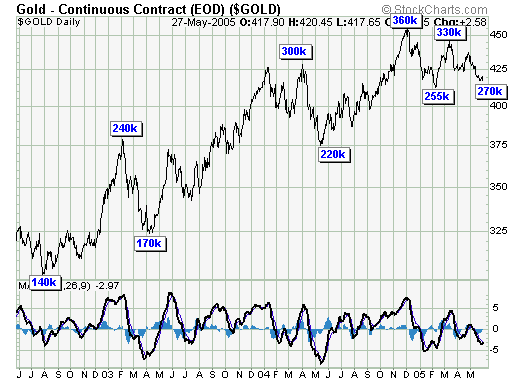

What many analysts do not take into consideration is the OI (open interests). In a rising market such as gold has been these past three years, OI increases in increments at each new top and bottom, and if the bull market is to continue, so must the OI. Any significant reduction on the OI, and specifically a divergence, such as if gold holds above $375 with OI dropping below 220k, would be a bad sign because it simply indicates that specs are leaving the market. Without sufficient speculation, gold price will drift lower either resulting in a trading range or even back to a bear market.

Summary

I am not and do not pretend to be an expert on COT data or the futures market for that matter. But I want to clear up the misconception about the COT data, who the commercials are, and why they do what they do. Commercials are not in the market to speculate market directions, although they often profit from them. Speculators speculate, commercials hedge; simple as that. There is no smart money, and no dumb money; only smart specs and dumb specs.

Jack Chan at www.traderscorporation.com

2 June 2005