US Civil War Cycle & Gold

Can market trends be predicted? Sometimes they can, but more often not.

If prediction is a questionable tool at best, then what tools can investors use to build wealth with reliability?

For the answer to this key question. The monthly chart of the Dow.

In the stock, gold, and crypto markets, the big horizontal support and resistance zones (HSR) on the weekly and monthly charts offer the best opportunities for investors to take buy and sell action…

And sometimes they occur in all three markets at the same time!

I laid out Dow 7.5k, 18k, and 30k, as “buy zones of champions”, years before they happened. The bottom line is this:

If investors don’t spend significant effort preparing to buy these zones ahead of time, the emotional negativity that accompanies the opportunity can be overwhelming and investors won’t buy anything at all.

Basis the CAPE ratio, the US stock market is massively overvalued, and doesn’t become a good value until the CAPE reaches 10 or lower.

That doesn’t change the fact that Dow 30k was a significant support zone and significant opportunity zone for investors.

The next Fed meetings in September and December are likely to mark the end of the party.

The key bitcoin support and resistance zones chart. My preferred approach for most investors is to buy the crypto miners and the “alt coins” in the key support zones for bitcoin, for fast 50%-200% profits!

I issued an “across the board” buy alert for the miners in the 20k zone for bitcoin, and key miners have rallied 100% in 1-2months since then.

Crypto investors who followed my big calls to buy at bitcoin $4k, sell at $40k (and buy gold with the profits!), and buy at $20k… they are in a fabulous financial position. At just $299/year, my Crypto Palace newsletter is the market leader. I have an incredible inflation fighter special offer this week of just $259 for 15mths. Click this link to get the offer, or send me an Email and I’ll get you onboard. Thanks!

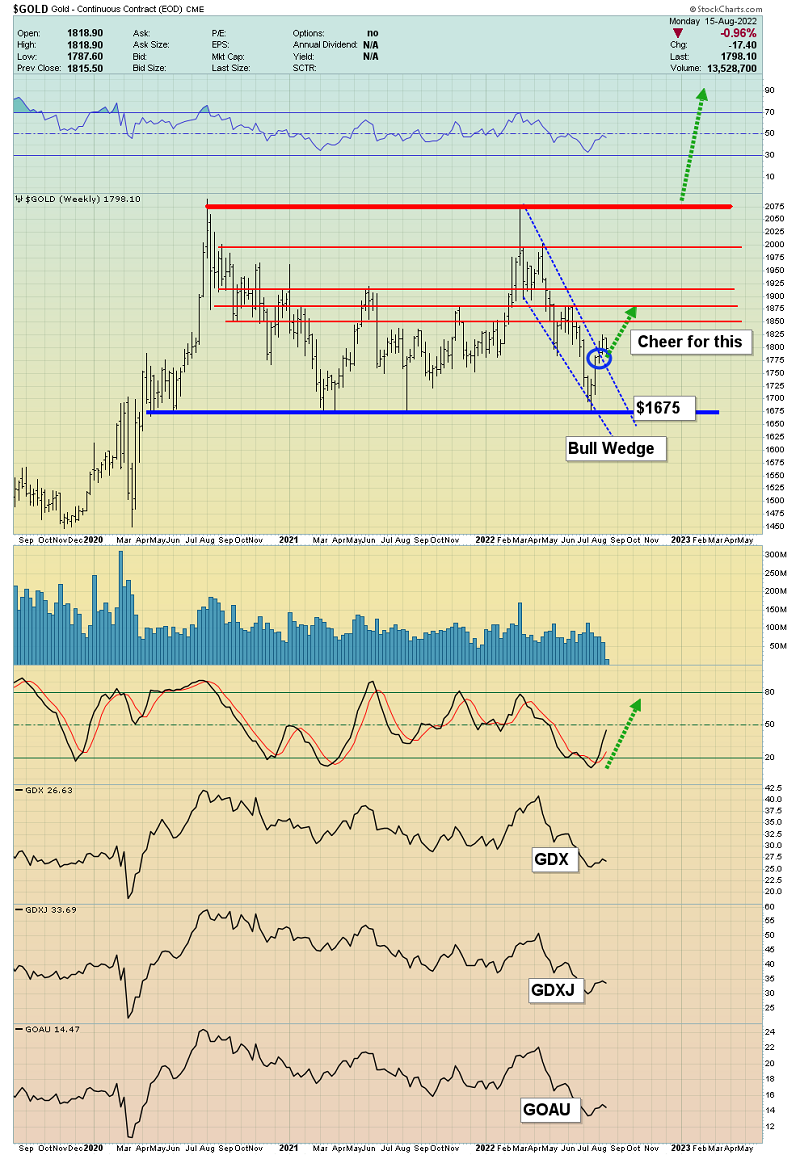

Gold? The somewhat boring but money-making gold chart. Note the GDX, GDXJ, and GOAU price action at the bottom of the chart. Clearly, gains of 20% and more are realistic for investors who take action once or twice a year at the key support zones for gold.

The most recent one was $1675, and my suggested focus “out of the gate” was the XME ETF and its component stocks.

I’m in sell mode now and investors can book profits too.

XME holds base metal miners as well as gold and silver miners, and the good news is that the next stage of the rally from the gold price of $1675 should see the GDX, GOAU, SIL, GDXJ, AND SILJ ETFs outperform XME.

As the September Fed meet gets closer, the stock market investors are likely to get nervous. Social unrest in Europe due to energy prices (and energy shortages as the weather gets cold?) is likely.

That’s good news for gold and not so good news for the stock market.

Also, it appears that the FBI has confiscated Trump’s passports. Is his arrest imminent? Will all his voters just stand there if that happens… or will some of them turn violent? If he’s arrested, I’ll suggest it would likely be the latter event.

Most stock market investors appear to be viewing the current lull in the 2021-2025 civil war cycle as an end to it. They may need to revise that outlook… and soon!

This weekly chart tells the main GOAU story. Minor weakness needs to be bought (and I’m buying it eagerly) in preparation for a powerful run to $18 by September 21 “Jay Day”.

At that point, if Trump is put in the clink, multiples of $18 would become likely, with gold at $2500-$3000, as the American civil war cycle goes into overdrive.

The bottom line: US gold stock investors are poised to get a lot richer, but they need to stay safe too!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Rockets In Launch Mode Now! report. I highlight junior miners that are roaring higher even as the gold and silver rallies pause. Key buy and sell tactics are included for each great stock.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*******

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: