US Dollar Forecast And Gold Outlook

A few days ago we wrote about the potential effects of a Fed rate hike on precious metals. After consulting history we concluded that the rate hike would be immediately bullish for precious metals but subsequently bearish. The main reason is because when the Fed started a new cycle of increases during an already established bull market in the US$, the US$ continued higher in the months and quarters that followed. We see that repeating itself in 2016 but not without some consolidation first.

A few days ago we wrote about the potential effects of a Fed rate hike on precious metals. After consulting history we concluded that the rate hike would be immediately bullish for precious metals but subsequently bearish. The main reason is because when the Fed started a new cycle of increases during an already established bull market in the US$, the US$ continued higher in the months and quarters that followed. We see that repeating itself in 2016 but not without some consolidation first.

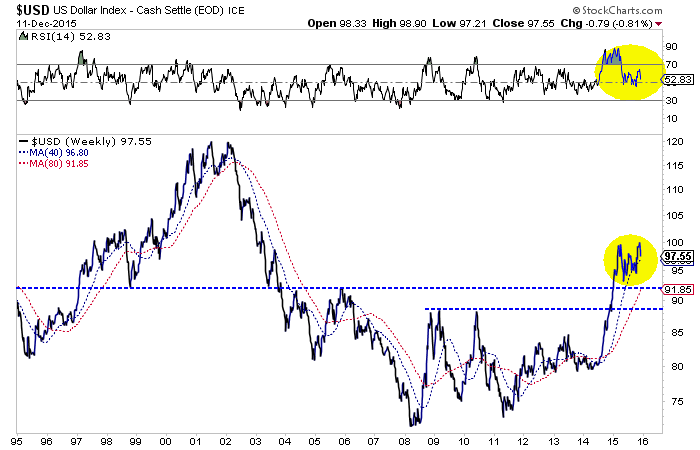

The technical outlook for the US$ index mirrors the outlook described by the aforementioned history. The US$ index is currently correcting and consolidating within a strong longer term position. The US$ index reversed at resistance at 100 and should find support at 94 if tested. Longer term strength is evident as the buck never traded below 92 which was resistance dating back to 1998 and the 38% retracement of the 2014 to 2015 advance. That bolsters our thinking that the US$ index will break above 100 in the first half of next year.

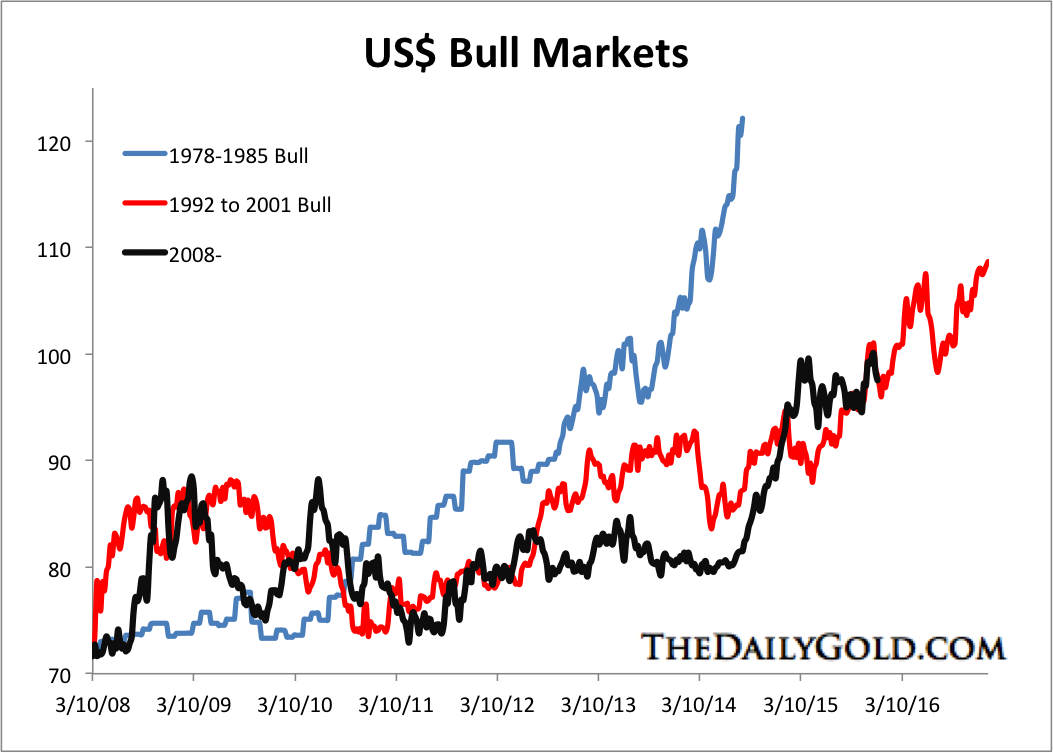

We would not be surprised to see accelerated US$ strength following a successful breakout past 100. Note the above chart and the thin trading between 100 and 120. The chart below which puts the previous US$ bull markets on the same scale as the current bull market, shows how the previous two bull markets accelerated towards the end. The 1978-1985 bull market accelerated 28% in its final 12 months. After the rate hike in summer 1999 the US$ declined 7.5% but then surged roughly 22% in the next 12 months. Then it began a topping process. History (or the chart below) also argues that the US$ likely has some upside potential remaining in its bull market.

Our current forecast is for the US$ to make an explosive breakout sometime in the first half of 2016 and that said breakout could cause or coincide with capitulation in precious metals markets. This being said, we are constructive on Gold and especially gold stocks in the short-term. Conversely, we see the US$ consolidating between resistance at 100 and support at 94. Bear in mind this is only a forecast and forecasts are subject to change. The key takeaway is that if the US$ can takeout 100 then it could see accelerated strength.

Jordan Roy-Byrne, CMT