US Gold Coins Bought At Fastest Pace In 3 Years

● The best performing precious metal for the week was gold, off only 0.45 percent. The yellow metal is continuing its strong showing. Gold futures had its sixth straight quarterly gain in the first three months of this year – the longest stretch of gains since 2011. Bullion rose 4.8 percent in the first quarter. Last week, the gold market was thrown into turmoil as logistical disruptions caused speculation that there wouldn’t be enough bullion in New York to deliver against contracts traded on the Comex, but things turned around this week. Bloomberg News writes: “Open interest in April futures or the amount of outstanding contracts eligible for potential delivery – on Tuesday was the equivalent of 737,800 ounces, down from as much as 1.96 million ounces last week. By comparison, total deliverable stocks in Comex warehouses were 3.7 million ounces on Wednesday, jumping from about 1.8 million ounces a week earlier.” Logistical issues in the gold market could be transitory, according to Bart Melek, head commodity strategist at Toronto Dominion Bank.

● Hedge funds cut their short positions in gold by 78 percent in the week ended Tuesday, the most in government records going back more than a decade. Bloomberg notes that the exit came amid speculation bearish speculators might get squeezed as investors holding April futures seek delivery of the metal as suppliers are facing disruptions. Commerzbank AG analysts said in a note this week that “it is obvious that gold – an alternative currency that cannot be reproduced at will – will profit from this unprecedented orgy of money-printing.”

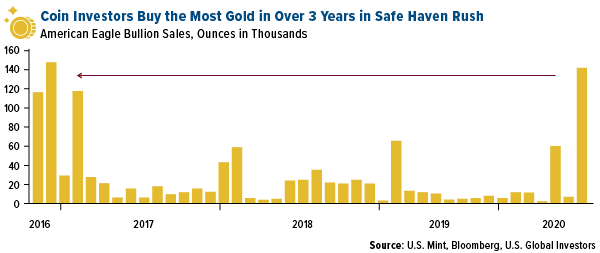

● Gold coins sold by the U.S. Mint were bought in March at the fastest pace in over three years as investors continued to flock to gold. Investors bought 142,000 ounces of American Eagle coins. Long-only ETFs linked to gold have grown by $13 billion so far in 2020, the most since data was collected in 2004, when the first gold ETFs began trading, reports Bloomberg. The SPDR Gold Shares saw a quarter of that inflow. Blackrock’s iShares Gold Trust attracted $332 million on Monday alone. Bob Phillips, managing principal at Spectrum Management Group, said “demand for gold is going to stay pretty high because gold is a hedge against currency devaluation.”

Weaknesses

● The worst performing precious metal for the week was palladium, off 4.47 percent, on likely anticipated falling automobile sales in the near term. Impala Platinum, one of South Africa’s largest platinum-group metals producers, declared force majeure due to the 21-day nationwide lockdown, reports Bloomberg. Impala is seeking government approvals for limited smelting operations and permission to conduct limited underground ore transport and milling to keep some operations running. Zimbabwe’s government did grant permission for the company’s local operations to continue amid Zimbabwe’s own 21-day lockdown.

● Russia’s central bank, a long-time gold buyer for domestic producers, said that it will pause purchases from April 1 onward. “Further decisions on purchasing gold will be made depending on the situation on financial markets,” read a statement on the bank’s website. Russia’s gold stockpile is valued at $119.8 billion, or about 73.6 million troy ounces. Although it is negative that the country stopped buying gold amid economic challenges, Russia is simply pausing purchases for now, rather than ending the entire buying program; western news media tried to spin the story’s translation into an end of central bank buying everywhere.

● Jeffrey Gundlach has warned investors that are piling into gold-backed ETFs such as the GLD about possibly not getting the physical gold back. Gundlach says these investment products are “paper gold” and that buyers should be aware that holding shares doesn’t amount to having gold bars. Bloomberg reports that the legendary investor said these statements in a webcast this week. “What happens if physical gold is in short supply and everyone wants to take delivery of their paper gold? They can’t squeeze blood out of a stone.”

Opportunities

● UBS responded to the resurgent gold price by boosting its 2020 price forecast to $1,649 an ounce, noting that most stocks are pricing in a gold price of between $1,300 and $1,500 an ounce, reports the Australian Financial Review. UBS added that its preferred stocks for gaining exposure to gold are Saracen Resources, Evolution Mining and Alacer Gold. The Australian dollar is weak, which has boosted cash flows, but travel restrictions in the country could challenge production. Matthew Sigel, CLSA Portfolio Strategist, in his recent iconic “Hello Investors” makes the case for owning gold mining stocks as Central Bank balance sheets are exploding upward and budget deficits are expanding. Matthew shows how gold miners were the first to bottom in 2008 in the prior crisis and then became one of the strongest performers with the stressed financial conditions. Gold in the ground held by miners is the cheapest way to acquire access to future cash flow stream that will likely be rising in magnitude.

● Premier Gold Mines Ltd. announced that an offer has been made to acquire Centerra Gold Inc.’s 50 percent stake in the Greenstone Gold Mines Partnership in a deal worth $205 million. Argonaut Gold and Alio Gold announced that they entered into a definitive agreement for an at-market merger where Argonaut will acquire all of the issued and outstanding shares of Alio. TD analysts said that Barrick Gold has been upgraded to “action list buy” from hold due to the improving gold price outlook. Bloomberg reports that TD also raised Centerra Gold to a buy from hold after a recent selloff.

● BNP Paribas highlighted in a recent report that the growing fallout amid COVID-19 suggests investors are likely to continue to seek refuge in gold. “We expect demand for gold to remain strong, at least until such time that economic conditions stabilize and the outlook begins to improve following the raft of unprecedented stimulus measures put in place by governments and central banks alike,” wrote Michael Sneyd in a March 30 report titled “Gold: The Jack of all Trades.”

Threats

● According to bond manager Jeffrey Gundlach, the March lows that the S&P 500 reached are likely to be surpassed in April as economic uncertainty continues, reports Bloomberg. Gundlach said in a webcast this week that “I think we’re going to get something that resembles that panicky feeling again during the month of April.” The S&P 500 dropped 12.5 percent in the month of March – it’s worst month since October 2008.

● The rush to get hands on U.S. dollars continued this week. Foreign official holdings of Treasuries at the Federal Reserve dropped by $109 billion in March – the largest monthly drop on record. Bloomberg reports that international governments and central banks are struggling with the economic fallout from the pandemic and is a sign of the global rush to raise U.S. dollars. Countries that are especially reliant on oil exports have been selling U.S. debt and offloading older, less-liquid Treasuries.

● The economic impact of COVID-19-induced lockdowns became incredibly visible in the U.S. this week. A record 6.6 million Americans filed unemployment claims. This is a record high number of weekly claims and double the previous week’s 3.3 million. Unemployment in March was reported at 4.4 percent, up from 3.5 percent in February. According to the Bureau of Labor Statistics, the U.S. economy lost 701,000 jobs in March. A number of gold mining operations have reduced operations at some mines while in Mexico; they have called for halt to mining to battle transmission of the virus.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of