US Stock Market Meets Insidious Inflation

In the West, gold has rallied decently during five of the past seven recessions. I’ve suggested that the current situation in America is something like 1965 – 1970, when inflation began a long and strong up cycle.

That’s partly why I’m adamant that it’s the best time in American history to own a portfolio (a global portfolio) of companies involved in precious metals mining and jewellery.

The other reason that I’m excited about these stocks is that in the East, when people get richer, they buy gold. They are now getting a lot richer, and a lot faster.

Simply put, deflation is out, and inflation is in. It’s really that simple, and investors around the world need to get positioned right now to ensure they get maximum financial benefit.

With their statements and analysis, Morgan Stanley moves “thunder cash” in the institutional investor community.

Their top US equity man, Mike “Mr. Big” Wilson, predicts that while US markets are a clear short-term buy, valuations peaked in 2017, and prices will peak in 2018.

I’m in 100% agreement with Mike. Tactically, I’ve urged investors who are not afraid of price chasing to buy some bank stocks, energy stocks, and growth stocks. Gamblers can buy call options.

That’s how to play the final months of upside fun in the US stock market, but investors must be seriously prepared for years of inflationary bear market horror to follow this blow-off top.

I’ve predicted that only the most astute stock pickers will survive being invested in the US stock market from 2019 forwards. In the coming inflationary inferno, index and ETF investors will essentially be turned into tumbleweed, burning in a financial desert.

When will the inferno begin? Well, I think it happens in the upcoming September – October US stock market “crash season”, and by year-end at the latest. I expect gold to go ballistic as that happens, because it will be an inflation-oriented meltdown, and that means institutional thunder-buying takes place in the metals.

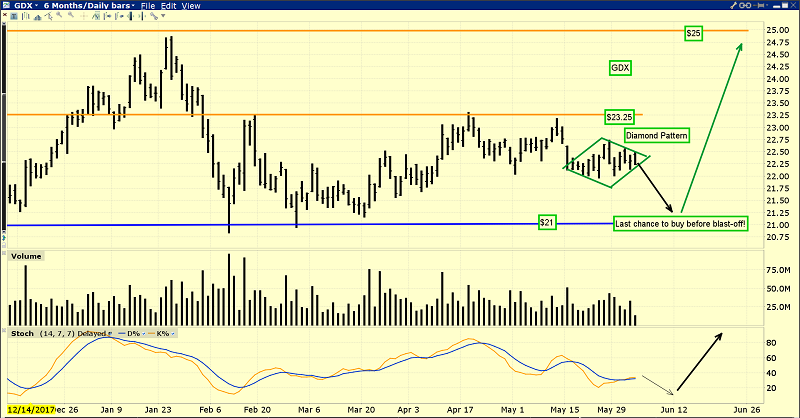

This is the GDX chart. In terms of time, I think gold stocks will initially surge higher for two to three years as the stock market falls.

Most of the gains should be sustained due to an imminent drop in US and Chinese gold mining production. Canadian, Australian, and Russian miners should be the clear leaders in what I call the gold bull era.

Note the diamond pattern in play on that GDX chart. A drift down

from it now would put GDX at my key buy area of $21 just in time for the Fed’s next rate hike. That hike will put another major nail in the US stock market valuations coffin. It will be followed at the end of June with another ramp-up in QT.

Many investors who failed to buy the stock market in 2008-2010 and are buying now are trying to convince themselves that the Fed will back off from more hikes and QT. This is very childish thinking. Those engaged in it will soon learn the hard way that the Fed doesn’t care about their silly stock market price chase.

On a demographics note: In my professional opinion, about 60% of the Western gold community is now composed of younger “smart money” investors. They have been invested in the US stock and bond markets and are becoming very concerned (and rightly so) about the growing risk that inflation will cause a severe bear market in these traditional asset classes.

This new breed of gold bug has more patience than the “old guard” gold fear trade investors. The old guard focused more on financial system risk and government debt that threatened to create a kind of “parabolic moment” of vertical price rise for precious metals. The transition from deflation to insidious inflation is an enormous process that requires investor patience, but it is now well underway.

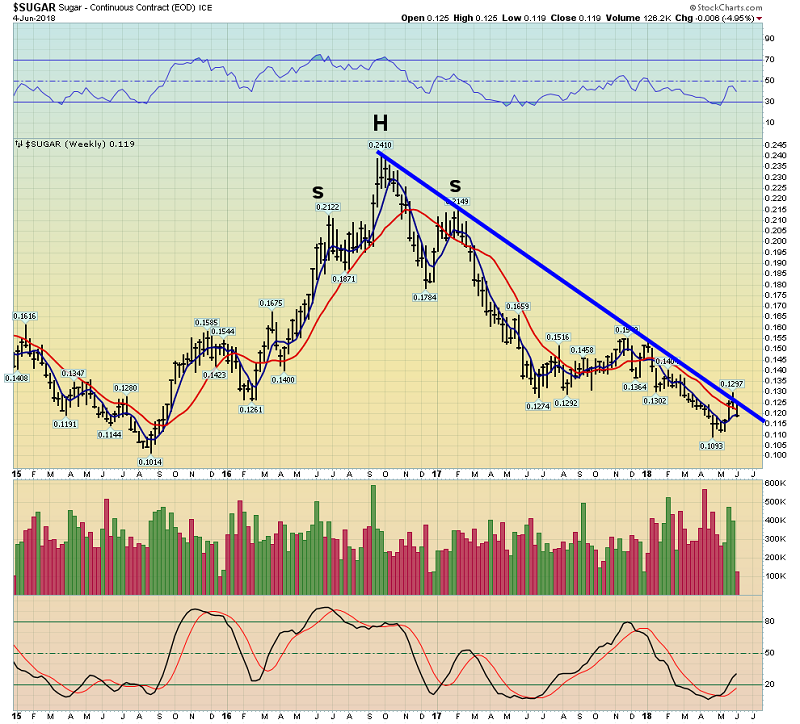

This is the beautiful silver chart. The silver price has been consolidating the rally from the summer of 2017 in a nice symmetrical triangle pattern. Silver is highly correlated to gold, but during periods of inflation there is also a significant correlation with sugar.

That’s because the average “man/woman on the street” tends to see gold as too high-priced to buy. Silver’s lower price is more enticing, and they can relate to an ounce of silver rising like the price of a pound of sugar rises.

Sugar is arguably even better than money velocity as an inflation indicator.

Investors should watch for a two-month close over the blue downtrend line. That must be followed by a two-week close over sixteen cents a pound. That price action is likely to indicate that inflation is becoming a firestorm for the stock market and will function as a green light for most gold stocks to blast higher.

Note the peak in the summer of 2016 for sugar. That functioned as a red light for gold stock investors. The next signal will be a green one and investors need to get prepared now.

In contrast to the hyperinflation envisioned by older gold bugs who focused on bank and financial system risk, the type of inflation that is coming now is more like the inflation of 1966 -1975, on an even bigger scale because of rampant Chindian income growth. It’s insidious.

This inflation will last for a hundred years and likely for much longer, not just for a decade or two like in the 1970s. It’s a process akin to millions of solid gold termites invading the US stock and bond market house. No bug spray works, so the institutional investors inside the house will all leave.

The bottom line: If you can’t fight a gold bug invasion, you have to join it. Gold stocks will rise thousands of percentage points higher as investors begin to understand what is happening. The inflation is imminent, and investors must get prepared!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Show Me The Gold Stocks Money!” report. I cover ten key gold stocks that are trading above their 2016 highs now, and poised to stage 100% -200% gains over the next twelve months! I include investor tactics to buy and book quality gains.

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: