Where Is Gold’s Rally In Response To Yesterday’s USD Weakness?

Yesterday, the USD Index moved substantially lower while precious metals barely yawned. Why is gold not rallying? What does the gold-USD link tell us now, in combination with latest developments throughout the PMs sector? Let’s examine these and many more clues together.

Almost nothing happened yesterday in gold and silver, while miners moved a bit lower. The latter is a bearish indication, but not the most important one that we saw. The key issue is that what happened in the gold-USD link showed that gold was previously not showing strength with regard to the US currency. Yesterday’s action confirmed our yesterday’s thoughts on that matter. We explained the reasoning behind the lack of decline in gold in light of USD’s rally in the following way:

One reason might be that gold is simply showing strength, as it doesn’t want to move lower – it’s waiting for factors on which it could rally. But we don’t think that this the correct interpretation. There are multiple long-term bearish factors that remain in place and thus it seems that there might be a different interpretation. And there is. Actually, there are two reasons due to which this might be the case.

First, gold is often reacting to major breakouts in the USD Index (and breakdowns), not necessarily to smaller moves that lead to the breakouts (breakdowns). The investors simply doubt that the USD strength will be upheld and don’t sell their gold based on the above.

(…)

Second reason may be the very recent discrepancy between the triangle-vertex-based reversals in the USD Index and the precious metals market. The USDX reversal took place earlier, so it may still be the case that the recent resilience of the precious metals sector is a way in which the natural delay takes place.

Consequently, the recent “strength” in gold may be no real strength at all.

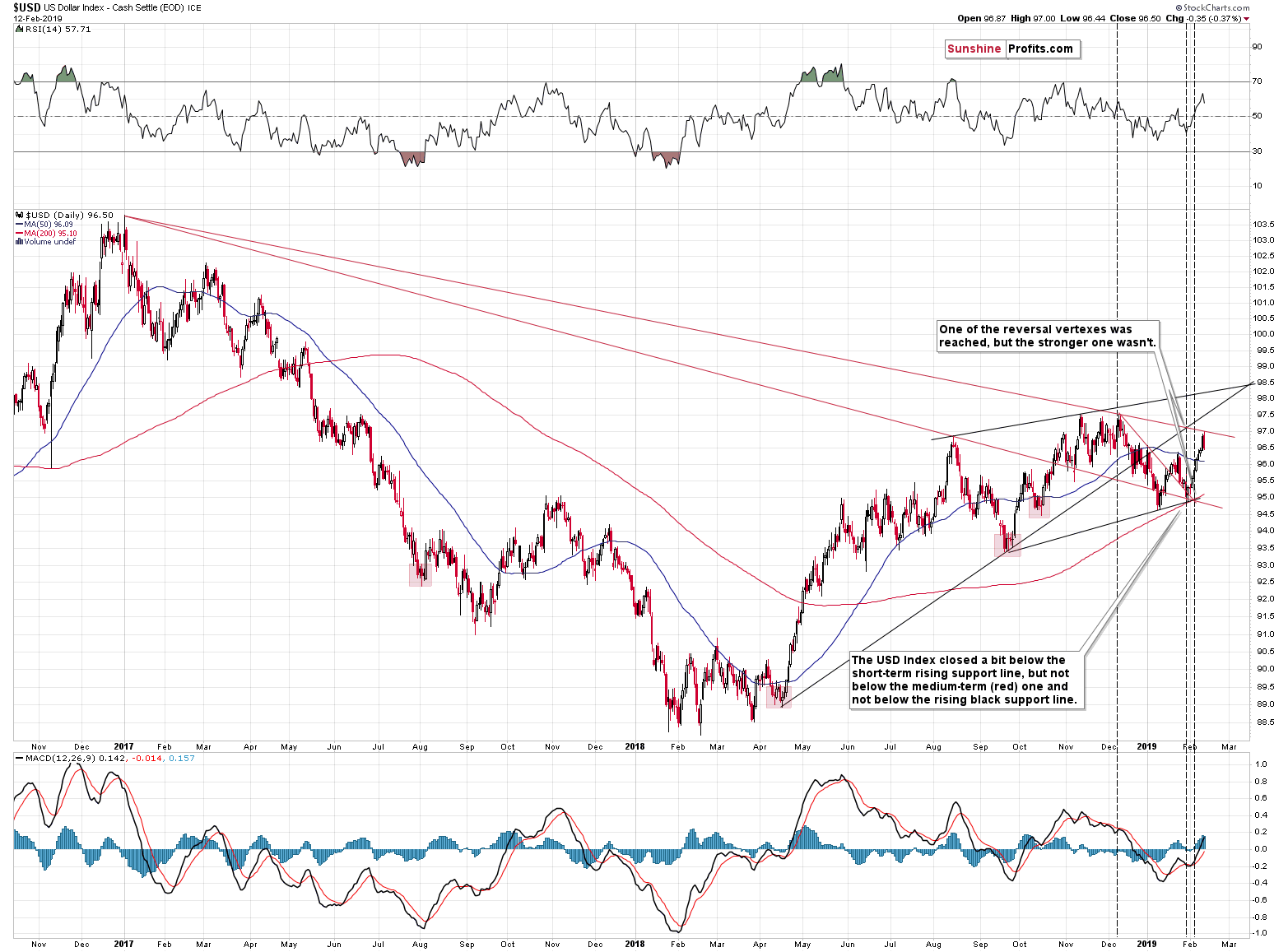

Let’s see what happened in the USD Index yesterday:

Quoting yesterday’s Gold & Silver Trading Alert:

The USD Index moved to the declining red resistance line. It’s not visible on the above chart, but the USDX moved a bit higher in today’s pre-market trading and thanks to this, the above-mentioned line was reached. The line was reached, but not broken, so the fact that gold investors are hesitating seems natural.

Moreover, the recent movement in the USD Index (approximately since the second week of January) looks like a corrective zigzag pattern. That’s yet another reason for traders to doubt the recent strength.

Naturally, the big picture for the USDX remains bullish (and our profits on the EUR/USD pair keep on growing even though we took part of them off the table yesterday). The fact that USD keeps on rallying since Fed’s dovish remarks (a strongly bearish factor for the USDX) is more important than the above assumptions.

The USD Index has indeed corrected after moving to the declining resistance line. The key thing about this decline is that it didn’t take gold todamoon. Gold and silver mostly ignored USD’s decline despite early gains and mining stocks even declined. If gold’s previous lack of decline despite USD’s strength was really a sign of strength, it would have rallied strongly yesterday. It didn’t and miners even declined, which shows that it was not the factor behind the recent gold-USD dynamics. This further increases the chance that gold’s decline was simply delayed.

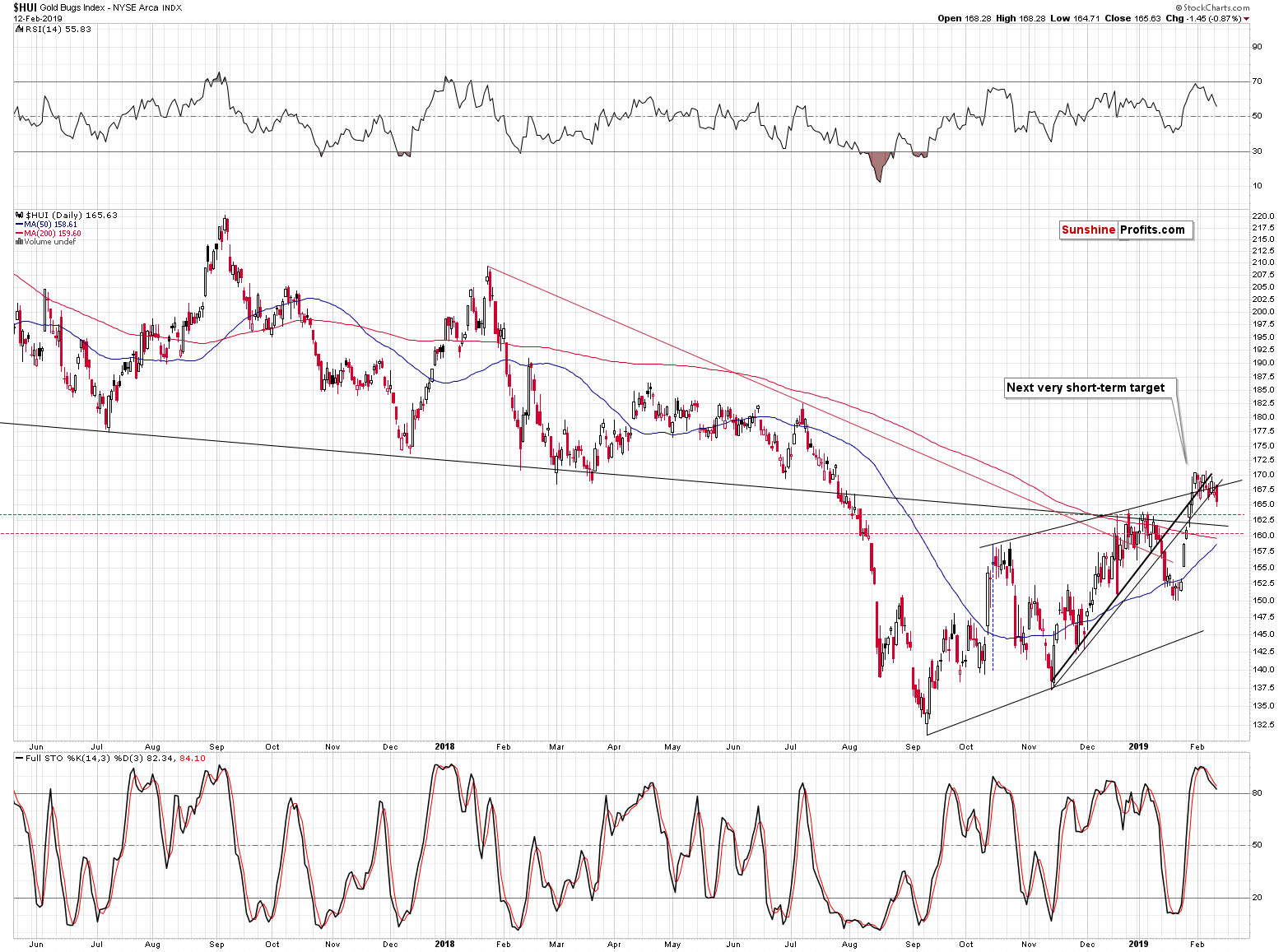

Gold miners’ decline was important as it was the lowest closing price of the month and at the same time, it was the first daily close that was visibly below all the rising short-term support lines. The breakdown presented on the above gold stock chart is now much clearer than it was before and the implications of the above chart more bearish.

Everything that we wrote yesterday about gold’s and silver’s daily charts remains up-to-date, so instead of repeating it today, we will provide you with an update on two more long-term oriented factors.

Japanese Yen, Triangles and Technicals

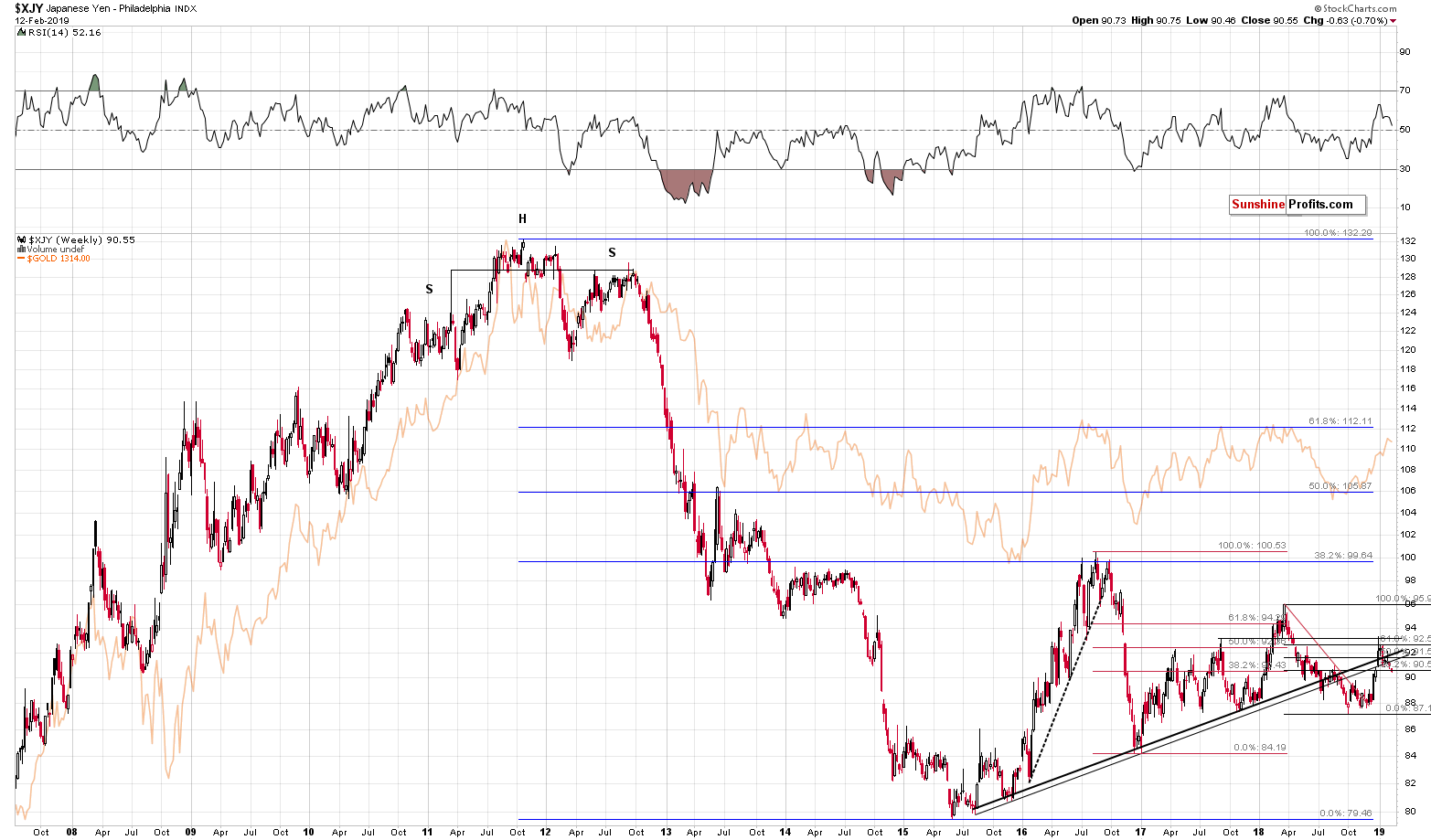

Let’s take a closer look at the Japanese yen. It’s the second most heavily-weighted component within the USD Index. It’s worthy of our attention as precious metals tend to move in tune with it. Just take a look at the chart below:

Most prominent features are both the triangles (created by two support lines starting from the late 2008 bottom and the declining resistance line that’s based on the 2013 and 2015 tops) and the mentioned declining resistance line. Triangles help us with determining the time and direction of the next turning point, while the resistance line obviously serves as a resistance. Here, we see that after reaching the second triangle, the gold-yen ratio indeed turned down (just as it did after reaching the first triangle top). However, it later made a higher low and turned up. Now comes the declining resistance line – the ratio is so close to it currently that any room for further increases is minuscule. The odds favor a downside resolution, both in the ratio and in the price of gold. If not immediately, then shortly. Most factors (including gold’s, silver’s and miners’ triangle-based reversals) suggest the “immediately” scenario, though.

That was the gold-yen ratio. Next, we will visit the Japanese yen itself:

The weekly chart shows the yen to be after a verified breakdown below two rising support lines. These support lines have been drawn using either intraday or closing prices. The price is currently in the process of invalidation of the short-term breakout above both the rising support lines. Invalidation of a breakout is a strongly bearish development and as a result, we can expect the yen to head lower. Remembering the strength of the gold-yen link, it’s one more reason for PMs prices to decline in tandem.

Summary

Summing up, the recent rally and kind of resilience in the PMs complex may appear encouraging, but it doesn’t change the medium-term trend and outlook, which remain bearish. It seems that gold’s reaction to the strength in the USD Index is simply delayed.

The upside is quite limited, while the downside remains enormous. The reversals have been reached last week. As PMs, miners, and the USD Index move beyond their reversal dates, the chance for any meaningful upswing in the former before medium-term decline’s continuation, is declining with the time passing.

Naturally, the above is up-to-date at the moment of publishing it and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis (including the intraday ones, when things get hot), we invite you subscribe to our Gold & Silver Trading Alerts today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long.

********

Przemyslaw Radomski,

Przemyslaw Radomski,