Will stocks ignore the long-term Kress cycle?

Frequently I receive emails from clients who ask variations on the theme of the QE-driven stock market in light of the long-term Kress cycles. For instance, one client recently wrote: “I really like your work but lately am struggling to piece together the longer-term direction. You seem perpetually bullish, which has proven to be right, but am struggling to see what will change your mind to be bearish at any point. Is it mainly liquidity that you see driving the market higher from here to the end. Or the New Economy Index?”

My answer to this first question is that one can never underestimate the impact that liquidity has on pushing stock prices higher. The Fed has committed itself to a policy of stock market recovery. As the noted economist Ed Yardeni has opined the Fed’s “shadow mandate” is to support stock prices by means of its QE policy. As another observer stated, “Never sell short a liquidity-driven bull market.”

It should also be mentioned that Bud Kress, the late cycle expert, emphasized that as long as there are no major long-term yearly cycles down for the year in question, there’s no reason to assume the Fed can’t engineer a bull market even in the face of the major structural problems facing the U.S. economy. The next time a major series of yearly cycles will bottom is 2014. Therefore there’s a very real possibility the U.S. stock market will be able to dodge another bullet in 2013 before the next set of long-term cycle bottoms arrive.

He continues, “If earnings continue to grow and liquidity is maintained, will this override your 2014 bear thesis?” To this I can only answer that earnings growth will eventually reach its limitation and will be hard pressed to continue expanding into 2014 with the long-term deflationary cycles in the “hard down” phase next year. Already we’ve seen evidence that the all-important rate of change (momentum) of earnings is slowing down.

Another question: “When the departed Kress thought that if you artificially extend the cycles via direct intervention (i.e. the Fed), it may produce deeper ramifications down the line. Is that possible here?” I would argue that not only is it possible, but indeed likely due to the distortions the Fed’ endless QE programs are creating.

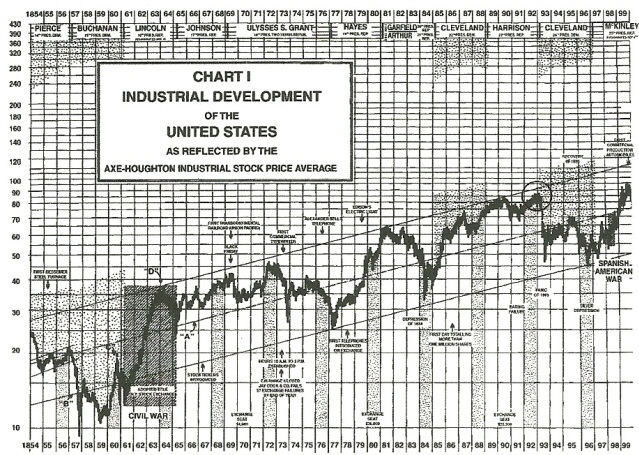

Another question: “If you don’t see any problems amounting until end of this year or early next year, it all seems a bit too quick to bring about a deflationary cycle, does it not?” Under normal circumstances I’d agree with this observation. These aren’t normal times, however, and we’ve seen just how quickly markets can turn with the slightest provocation in recent years (e.g. the “Flash Crash,” Greece, Crete, et al). If you go back to the last time the 120-year cycle bottomed in the mid-1890s, you’ll find that the stock market was in a roaring bull market right up until the start of 1893 – less than two years before the scheduled 120-year bottom in late 1894. The panic of 1893 was swift, sudden and virtually without warning. If it can happen once it can happen again.

A final question: “Will a possible pick-up of inflation in 2015 be good or bad for stocks, margins etc.?” After the 120-year cycle bottoms in late 2014, a new inflationary cycle will commence. Historically it takes several years after the start of a new long-term cycle – usually around 10-12 – before inflation starts to take off. There is a question as to whether this time around, starting in 2015, inflation will accelerate due to the enormous amount of corporate cash and bank reserves on the sidelines. If this money is quickly introduced into the financial system after 2014 it could kick-start the inflation cycle at a faster than normal pace.

The Fed has defended its aggressively loose monetary policy since 2008 in the name of fighting deflation. It has also admitted that its object is to artificially create inflation in an effort to increase economic activity. Would it not be the ultimate irony if its efforts end up creating a massive inflation problem – much more than it bargained for – in the years following 2014?

Gold

Gold finally has experienced a long-overdue rally after what has seemed an endless decline through much of 2013. The latest rally caught many traders short, forcing them to cover and thereby fueling the rally even more. The growing list of bearish institutional banks growling against the yellow metal only strengthened the likelihood of a gold relief rally, as discussed in recent reports.

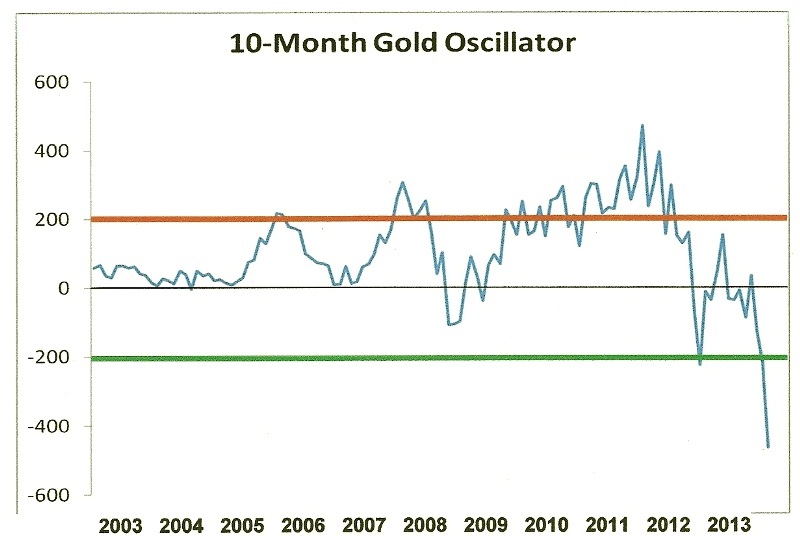

Gold traders have been bullish for four executive weeks according to Bloomberg. Analysts point to the Fed Chairman Bernanke’s proclamation that he will prolong the stimulus if U.S. economic growth slows as the primary reason behind the rush to gold. I disagree with this assessment since this theme has been a constant for the last several weeks and (until now) to no avail. A more likely reason is the record “oversold” condition of the yellow metal according to the 10-month price oscillator (below). A record build-up in short interest by uninformed traders is also fueling the latest rally.

The recent decline in gold prices revived sales of jewelry, coins and bars, according to Sharps Pixley, especially in China and Japan. Concerns over near-term gold supplies have also helped push up the prices of the July futures above the August futures, according to sources. In reflection of this, the cost of borrowing gold has risen to a four-and-a-half-year high in London.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you’re buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the “smart money” pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you’ll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.