Will You Go Up, Gold?

Biden asked Trump to shut up during the first presidential debate. But for us, the most important question is whether gold will finally go up.

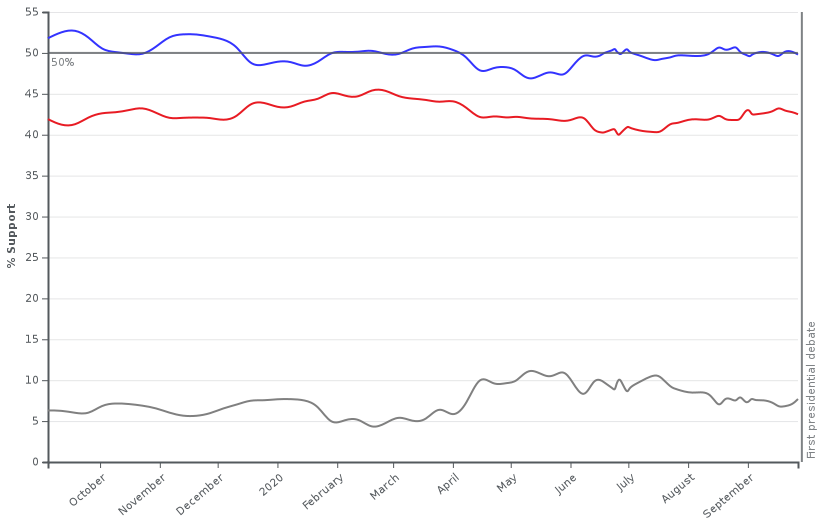

Thankfully, the first U.S Elections debate between Donald Trump and Joe Biden is behind us. Arguably, it was awful to watch and one of the worst presidential debates in history, as both candidates talked over each other and threw insults. Consequently, the debate did nothing to alter the Presidential race dynamic nor educate the public about the candidates. As the chart below shows, currently, Joe Biden has an average polling lead of 7.3 points over Donald Trump. Of course, the polls, especially nationwide, are not considered as very credible. But, according to the polls, if Trump changes nothing, Biden remains in the lead, and it is projected that the Democratic nominee will win.

The election could spur short-term volatility in the precious metals market, especially if the results are contested. However, they should not materially impact gold in the long run. Of course, a lot depends on who will win and how the markets will interpret the election results. At this point, it’s important to bear in mind that Biden could be more favorable for the stock market than many people think (as his views on tax hikes should soften over time, especially in the fragile post-epidemic recovery).

The best-case scenario for gold would be a full Democratic sweep of the White House and the Senate. A complete takeover by the Democrats could unsettle the marketplace (think about worries about new regulations and tax hikes), pushing investors again towards safe-haven such as gold.

On the other hand, if Biden wins the presidency but Republicans maintain the control over the Senate, it could indulge Wall Street by abandoning the harmful foreign and trade policies while keeping Trump’s tax reform in place. But still, in such a scenario, gold might somewhat struggle.

Implications for Gold

Throughout the debate, Trump made many interruptions. Biden quickly got irritated and said told him: “Will you shut up, man?” But the real question is: “Will you go up, gold”.

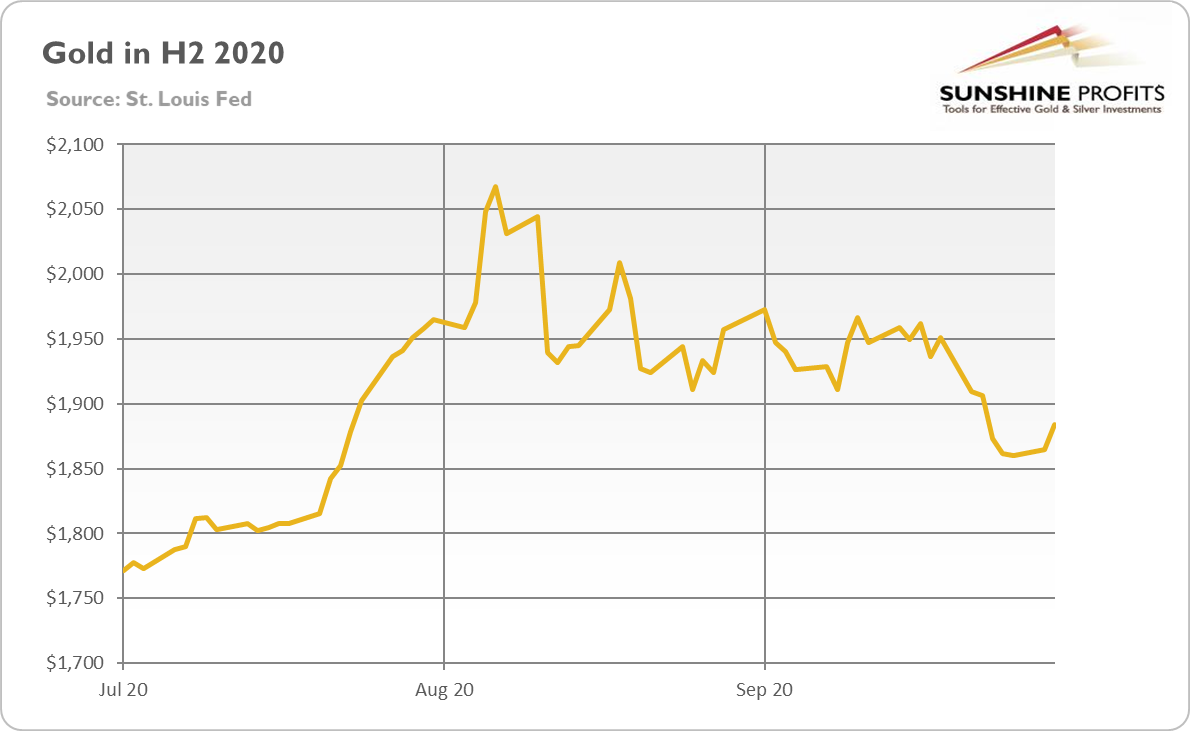

It remains to be seen. Most probably, the stage for the gold’s rebound is set, as the prices started to go up last week, approaching $1,900, as indicated in the chart below. The catalyst was the new hope of the U.S. fiscal stimulus package possibly being passed this year or even before the elections. After all, Congress members are under immense pressure to deliver aid to their voters. The new hope emerged as the Democrats have presented a brand new proposal of aid package with some Republicans concessions.

Most importantly, if the stimulus package is approved, the U.S. public debt will continue to climb at its historic pace, which should support the gold price as a result. The Fed would also have more Treasuries available to expand its balance sheet again.

To sum up, the debate between Trump and Biden was quite awful for watching and did not alter the presidential race at all. The elections and related uncertainty could cause short-term volatility in the gold market. Too much depends on the results, but they shouldn’t resume the underlying upward trend.

In any case, the U.S. fiscal stimulus will eventually be passed, which should encourage gold to continue with its bullish trajectory. This should remain in place given the environment of accommodative fiscal and monetary policies and negative real interest rates. Indeed, the persistent inflows of funds into thegold ETFs signal that the bull market is not over. The retreat from the August heights still looks like correction or consolidation, not a major reversal. To be clear, I do not claim that ETF flows drive the gold prices, but that the investors do not turn their backs on gold. And that gold’s fundamental drivers remain supportive, maybe still apart from the US dollar.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

********