Yesterday Really Did Not Happen

Yesterday really did not happen. How could we have seen a 10% rally when there was nothing to cause it?

Did we see an announcement about the eradication of the coronavirus? No. But, we did get more news of rising numbers of infected.

Did we see the passage of the Congressional bill? No. But, we did see more dithering by our wonderful representatives in Congress.

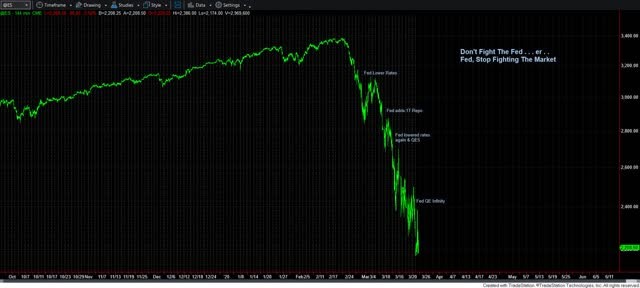

And, when the Fed announced further QE, all the market did was drop even more. In fact, based upon the reaction by the market over the last month, it seems the Fed “caused” many segments of our decline:

So, how is it possible that we rallied 10% on no news at all? That just can’t happen, right?

Well, Monday afternoon, we were seeing the set up for this rally off the lows, with a minimum target of 2450. And, guess what the high was for Tuesday? The SPX hit a high of 2449.71.

I am quite certain many of you will now perform mental gymnastics to come up with some reason as to why the market rallied 10% yesterday. But, all you are doing is fooling yourself. Consider that you are now stretching to come up with a cause for a rally which you did not foresee. And, you are stretching for that reason even in hindsight, since there was no accompanying news to support a 10% rally.

Yet, we care not about reasons, and we foresaw this rally.

I try to explain this time and again. All news provides us is an excuse for a move in the market which was already set up to happen. And, when there is no news, pundits struggle to find a reason. But, social experiments and historical analysis have been done over the last 30 years which prove that markets would move without any news needed.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

In a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, present a nice summation for the overall herding phenomena within financial markets:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

In 1997, the Europhysics Letters published a study conducted by Caldarelli, Marsili and Zhang, in which subjects simulated trading currencies, however, there were no exogenous factors that were involved in potentially affecting the trading pattern. Their specific goal was to observe financial market psychology “in the absence of external factors.”

One of the noted findings was that the trading behavior of the participants were “very similar to that observed in the real economy,“ wherein the price distributions were based on Phi.

And, yesterday, we saw an excellent example of a major move in the market without accompanying news. Moreover, the members of The Market Pinball Wizard were expecting this move and we really did not need any news to maintain such an expectation:

“I literally had the best day of trading to date today with positions I opened yesterday afternoon and then this morning based on your analysis.” (averagedown)

“Based on the Market Pinball Wizard analysis and using stocks identified on Stock Waves, the positions I opened yesterday were up an average of 33 percent. Without Pinball and Stock Waves, I would not have had the confidence to make those trades. Bravo to the Pinball Wizard!” (Steveandzoom)

“If the news is the major driver of the market, then Avi must have tomorrow’s newspaper at hand.” (lucidwonk)

Come join us at ElliottWaveTrader.net and see how math provides advance warning for moves well beyond any news. But, I will warn you. We are now heading into a very difficult period in market action which will likely whipsaw most. Are you prepared?

********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of