As The Yield Curve Flattens

For the reasons we've discussed over the past several years, the U.S. yield curve continues to flatten, with Wednesday seeing new, 11-year low spreads. As you know by now, this has significant long-term implications.

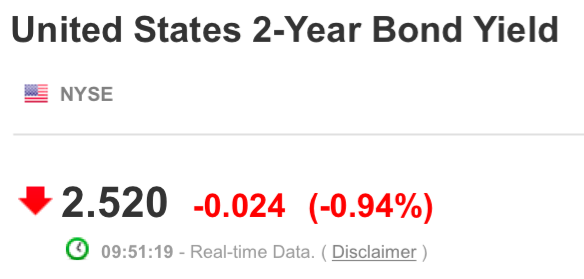

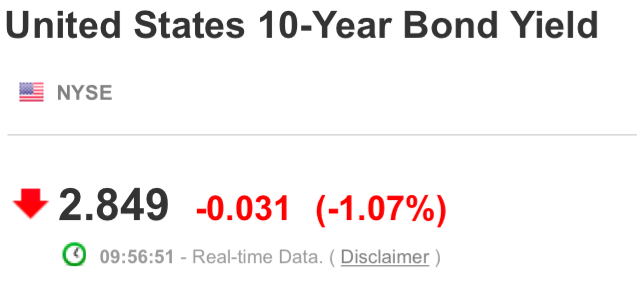

Let's start with the latest update. Below are snapshots of the current yields for the 2-year note and the 10-year note.

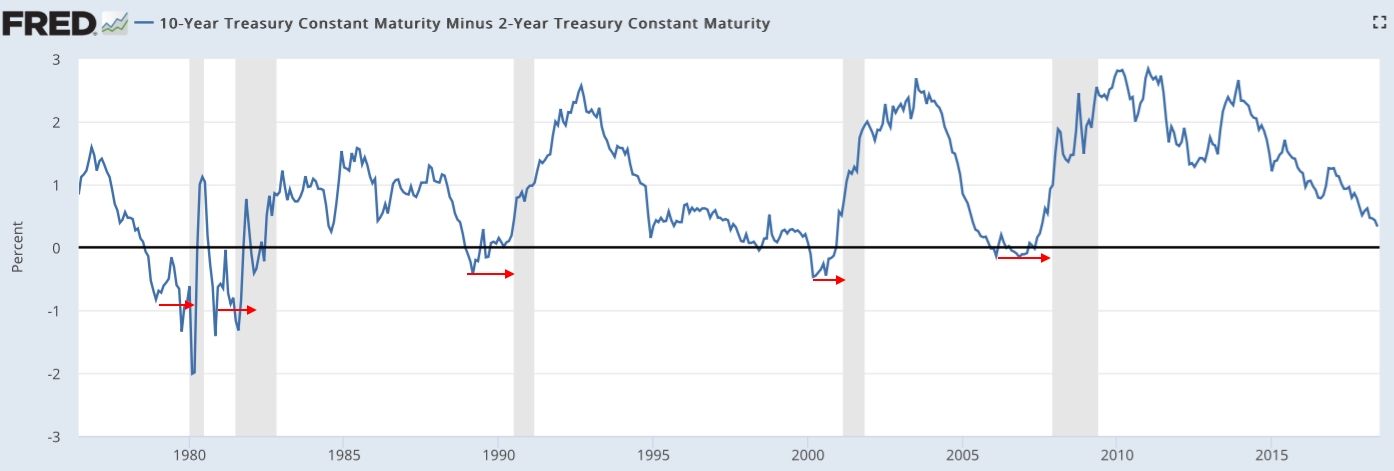

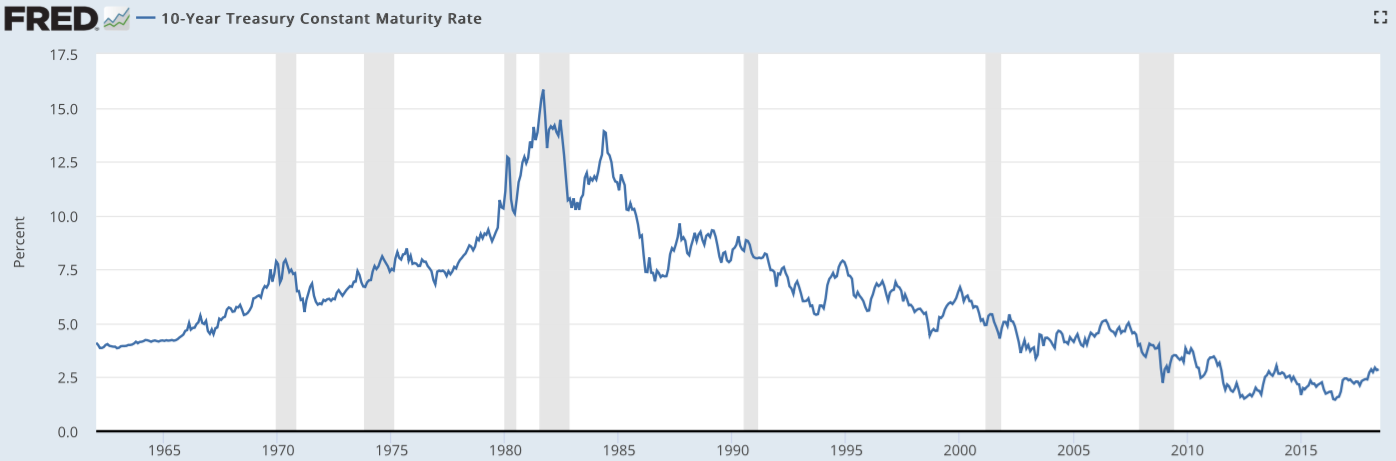

Subtract the 2-year yield from the 10-year yield and you're left with a spread of 0.329%, or 32.9 basis points. That's a new low for 2018 and a new low going back to 2007. This curve is steadily moving toward inversion, where the 2-year yield actually exceeds the 10-year yield. An inverted yield curve always precedes a recession, as The Fed itself shows below with recessions blocked off in gray:

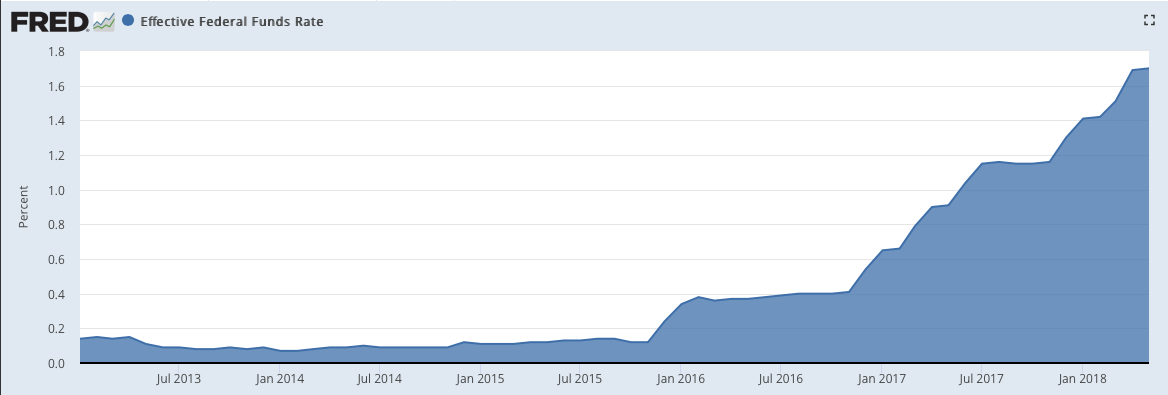

And why is the yield curve going to invert? Because Powell and his Fed are continuing to doggedly pursue Fed Funds rate hikes ... ostensibly to control "inflation". Note how Fed Funds and the 2-year yield are rising together:

Meanwhile, the yield on the U.S. 10-year note has plateaued again near 3.0% and is moving lower. Why? Quite simply, the Big 5 central banks have created at least $15T worth of new fiat through their QE programs since 2008. This $15T continually sloshes around the planet looking for a home that can provide any sort of "return". Thus, the near-constant bid for longer-term treasuries that keeps yields from moving to anywhere near “normal".

What does this all mean? In the end, the U.S. economy is now moving rapidly toward a reversal and slowdown. This will lead to recession (at least two quarters of negative GDP), and a renewed program of fed funds rate cuts and even more QE, as tax revenues plummet in the face of soaring U.S. government spending. And we are right back to where we were in 2009-2011.

You recall 2009-2011, don't you? The Fed's QE1 program was going to be their only foray into quantitative easing. It was supposed to be a one-and-done. And, by mid-2010, it appeared that this might be the case. Interest rates had begun to rise, with the yield on the U.S. 10-year note moving up from 2.25% in 2009 to nearly 4.0% by mid-2010. CNBC and Bloomberg were issuing daily reports regarding the "green shoots" of economic recovery.

But then reality hit. The U.S. economy slowed, and by November 2010, Bernanke's Fed announced a new program of $600B worth of bond buying dubbed "QE2". Both long-term interest rates and the U.S.$ fell, and this led to a gold price surge of nearly 30% over the next 10 months. Additionally, COMEX silver rallied from $18 in June of 2010 to $48 in April of 2011.

The point of all this is to once again assure you that all is not lost. Though prices have fallen steadily over the past 60 days, COMEX gold is not going to $700 and COMEX silver is not going to $8. By simply looking ahead at the obvious and ominous signals, you can see that this current decline will soon reverse and that much higher precious metal prices are looming for the second half of 2018 and beyond.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.You may copy, link to or quote from the above for your use only, provided that proper attribution to the author and source is given and you do not modify the content. Click Here to read our Article Syndication Policy.