Yield Inversions As A Harbinger Of Recessions And Higher Gold Prices

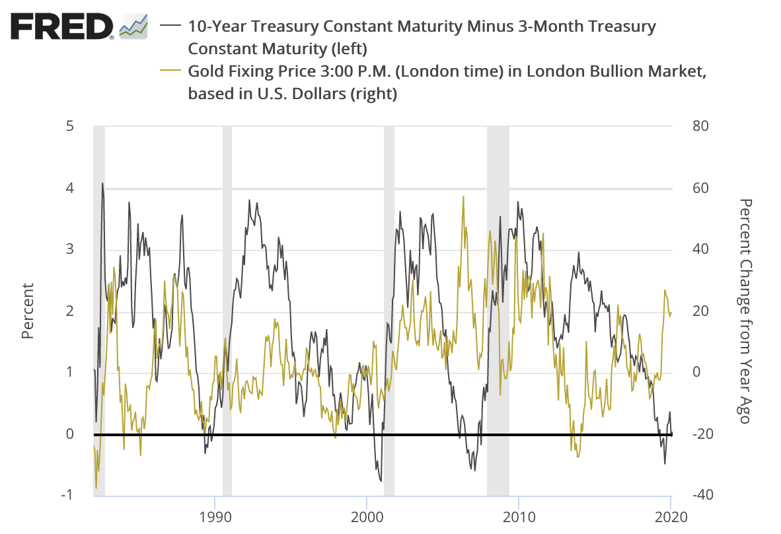

During the course of the past several months, we have heard much about the inverted yield curve in three-month and ten-year Treasuries as a harbinger of recessions. Missed in the press reports is the fact that it has also been a harbinger of higher gold prices. In the chart above, please note the upward surges in the price of gold following the three most recent yield inversions in 1989, 2000 and 2006. Those price rallies, it is now well understood, came in response to aggressive central bank stimulus intended to beat back the ill effects of the recessions that followed in 1990, 2001 and 2008.

In recent months, as shown in the chart, the yield differential between the ten-year and three-month Treasury yield has again pinched to zero. After briefly recovering at the end of the year, it dropped to the zero line again a few weeks ago. Note, as well, the sudden rise in the price of gold from the time the inversion first made its appearance in May of last year – a more than 20% increase.

Source: St. Louis Federal Reserve [FRED]

Chart note: The grey bars indicate recessions.

Are the markets hooked on Fed stimulus?

Fed Chairman Jerome Powell’s forceful statement that the Fed is “determined” to avoid a disinflationary outcome in the United States is a clear indication of the central bank’s intentions. The question hanging over the markets is whether or not the central bank’s policies will deliver the intended result. At the same time, it seems the Fed is not only reluctant to back down from the dovish course of action already in place, but it could also be intent in upping the ante by providing the necessary “liquidity” as long as credit markets need it – no matter how the policy is labeled.

“In essence,” says analyst Jim Bianco in a Bloomberg opinion piece, “the Fed has become the lender of first resort when it should be the lender of last resort and offer repo at a penalty rate. The Fed should be willing to help a dealer in need, but it should come at a price.” Some of the more skeptical on Wall Street are asking “what happens when QE4 is turned off?” The better question might be “what happens if it is not?“

Why financial advisers should line their portfolios with gold

More and more, it is becoming a mainstay in the financial business that the wise investor and/or financial advisor embrace gold as a means to capital preservation in a rapidly changing and increasingly dangerous investment climate. In Cazenove Capital’s case, it is emphasizing gold as a hedge against geopolitical turbulence. “Speaking at a Schroders breakfast briefing yesterday (January 22),” reports Financial Times, “Janet Mui, global economist at Cazenove Capital, said she thought investing in gold was the best way for advisers and fund managers to hedge the risks in their portfolios. She said: ‘Gold has the feature of portfolio hedging and diversification. Gold should be in your portfolio.’”

Related, please see: Precious metals for financial planners and advisors. We will work with you to offer your clients a strong, service-based presence in the gold coin and bullion market

Central bank gold demand for 2019 second-highest level in 50 years

“Gold demand,” says the World Gold Council in its Demand Trends analysis for the year 2019, “fell 1% in 2019 as a huge rise in investment flows into ETFs and similar products was matched by the price-driven slump in consumer demand. . . Central bank demand also slowed in the second half – down 38% in contrast with H1’s 65% increase. But this was partly due to the sheer scale of buying in the preceding few quarters and annual purchases nevertheless reached a remarkable 650.3t – the second-highest level for 50 years.”

We are quite a distance from the days when central banks were net sellers of gold. Some central banks are building reserves. Others are making certain that gold is repatriated within their borders. Few are selling and when they do it is usually under stressed circumstances. De Nederlandsche Bank, the Dutch central bank, recently offered a bedrock reason for the official sector’s interest in building and maintaining gold reserves. “[I]f the system collapses,” it said, “the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security.’”

In the same week the World Gold Council released its analysis, GFMS published its annual assessment of gold market fundamentals and price outlook. “While demand from key Asian markets will likely to remain weak this year,” it advises, “ongoing central bank purchases and renewed investor interest will lend support for higher gold prices. We therefore expect gold to average $1,558/oz in 2020, with a possibility to test and move beyond $1,700/oz later in the year.”

(Please see GFMS Research/Review and Outlook/January 2020)

Image courtesy of the World Gold Council

The best-performing asset of the 21st Century

Echoing a theme, we advanced in this newsletter several months ago, Charlie Morris of Atlantic House Fund Management in the United Kingdom says “Gold remains the best-performing mainstream asset of the 21st century, yet investors own a mere 82 million ounces (worth $128bn) between them via the exchange-traded funds. That might sound like a substantial holding, but it is not. With global exchange-traded funds worth over $5trn, the implication is that the average portfolio has a mere 2% allocation to gold. Academic studies range in their conclusions, but they all suggest the optimized allocation should be greater than zero. I have often felt that 8% makes sense for a balanced portfolio and 15% to 25% for an all-weather total return fund.”

The question becomes whether or not an investment that has performed so well in the past is likely to perform equally well in the future. Though nothing in the world of finance and economics is certain, we rest the bullish case for gold on the understanding that none of the economic and financial system problems that created a positive price environment for gold over the last nearly nineteen years have been removed from consideration. In fact, a case could be made that they have only intensified – and dangerously so. Gold is up 5% through January of the new year while the Dow Jones Industrial Average dropped 1%.

Please see: Gold’s Century: While stocks dominated headlines, gold quietly performed

If you think you could benefit from a concise review of the latest news, analysis and opinion on the gold market from a variety of expert sources, then News & Views is the newsletter for you. Since the early 1990s, we have offered it free-of-charge as a monthly service to our regular clientele and as an incentive to prospective clients. By subscribing, you will automatically receive future editions and occasional in-depth Special Reports by e-mail.

The next great monetary experiment

Daily Reckoning’s Brian Maher warns of the potential consequences of modern monetary theory. “This MMT sounds like a recipe for immense inflation, even hyperinflation,” he says. “You are spending all this money directly into the economy. It will drive consumer prices through the attic roof, you say. This is crackpot. A witch’s sabbath of inflation would surely result. Yes, but here the MMT crowd meets you head on… They agree with you. They agree MMT could cause a general inflation, possibly even a hyperinflation.” [Link to full article]

Modern Monetary Theory (MMT), we would add to Maher’s observation, is neither modern nor a theory. John Law, the Scottish financier, tried a version of it almost exactly 300 years ago (1717-18) in France.* He did so with the blessing of the French monarchy and with a rationale very similar to MMT’s proponents today. MMT entails, simply put, a federal government fiscal policy without spending limits coupled with the power to print whatever money is required to finance any deficits. In the end, Law’s theories (to his surprise if we are to believe the historical account) bankrupted the French people and the government, reduced the economy to ashes, and created such a distaste for paper scrip among the citizenry that it took 80 years for France to reintroduce paper money as a circulating medium.

In The Story of the Greatest Nations (1900), Edward S Ellis and Charles F. Home tell of the public mania that engulfed the French people and led to ultimate financial ruin for thousands:

“The shrewder speculators* became alarmed. They began to sell their shares of stock, and hoard in gold the enormous wealth they had acquired. This resulted in a demand on the government for metal in exchange for its paper, and soon the government had no metal to give. Then the crash came. Those who had the government paper could buy nothing with it. Those who held the Mississippi stock could scarce give it away. It was worthless. The government itself refused to accept its own paper for taxes. A few lucky speculators had made vast fortunes; but thousands of families, especially among the wealthier classes, were ruined.”

That snippet provides a hint as to the steps taken by those who survived Law’s version of modern monetary theory. For those to whom all of this has a distinct ring of familiarity, perhaps a judicious hedge makes some sense. A number of analysts have made the argument that we do not have to wait for the formal launch of modern monetary theory. It is already here.

* Please see this link for a summary of Law’s Mississippi Company land scheme.

Cartoon courtesy of Scott Stantis

Australia’s Perth Mint attributes sales surge to a single European country

“Gold coin and minted gold bar sales from December showed a 45% uptick compared to the previous month [for Australia’s Perth Mint],” reports Kitco News. “There was a total of 78,912 ounces of gold coins and minted bars sold in December, marking the highest monthly increase since October 2016, The Perth Mint said last week. The year-over-year comparison shows that sales were up 170%.”

These results raise two items of more than passing interest among gold owners and advocates. One is the Perth MInt’s experiencing very strong demand for its bullion coin production – in stark contrast to the U.S. Mint’s dismal numbers for 2019. The other is the source of that demand. At first blush, one would think that the reason for the differentiation is Far Eastern demand given the Perth Mint’s location. Surprisingly, though, Germany, according to the mint, is the source of that demand where investors are concerned about a developing economic slowdown and the longer-term effects of Brexit. The U.S. Mint reported a dramatic turnaround in sales of the American Gold Eagle bullion coin in January from 2,000 ounces in December to 60,000 ounces in January – a 30 times increase.

Silver a sleeping bull

At present, the gold-silver ratio is near 87:1. Quite a few among our regular clientele who normally concentrate capital in gold have taken the step to fill their ‘silver gap’ at the current price ratio. Within that group, a good many opt to store the metal at a depository facility by which you can buy or sell with a phone call and it is fully insured. Cost-wise, it is competitive with an ETF and offers the additional advantage of a delivery option in case you would rather have your silver nearby at some point in the future. “In modern times,” says Andrew Hecht in a column at Seeking Alpha, “since the 1970s, the average level of the relationship between the two precious metals has been around fifty-five ounces of silver value in each ounce of gold value. When the ratio between the metals is below the 55:1 level, silver is historically expensive compared to gold. At levels above 55:1, silver becomes historically cheap. . .Silver could be a sleeping bull at the $18 per ounce level.”

Editor’s note: If you have an interest in exploring silver ownership and storage options, we invite you to contact us for details.

Three reasons Ray Dalio’s hedge fund is betting on a 30% gold price surge

“[T]he world’s largest hedge fund says that investors should be prepared to sell the news and park their cash in the next asset primed for a surge – gold,” writes Josiah Wilmoth in an article posted at CCN. Wilmoth identifies three catalysts for Bridgewater’s forecast gold is going to $2000 – 30% higher than current prices: (1) a permanent shift in Fed monetary policy; (2) ‘boiling conflict’ in China and Iran; (3) political turmoil in the United States. Still early in the election cycle, many overlook political turmoil with respect to its effect on the price of gold. As most of you already know, Bridgewater Associates is headed up by Ray Dalio whose attachment to gold is well known. This is the first time, though, that the fund has gone public with a number. The fund advises that investors make gold “a cornerstone” of their portfolios.

Why are Indians in the grip of a gold obsession?

“In an economy buffeted by the ups and downs of farming and fishing, the people are used to buying gold after bumper harvests or fishing seasons and selling it after lean ones.” –– LiveMint/Vivek Kaul/1-13-2020

Dr. MoneyWise says: “It’s all very simple. Own gold for a rainy day. Use it if or when that day arrives.”

Up-to-the-minute gold market news, opinion and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

Ready to move from education to action?

ORDER DESK: 1-800-869-5115 x100/[email protected]

ONLINE ORDER DESK-24/7

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD does not warrant or guarantee the accuracy, timeliness or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors are solely their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything.

********