Back to the Future

Introduction

One of the best thing being an independent trader/analyst is that I don't have to conform. I make my own rules, trade my own models, and simply ignore the noise. It amazes me to read articles days after days and weeks after weeks written by well known experts of the financial world, why the markets will do this and that, because of this and that. So much focus is on the prediction of the future that many just do not see what is happening now. Does it not make sense that what is happening now has direct influence on the near future? For example:

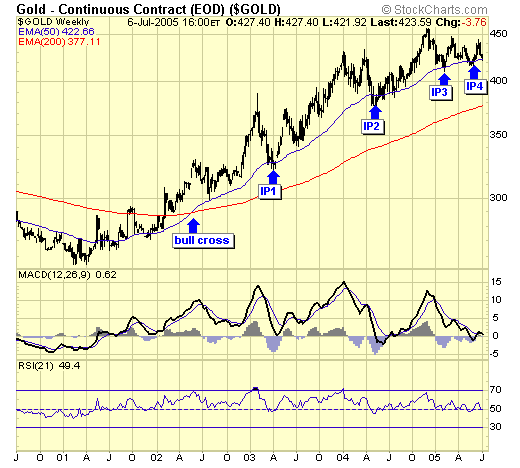

- gold has been in a bull market for four years now, yet so many so called "deflationists" refuse to accept this simple fact and insist that gold is a poor investment based on their outlook of a deflationary future…..HELLO?? Why live in the future when you can live now?

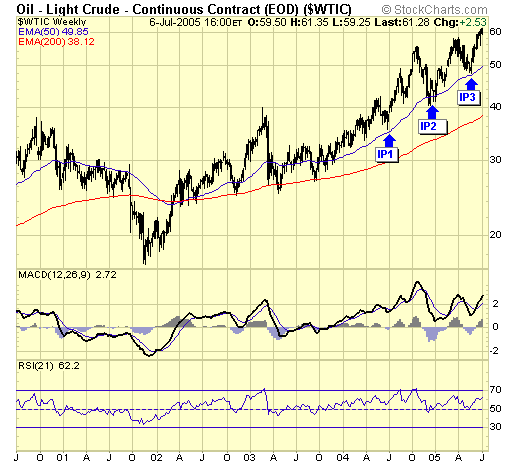

- Crude oil has been in a bull market for six years now, still many choose to disbelieve, blaming the high oil prices on the war, the middle east, George Bush, and now, China.

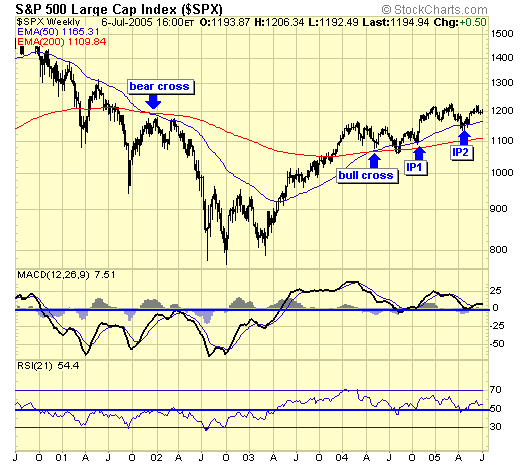

- The broad market as defined by the SP500, has been going up since 2002, yet so many still choose to believe a crash is imminent, that the market simply cannot sustain itself because of this and that.

Being a technical analyst, I do not have the capacity to debate over the fundamentals of the markets, I'll leave that to the experts. And frankly, I don't really care, there is a lot more to life than to be totally preoccupied with tomorrow's stories. I live in the present, and the current market condition will have a direct influence on the future, and this information is available to anyone who has a keen eye.

Gold - is in a bull market, and currently in an impulsive phase. As many traders say, buy the dips of a bull market. IP1, 2 3 and 4 are the dips, folks.

Crude oil - also in a bull market, and impulsive. IP1, 2 and 3 are the dips.

SP500 - officially in a bull market since 2004 according to my model, and IP1 & 2 are the dips.

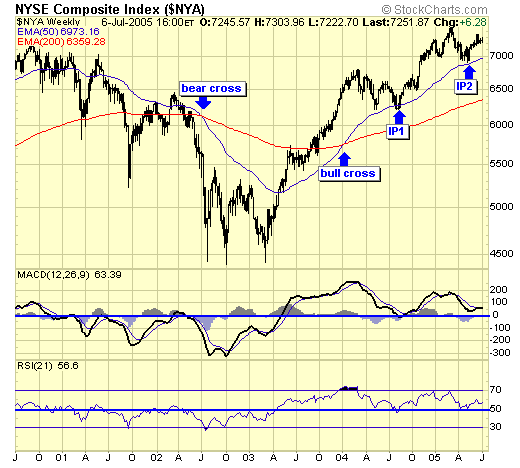

NYSE - the big board. In a bull market since 2004, and there has been two stops to board this train also.

Summary

First, a little story.

One day this little town in middle America had a serious flood. It was so bad that the whole town had to be evacuated. The town's priest went door to door in chest high water to make sure no one was left stranded. A small boat came by, and rescuers urged the priest to get in before its too late. The priest refused, saying that God will take care of him. Second boat came by, same thing. The third and last boat came, and insisted the priest must leave with them now, still, the priest refused, trusting his life to god.

The priest drowned.

At heaven's door, priest was greeted by the almighty. Visibly upset, the priest asked god why he was left behind to die. God says, " I sent three boats out for you! "

Precious metals, energy, and the broad market are all in the middle of an impulsive phase of a bull market, all at the same time! This is very confusing to the experts, because according to conventional wisdom, it is almost impossible, because of this and that. Often at social functions, I get asked by strangers what I do for a living. I say, I follow the markets. And every time, their response is the same, " what do you think such and such will do in the next few months?" And I say, " I don't know, that is why I follow the markets."

Markets are dynamic and subject to constant change, no predictions or forecasts can have any influence on the outcome, just follow them.

Peace and profits,

Jack Chan at www.traderscorporation.com

8 July 2005