Gold above $3,370 as Powell turns dovish, labor risks rise

NEW YORK (August 22) Gold prices continue to trend higher on Friday after the Federal Reserve (Fed) leaned dovish, as commented by the Fed Chair Jerome Powell, who said that “downside risks to the labor market are rising.” XAU/USD trades at $3,371 after hitting a daily low of $3,321.

The day arrived and Powell hinted that there’s a “reasonable base case” to think that tariffs would create a “one-time” increase in prices. Nevertheless, he acknowledged that risks to inflation are tilted to the upside and risks to employment to the downside, a “challenging situation.”

After his remarks, Bullion prices initially soared towards the $3,350 area before resuming to the upside, heading to a daily high of $3,378 before retreating somewhat to current price levels.

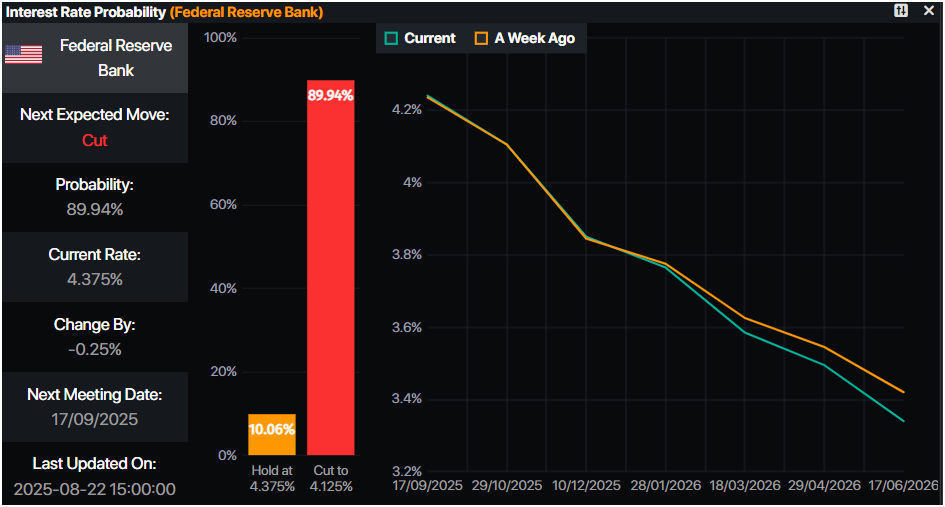

Market participants had priced in a 90% chance that the Federal Reserve will cut 25 basis points (bps) from its main reference rate, according to Prime Market Terminal. However, there are two inflation prints left and the following Nonfarm Payrolls report on September 5.

Source: Prime Market Terminal

After Powell’s speech, Cleveland Fed President Beth Hammack said that she heard that Powell is open-minded about the policy outlook, and she reiterated her stance to get inflation back to target.

Next week, the US economic docket will feature Fed speeches, Durable Goods Orders, CB Consumer Confidence, GDP figures, Initial Jobless Claims, and the Fed’s preferred inflation gauge measure, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold boosted by speculation of September rate cut

- Following Powell’s remarks, US Treasury yields tumbled, flattening the yield curve. The 10-year Treasury note is down nearly seven basis points at 4.261%. US real yields —which are calculated from the nominal yield minus inflation expectations— are down seven bps at 1.871% at the time of writing.

- The US Dollar Index (DXY), which tracks the performance of the USD against a basket of six currencies, drops more than 1% to 97.55.

- Fed Chair Powell said, “The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” He added that “the stability of the unemployment rate and other labor market measures allows us to proceed carefully.”

- Cleveland’s Fed Beth Hammack added that the Fed is a small distance away from the neutral rate and that the “Fed needs to be cautious about any move to cut rates.” She expects a rise in inflation and in the unemployment rate.FXStreet