Gold Speculators Increase Bearish Bets For 3rd Week, Highest Since 2001

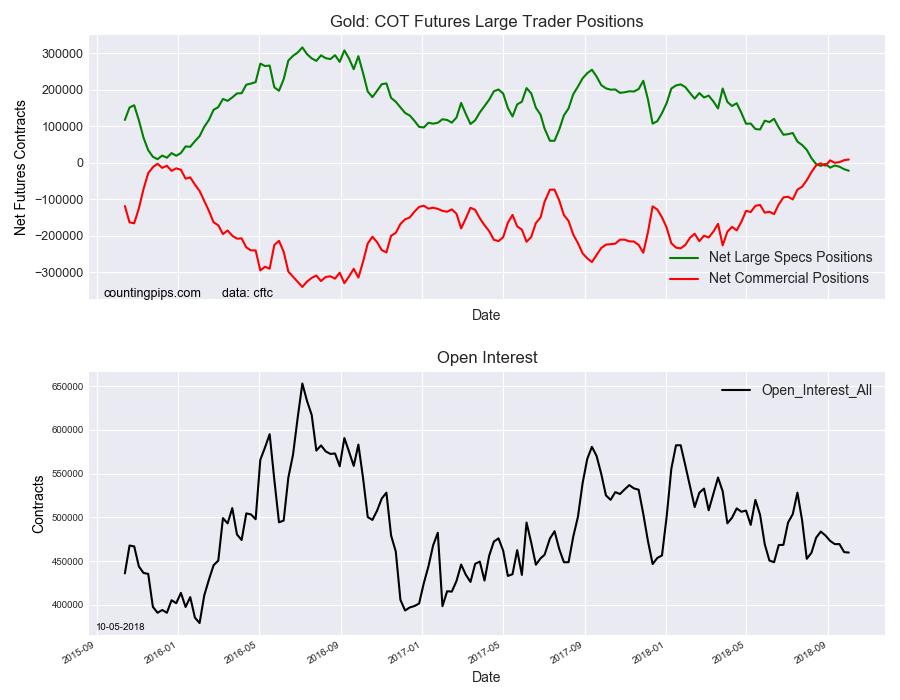

Gold COT Futures Large Trader Positions

Gold Non-Commercial Speculator Positions

Large precious metals speculators added to their bearish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of -21,822 contracts in the data reported through Tuesday October 2nd. This was a weekly decline of -4,174 contracts from the previous week which had a total of -17,648 net contracts.

The speculative bearish position rose for the third consecutive week and for the fourth time out of the past five weeks. The current standing is now above the -20,000 net contract level for the first time since December of 2001. This week marked the eighth straight week that gold speculator bets have been in bearish territory.

Gold Commercial Positions

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 8,875 contracts on the week. This was a weekly gain of 1,795 contracts from the total net of 7,080 contracts reported the previous week.

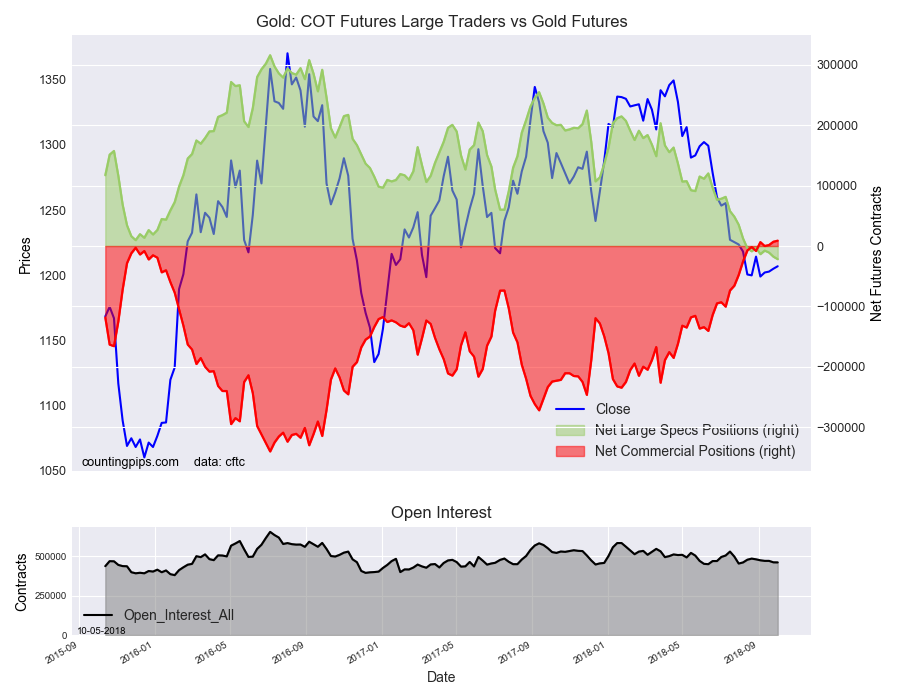

Gold COT Futures Large Trader Vs Gold Futures

Gold Futures

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1207.00 which was a rise of $1.90 from the previous close of $1205.10, according to unofficial market data.

*********