Gold ETF – The Gold ETF Experience

Gold ETF Trading – Taking advantage of the gold market using the GLD ETF to generate consistent profits in any market condition.

Gold’s price action in the past 5 months has frustrated many traders. Especially those who have difficulty making money during consolidation periods which are in. The past couple months are consistently the weaker months for gold prices year after year. That being said August through year end have been consistently strong for trading gold and gold ETF’s.

Chart 1 – Gold Spot Price, you will see that gold found support at the 50 exponential moving average and also found major support at the 200 EMA. August is just around the corner when gold generally picks up steam, which you can see in the chart below in 2007.

Gold at support levels and entering August

Chart 2 – The Collapsing Dollar looks to be struggling at resistance and making a lower high and lower low (bear Trend). If the USD breaks down it should slide to the 67 cent level and send gold soaring for 2-3 months.

US Dollar at resistance making lower highs and lower lows.

Chart 3 – A close up chart of the USD, you can see its currently at the top of its Bollinger Bands and just made a lower low 2 weeks ago. Head and Shoulders anyone….

Weak dollar at top or range with head and shoulders pattern

Chart 4 – GLD Gold ETF is my trading vehicle of choice and is currently at support making higher highs and higher lows (bull trend). While this does not provide a buy signal with my daily trading model, it does provide an excellent trading opportunity for an intraday trade as we should see prices make a move much higher or much lower within the next couple days.

GLD Gold ETF is poised for a move, does not matter which way at this point thought.

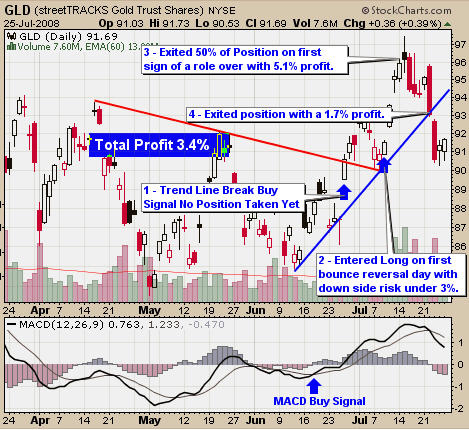

Chart 5 – Recent Gold ETF trade. My focus for short term trading is simple. Wait for a breakout which satisfies my trading model, enter the trade and then exit 50% of position on the first sign of weakness. Exit second half on a trend line break. My goal for GLD ETF is 2-5% and we are in trades for 2-10 days unless prices continue to run. I generally have 10-20 trades per year with gold.

My recent Gold ETF trade which profited 3.4% with very little down side risk during a sideways market.

GLD trading for me is the most accurate trading vehicle I have come across. I have been using my proven trading model which avoids the price gaps and keeps risk for each traded under 3%.

Gold ETF makes it simple to profit from the markets using a proven trading model for trading long and short term gold setups.

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Reach Chris at: [email protected]

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.