Gold Price Forecast – The Strong Bearish Signs From Palladium And Platinum

There are days and weeks, when one precious metals sector leads the other, or lags behind. In fact, such clues can and do form valuable gold trading tips. What messages have palladium and platinum been sending our way exactly?

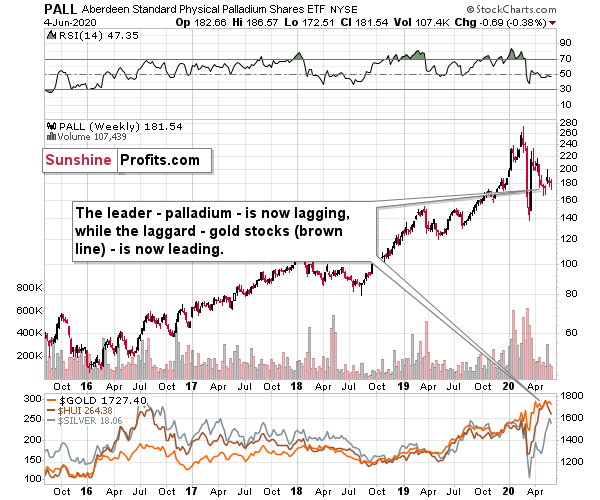

What catches the eye, is palladium's weakness. This precious metal was the one that soared most profoundly in the past few years and while it recovered some of its 2020 declines recently, it appears to be back in bearish mode as it's unable to keep gained ground, even despite the move higher in the general stock market.

The previous leader is now definitely lagging. And you know what is leading now? Silver - as it usually does in the final part of the upswing. When leaders are lagging, and laggards are leading, one should recognize that the market is topping - and that's the key take-away from the palladium and platinum analysis right now.

Palladium was the leader and platinum was actually one of the laggards. Palladium was down by 0.43 last week. And what did platinum do?

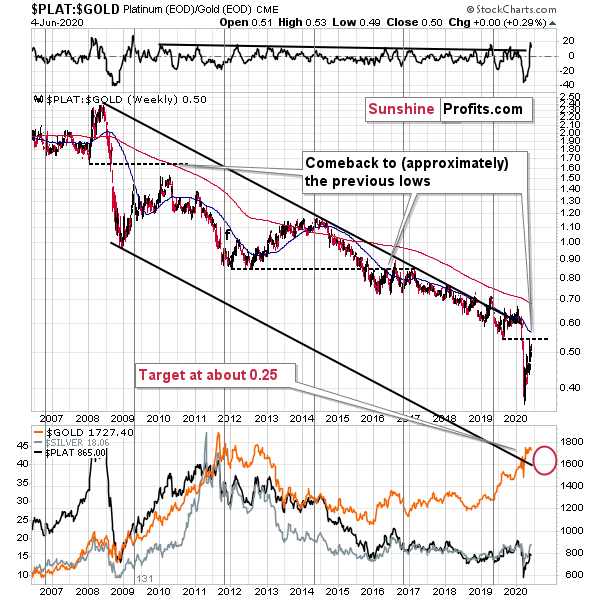

Platinum recently moved higher relative to gold, showing exceptional “strength”. The laggard is leading the way – very toppy action.

The long-term downtrend in the platinum to gold ratio has fundamental legs – the little silver (as that’s what platina means) is suffering from declining demand from the automotive industry. The diesel engines, where platinum is used as a catalyst, give way to gasoline engines and electric cars. But that’s just the long-term trend. There are local trends around the main trend and the interesting pattern in them was that once the platinum to gold ratio broke below the previous lows, it then moved back closer to them, to kind of “wave goodbye”.

It seems that we saw this phenomenon right now as the ratio moved to the 2019 low and then moved a bit lower. As the breakdown was verified, the ratio could now turn lower once again. The big slide that we saw earlier this year took place at the same time when stocks, silver, miners, and gold declined, as the USDX soared. Platinum seems to be telling us to be prepared for another wave lower, also in gold – and we are.

Summing up, palladium has been unable to recover its previous stellar performance, despite the strong recovery in the stock market. The former leader has been unable to regain its footing, while the previous laggard, platinum, made a comeback to prior lows. The bearish implications of the breakdown verification in the secular platinum-to-gold ratio downtrend, remain with us. And they don't bode well for the yellow metals in the short run. The above is further confirmed by multiple other trading signals coming from gold, silver, and mining stocks.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. You’ll also gain 7 days of free access to our premium Gold & Silver Trading Alerts as a starting bonus. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,