Gold SWOT: Basel III Rules, Effective July 2025, Will Let U.S. Banks Count Physical Gold as a Tier 1 Asset

Strengths

- The best-performing precious metal for the past week was palladium, up 3.77%, with platinum not far behind as one of the top performers. Ivanhoe Mines reached a major milestone at its Platreef project in South Africa, with mining crews accessing the massive, high-grade orebody for the first time. The Platreef mine—projected to become one of the world’s lowest-cost and largest primary platinum producers—contains over 50 million ounces of indicated precious metals and is expected to deliver decades of stable supply. This progress underscores platinum’s strategic value in securing long-term sources of clean energy and industrial metals.

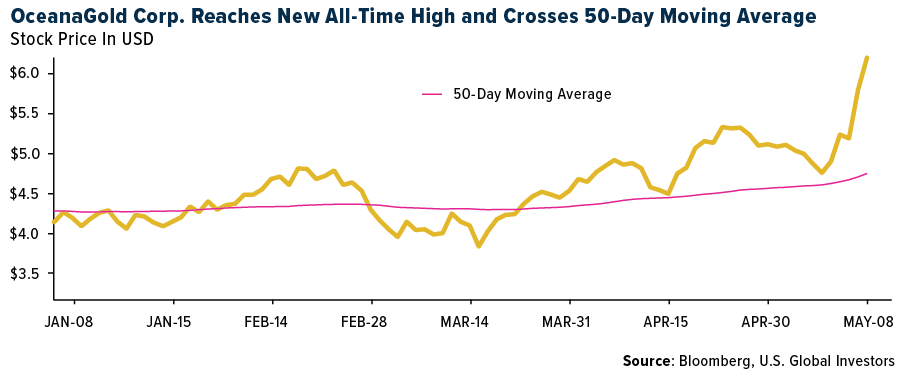

- OceanaGold hit an all-time high, surging 13% to C$5.73, as momentum builds following a standout first quarter marked by strong earnings, zero debt, and $312 million in trailing 12-month free cash flow. The company’s performance and growth outlook have positioned it well for a potential U.S. listing aimed at broadening its investor base.

- Kinross reported adjusted earnings per share (EPS) of $0.30, a beat against the Street at $0.24. The beat against CIBC’s estimate was driven by strong production of 512,000 ounces and lower operating costs. Free cash flow of $371 million beat estimates of $307 million.

Weaknesses

- The worst-performing precious metal for the past week was silver, though it still gained 2.14%. Silver prices remain range-bound between $32 and $35, with traders capitalizing on short-term volatility ahead of potential catalysts from U.S.-China trade talks. While technical momentum is muted, fundamentals received a boost from Aya Gold & Silver, which reported a 200%+ surge in first-quarter silver production and reaffirmed its 2025 guidance based on strong operational performance at the Zgounder Mine. The combination of steady industrial demand and positive supply-side momentum supports a constructive outlook for silver.

- Gold declined on Tuesday and Wednesday as the dollar strengthened and President Donald Trump teased plans to announce a “major” trade deal on Thursday, boosting optimism around potential tariff relief. However, gold rebounded on Thursday and Friday as the news turned out to be a non-event.

- Gold Fields Ltd. and AngloGold Ashanti Ltd. have suspended talks to combine two mines in Ghana, more than two years after proposing the joint venture. The companies agreed to “pause discussions” on merging the Iduapriem and Tarkwa assets to focus on improving their respective standalone operations, according to statements released Tuesday.

Opportunities

- The upcoming Basel III "Endgame" rules, effective July 1, 2025, will allow U.S. banks to count physical gold as a Tier 1 asset for reserve requirements, equivalent to cash or U.S. Treasuries. This is expected to boost institutional demand as banks seek to hold more allocated gold, reducing exposure to riskier “paper” gold. Recognized as a zero-risk reserve asset, gold’s safe-haven appeal grows, making it a strategic tool for banks to strengthen balance sheets amid tighter global regulations.

- According to Bank of America, the Gold Road Board has unanimously recommended the final takeover offer from Gold Fields (GFI). The all-cash offer values GOR at A$3.40 per share ($3.7bn), including a fixed $2.52 per share (which incorporates GOR's planned $0.35 per share special dividend upon the scheme's approval), marking an 11% increase from the previous offer of $2.27 per share.

- Turaco Gold has reported a 41% increase in the Afema Gold Project’s resource, bringing it to 90.8 million tons and 3.55 million ounces overall. Notably, the indicated resource has grown by 17% compared to the August 2024 estimate. Canaccord had expected the resource to exceed 3 million ounces, so the 3.55 million ounces is a strong outcome for TCG.

Threats

- Spot gold could face headwinds if investors pull back on safe-haven investments amid hopes for constructive trade talks between the U.S. and China next week. Momentum traders may see the risk of a double top forming in gold, which could concern recent bullish positions expecting new record highs. Additionally, the 200-day moving average is about 18% below current levels, according to Bloomberg.

- The surge in gold investment demand, driving prices to record levels, has been offset by sharply lower jewelry purchases. Bank of America's supply and demand model suggests that gold can trade comfortably above $3,000 per ounce, but not above $3,500 per ounce for now, especially if trade disputes ease. For further gains, investment in gold would need to increase, and jewelry demand would need to stabilize.

- Thirteen gold-mining workers were killed after being kidnapped in an area of Peru known for violence, according to a statement from Compañía Minera Poderosa S.A. The workers were employed at a small mine operated by a contractor for Poderosa, one of Peru's largest gold producers. At least 39 workers have been killed in recent years in disputes over control of the gold-rich area of Pataz, in northern Peru, according to Poderosa.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of