Gold $3800 Key Investor Questions

Here are some interesting questions for gold bugs of the world to ask themselves: Can there be quarterly window dressing in the gold market? Would a US government shutdown be bullish or bearish for the nation’s fiat and bonds? What would a shutdown mean for gold?

Here are some more questions of importance: Can there be peace in Gaza? From a technical standpoint, how important is $3800 for gold? Is the resignation of the CEOs of the two biggest gold companies (on the same day!) just a coincidence?

To begin to address these items:

This is the weekly gold chart. The beautiful triangle pattern’s $3800 target price has been acquired.

What now? Well, aggressive players should consider booking some profits.

How much profit should be booked? That’s a key question and the answer to it depends mainly on where the gold bug sits on the aggressive gambler (maniac?) to conservative investor scale.

Typically, a conservative investor views gold as supreme currency and aims to get more. Profit booking (in gold, silver, or miners) would be limited to a maximum of 30% of their positions.

In contrast, gamblers would typically sell a minimum of 30% of their holdings in this situation, and as much as 70%. For my https://galacticswinger.com metals market gambling service, we sold 50% of our aggressive positioning yesterday and raised our stoploss order on the rest… to near to the current price.

For a closer look at the price action in the $3800 zone:

This is the exciting daily chart for gold. Interestingly, Tuesdays are often very soft days for gold… and of course today is Tuesday. The April high of $3500 occurred on a Tuesday, and it was marked with a key reversal on the daily chart. A potential key reversal is also in play today.

As a trending move matures, buying short-term dips becomes a riskier endeavour. Volatility increases and I’ll note that the “Golden Week” holiday in China gets underway tomorrow. Asian buyers are arguably more rational than their Western counterparts. With China on the sidelines, volatility should rise.

The most likely scenario right now is that gold trades with tremendous volatility (and sideways to slightly higher for the price) over the next few weeks before beginning a countertrend move towards $3200.

That target number would be adjusted higher if gold now moves substantially above $4000 rather than peaking here at about $3870.

If the horrifying war in Gaza ends, it could cause some leveraged hedge funds to temporarily reduce their exposure to gold and silver, but peace could be (and likely will be) “messy”, causing them to buy again.

What about a government shutdown?

For decades, I’ve argued that most governments are 50%-70% too large. A shutdown that features mass firings would encourage citizens to look after themselves rather than worship their government.

In the short-term, a shutdown is likely to help limit any technical dip from $3800. A smaller government also opens the door to a new gold buy program for the Treasury. Ultimately, it could help usher in the complete jettison of fiat.

That’s because gold is honest money, and a smaller government is generally a more honest one.

This is a long-term “death march” chart for US fiat versus gold.

At some point, there will be one of the rare countertrend rallies for fiat and $3800-$4000 is as good as any, as a point for it to begin. Gold money enthusiasts should already have a fiat cash horde ready to deploy at key buy zones like $3500 and $3200… to get more supreme money gold.

The miners?

This is the fabulous CDNX chart. While gold could stall for a few months, any price over $3000 is a great one for most miners.

A technical pause at the neckline zone of 900-1100 is expected and normal, but from there a mighty surge to the inverse H&S pattern’s target zone of 1800-2200 should occur. Given the time involved in the formation of the pattern (about 10years) an overshoot to the all-time 3300 area highs is also highly probable.

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

What about the senior producers?

This is the GDX daily chart. For aggressive gold stock bugs who have significant amounts of their net worth in senior miners, I suggest placing stops on part of the position at $71 and $66, basis GDX.

Buyers with lots of dry fiat powder should focus on the $55-$52 zone. It’s a zone of significant support.

For conservative players who are nervous, put options are the go-to play. They are like fire insurance; hopefully it’s never needed, but if it is, the investor’s portfolio is protected.

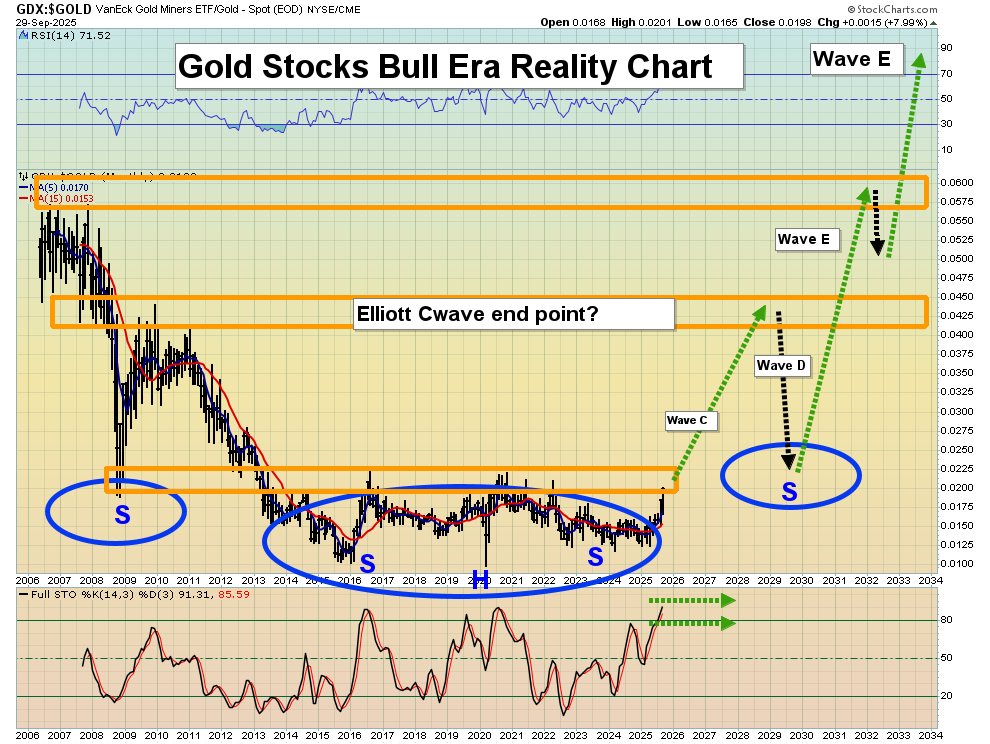

This is the stunning GDX versus gold chart. Changes in leadership at Barrick and Newmont aren’t going to end the gold bull era. The shutdown, Gaza peace, and October seasonality do coincide with the price arriving at the neckline zone of this spectacular inverse H&S pattern. A pause is expected, but it’s only a break in what should be decades of gold stock investor fun!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: