Gold Stocks: The Best Is Yet To Come

Is $4000 a top for gold? Interestingly, this question is mostly moot because calling fiat price tops for gold is an act that can cause significant harm to amateur investors.

A focus on getting more fiat by top calling gold is like watching a little child playing house league hockey rather than watching a professional play for the coveted Stanley Cup.

Gold is the Stanley Cup of currencies, so investors should focus not on calling fiat price tops, but on getting more.

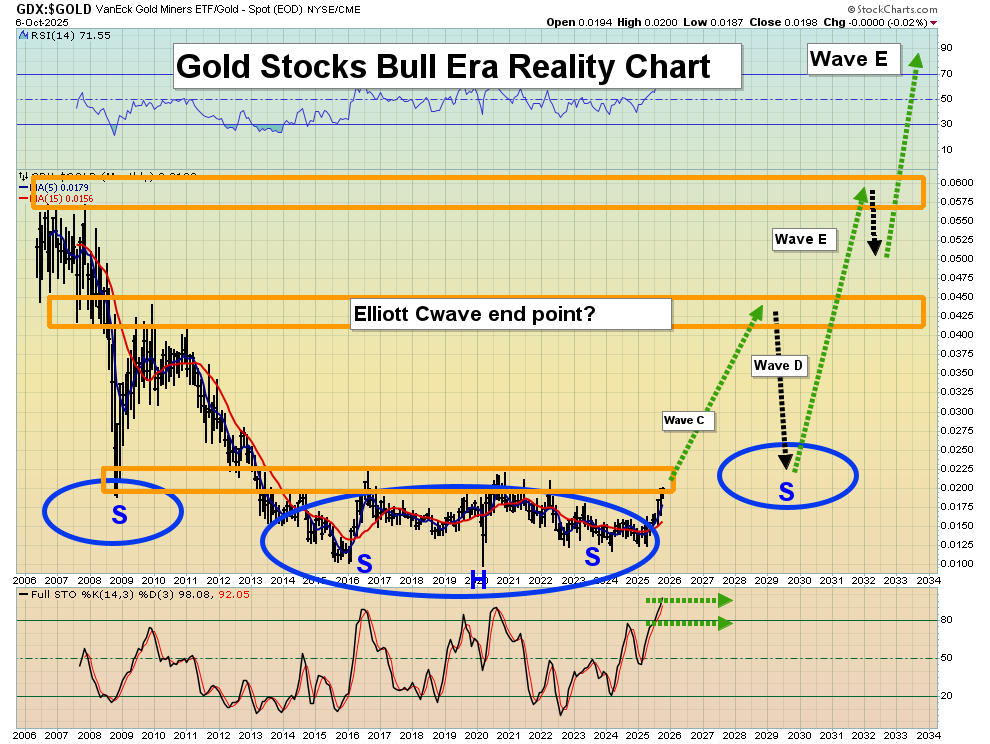

This is an awesome weekly chart. I’ll note that while Elliott Wave analysis is subjective, most of its highest quality proponents agree that gold is in a major C wave.

When this wave ends (likely between $3800-$5000, but perhaps not until a price of about $10,000 is reached!), wave D will provide both amateur investors (fear trade gold bugs of the West) and professionals (three billion supreme money gold bugs of the East) with a stellar opportunity to not only increase their holdings, but to do so significantly.

If wave C ends somewhere between $4000 and 5000, wave D could take gold in the $3500-$3000 area. I expect that would usher in maniacal buying from the citizens of China. It’s also likely to create an almost out of control buying stampede by the citizens of India, who I’ve dubbed as the world’s “Titans of Ton”.

My only question is, are gold bugs of the West prepared to join the coming stampede, or will they be left behind trying to call final fiat price lows, and do it while holding little or no gold? I’ll dare to suggest that more and more of them are ready to get significantly more gold on the next big sale in the price!

My original target for wave E was $6500, but there’s now a significant global institutional and central bank loss of fiat confidence event in play. For wave E, that event opens the door to target prices in the $10,000, $15,000, and $20,000 range.

My suggestion to amateur wave counters is to loosely fit their counts around the fundamentals in play rather than trying to make the fundamentals fit with their counts.

In a golden nutshell, bigness and permanence matters… and the current global loss of confidence in fiat and in government itself are probably two of the biggest and most permanent events in the history of the world.

What about silver… what’s next for this exciting monetary metal?

Compared to gold, silver is even more undervalued than gold stocks!

To put it in perspective, gold is trading more than four times its 1980 fiat price high, yet silver is only approaching its 1980 high now. The bottom line: A rise to $200/oz would only put silver at what I would call “righteous” pricing. It would likely need to rise to $400 or higher before becoming significantly overvalued against supreme money gold.

The most likely scenario for silver right now is a move to all-time fiat price highs, a pullback after the breakout… and then a powerful surge to the $100 target of the massive base pattern. That base formed over 45 years, from 1980 to 2025.

What could create the surge to $100, a move that could see silver function like the Lone Ranger, riding alongside the queen of currency, gold, in magnificent C wave glory?

What’s most likely is that the US stock market stages an E wave blow-off move higher while silver surges in a C wave.

The difference is that the ending of these waves would feature de facto obliteration for the stock market and a superb buying opportunity for silver.

The next stage of empire transition from the relatively tiny population of the fiat and debt-oriented West to the massive population of the wisely gold-oriented East is likely to feature a lot more excitement than the previous stages did.

What about the miners?

Here is what I’ve dubbed as one of the three most explosive charts in the history of markets, the CDNX weekly chart. As expected, the rally has pushed the index well into the neckline zone.

Note the significant uptick in volume over the past couple of weeks. This is typical in an inverse H&S pattern of significance… and this one is massive!

Excitingly, there’s an inverse H&S pattern appearing on the BPGDM sentiment index. It’s similar to the pattern that appeared on the weekly chart Stochastics (14,5,5 series) for gold just before gold blasted from $3500 to almost $4000!

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

For a look at the senior miners:

This is the daily GDX chart. GDX would need to trade under 74 and then under 71 to trigger any short-term pullback.

The pattern of higher highs and higher lows is intact and many technicians are stunned by how long the market has stayed overbought without a pullback of significance.

For a look at the weekly chart:

Against failing fiat, gold stocks appear to be in a parabolic blow-off move like the stock market but…

Against the mightiest of currencies, supreme money gold, the miners are in a massive base pattern, one that promises years of fabulous gains lie ahead for enthusiastic gold bugs in the West!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: