The Fed: Large Banks More Likely To Fail Now Than Before The GFC

The great majority of the public believe that larger banks are in a much better financial position since the Great Financial Crisis of 2008. And, the confidence in these banks seems quite ubiquitous. However, the Fed has recently published a study which suggests just the opposite.

We recently discussed a Fed article that concludes post-GFC prudential reforms aimed at large banks have not reduced solvency risk. In particular, post-crisis prudential changes for larger banks (the red diamonds in the charts below) do not appear to have produced materially lower solvency risk, either over time or relative to smaller banks. Importantly, deposit-funding risk at larger banks has risen significantly as these firms have increased their reliance on uninsured deposits.

Source: Fed

Source: Fed

Last week, the Fed published another study on economic capital, presenting a range of results showing that its measure of economic capital is a more timely and accurate indicator of bank failure than more conventional accounting-based measures of bank solvency.

The Fed examined all failed banks between 1997 and 2025. The resulting sample of 465 failed banks is dominated by failures during the GFC, as roughly two-thirds of the failures occurred from 2008 to 2010. The regulator compared four measures: its baseline economic capital measure (EC), R-EC (economic capital under a “run scenario,” where the Fed assumes that uninsured deposits must be replaced with market-rate funding that is more expensive than deposits), TCE (tangible common equity), and TCE adjusted for estimated losses on loans and securities (MTM TCE). Each measure is scaled by total bank assets to create a leverage-ratio-type metric.

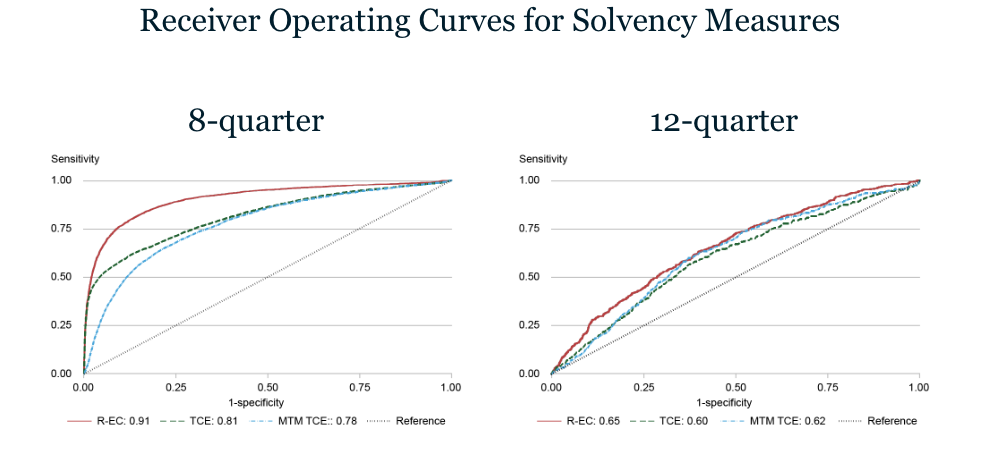

To explore how well the various solvency measures predict the broader set of bank failures, the Fed estimated simple logit models, using a zero-one indicator of bank failure and, in turn, the values of R-EC, TCE, and MTM TCE as the explanatory variable. The regulator estimated these models using solvency measures eight and twelve quarters prior to failure and used the resulting coefficients to construct Receiver Operating Characteristic (ROC) curves, showing the tradeoff between correctly identifying a failing bank (on the y-axis) and incorrectly identifying a non-failing bank as failing (on the x-axis). An ideal measure would correctly identify a high proportion of failing banks while incorrectly identifying only a small proportion of non-failing banks. So curves that are sharply sloped and closer to the y-axis (with more area under the curve) indicate better performance of the metric in optimizing this tradeoff.

Unsurprisingly, at both horizons, R-EC is more accurate than the alternative solvency metrics, with differences at the eight-quarter horizon being particularly notable. In all cases, results for R-EC (the red lines) are steeper and closer to the y-axis than results for TCE and MTM TCE, which perform similarly to one another.

Source: Fed

Note: The chart shows the receiver operating curves (ROCs) distinguishing banks that fail (on the y-axis) from banks that do not fail (x-axis) based on logit regressions using three solvency measures: run economic capital (R-EC), tangible common equity (TCE), and mark-to-market TCE (MTM TCE). The panels show the ROCs 8 quarters and 12 quarters before failure.

Taken together, the first study (published two months ago) shows that large US banks have weaker economic capital compared with 2007, and the second study shows that economic capital better predicts bank failures than the classic capital ratio used in the Fed’s stress tests. The takeaway from these studies is very simple: large banks are now more likely to fail than before the GFC. This effectively ends the argument of those who still believe that large banks are better prepared for a crisis than they were in 2007.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, high-risk shadow banking (the lending for which has exploded), and elevated default risk in commercial and industrial (C&I) lending. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. You can feel free to review our due diligence methodology here.

*********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of