A Fight For Freedom & Gold

Big round numbers are in play and in that regard, one question for investors to consider is this: Could gold hit $5000 while the Dow hits 50,000 and silver hits $100? It seems likely and gold stock enthusiasts may want to also note that GDX is also closing in on the $100 marker.

Does this mean that red-hot geopolitical action is reaching a crescendo and a significant lull will soon occur?

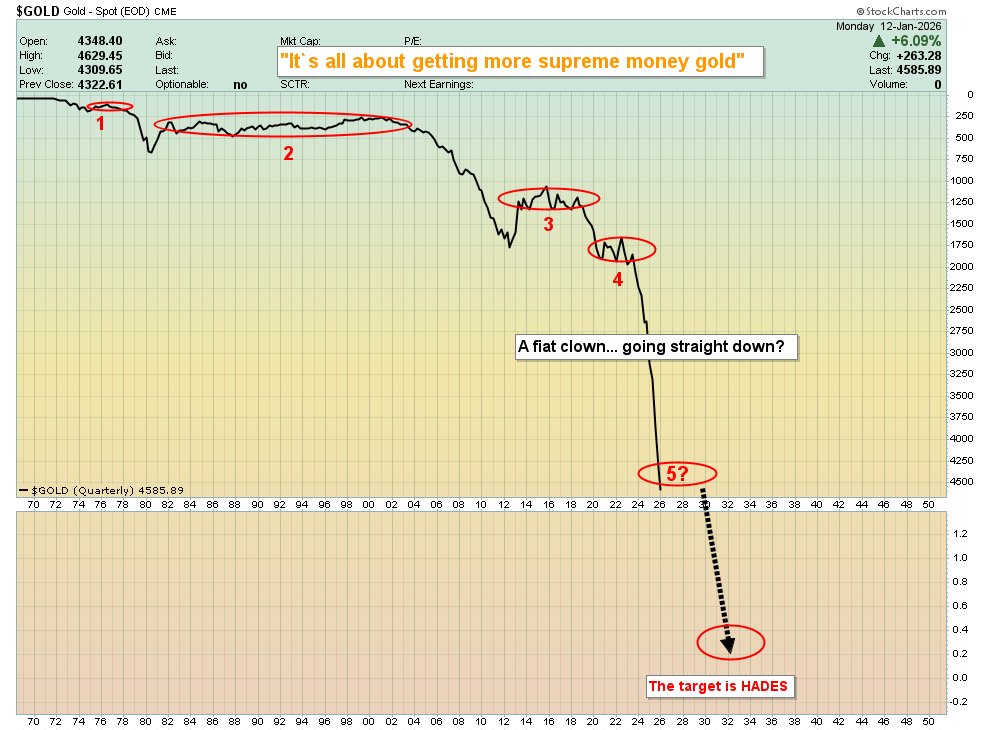

Well, nothing goes up in a straight line forever, but what about… straight down?

This is the “Death of the Dollar” chart. Clearly, investors (and regular citizens) need to focus on getting more gold rather than more dying fiat.

For somebody just starting out, a 10% allocation is probably enough, and from there significant dips in the price can be bought until the allocation reaches the 20% marker.

At that point, additional items like silver and mining stocks can be added to the mix. The key is to seek an allocation that allows the investor to remain emotionally stable during extended periods of disappointing price action.

That allocation should vary from one investor to another… and sometimes quite dramatically.

This is the daily chart for gold. The positive action continues. Note the fresh buy signal in the momentum zone for Stochastics.

For a look at the weekly chart:

If gold is to experience a significant correction, it likely plays out something like this.

Investors who bought at much lower prices many years ago could consider selling 30% of their holdings, which is what I’ve done.

For more insight into the gold market:

The DOJ probably should open a criminal investigation (and indictment) into both the Fed and the Treasury… for their promotion of fiat as money instead of gold.

Regardless, with both these entities committed to fiat, a 70% allocation to gold, silver, and miners gives investors plenty of potential upside reward… and the flexibility to buy any significant sales in the price.

In the Chinese zodiac, last year was the year of the snake (think tariff taxes) and this year is the year of the flaming horse, which can be interpreted as citizens fighting for freedom.

The fight for freedom in Iran, Cuba, and Venezuela could continue for many years. An initial peak in the action is probably just a few months away and it is highly likely to coincide with an intermediate peak in the fiat price of gold.

I’ve suggested the most likely time for that to occur is in the month of April. For the past year I’ve called that the most likely time for the event, and nothing has changed since then.

How will it affect the miners? That’s a great question, and for some key insight:

This is the spectacular CDNX daily chart which is a key indicator not just for the juniors, but for all the miners.

As good as this chart looks, it only tells one small part of the big bull era story for mining stocks and on that note…

This is the long-term weekly chart. I urged investors to be patient until 2024. That was when the trading volume began to rise with the price.

It now looks like the junior miners are poised for what is likely to be seen (in hindsight by mainstream money managers) as the greatest technical breakout in the history of markets. An April peak is likely to mark the end of the breakout move and a classic pullback to the neckline of the immense base pattern should unfold from there.

Junior mine stock investors may soon find themselves on not just cloud nine but on cloud nine bagger… with that kind of performance being the norm for most of their stocks!

Junior mine stock investing isn’t for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

As noted, the rise in the volume of the juniors over the past two years signalled the seniors were also set to soar.

For a look at those, via the GDX ETF:

Priced against gold, GDX sports the same fabulous inverse H&S pattern as the CDNX does against fiat and after a breakout and rally, an April peak also looks likely to mark an intermediate term pause in the action.

This is the GDX daily chart. While the round number of $100 is significant, the price action suggests that any pause before April is likely to be shallow.

It’s likely that GDX doesn’t reach an intermediate-term peak until it rises to $120-$130, turning the $100 zone into a potential floor and launchpad… for a surge to $200 and more!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: