Are We In Late Cycle? Implications For Gold

In the previous edition of the Market Overview, we explored the fascinating history of bull and bear cycles in both the U.S. dollar and gold. Since then, the idea of cyclicity doesn’t lead me to drop off, disrupting my sleep cycles. Let’s then dig into the topic. We start with the business cycles, as in the recent Gold News Monitor we wrote that “we are in the late stages of the economic cycle – as the cycle matures, volatility increases and investors start to buy more gold as a hedge.” Why do we believe so? And what are the implications for gold’s future?

As a short reminder, cycles exist throughout our lives. From the weather’s seasons to circadian rhythm. Business activity is no different here. The economy does not grow evenly, but experiences ups and downs. There are many theories of business cycles – our favorite is that formulated by the Austrian school. But now, let’s focus not on reasons, but on stages of business cycles. Knowledge is where we can improve investors’ returns.

Terminology may vary, but there are basically four phases:

-

Expansion – this is where economy grows healthily. Almost all measures – in particular, real GDP, real income, employment, industrial production, and wholesale-retail sales improves. Inflation stays low, while stocks are in a bull market. Gold usually struggles, but when the recovery is weak, it may revive.

-

Peak – things get tricky here. The economy accelerates. But inflation rises. Industrial production flattens. The stock market enters a state of irrational exuberance. It might be a good time to buy gold, as it hedges against both the inflation and a stock market crash.

-

Contraction – it starts to be less pleasant. The economy slows down. Bears triumph on the stock market. Gold may rise as a safe haven, but fire sales are able to sink the yellow metal. A lot depends on the U.S. dollar behavior and the broader macroeconomic context.

-

Trough – real apocalypse. The economy contracts. Consumer expectations are at their worst. It may be good idea to buy commodities, including gold, as they should be cheap during a recession, offering a substantial potential for gains.

Where is the U.S. economy right now? Well, neither in contraction, nor in trough. Instead, it enjoys a ninth year of upswing. The NBER recorded the last trough in June 2009. It means that February 2018 marked the 102nd month of economic recovery. It is the third longest expansion in the post-war history.

Although it was also the weakest expansion, its unusual length arouses some anxiety. The latest developments only added to these worries. Interest rates rose. Inflation also returned to the markets. Investor optimism hit a three month low last month. These are signals that the U.S. economy may be peaking. According to the February BofA Merrill Lynch’s survey, 70 percent of fund managers believe the global economy is entering the late stage of expansion, the highest share since January 2008, just a few months before the crisis. The fears of a breakdown made gold rally in February.

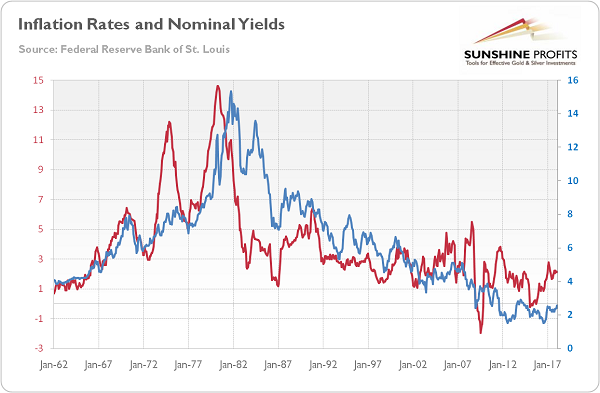

However, the current expansion may last a while before reaching a peak. Just look at the data. Inflation is still moderate and – given the global competitive pressures – should remain contained. Interest rates rose, but stay at a relatively low level from the historical point of view (see the chart below). Do you really believe that inflation will reach levels from the 1970s? Or that the sky will fall when treasury yields climb to 3 percent and above?

Chart 1: Inflation rates (red line, left axis, annual percent change) and 10-year Treasury Constant Maturity Rate (blue line, right axis, in %) from January 1962 to January 2018.

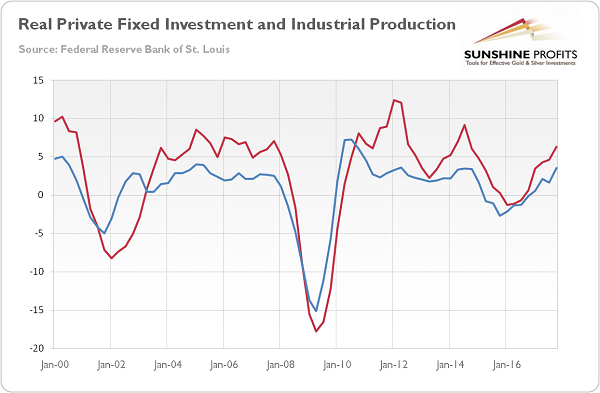

Jobs are plentiful and there are no bottlenecks in the labor market, which could signal overheating. Fixed private capital spending and industrial production have been accelerating recently, as one can see in the chart below. And that growth is not limited to the U.S., but it occurs worldwide, as we discussed it in the previous edition of the Market Overview.

Chart 2: Real Private Nonresidential Fixed Investment (red line, annual percent change) and Industrial Production (blue line, annual percent change) from Q1 2000 to Q4 2017.

What does it all mean for the gold market? Well, global fundamentals are healthy. We are still in expansion, not at a peak. It theoretically should be negative for the yellow metal. But markets are forward-looking. Although the U.S. economic expansion still has some time ahead of it, it is more mature than in the Eurozone. The relatively late cycle in the U.S. should, thus, weaken the greenback and support gold.

To sum up, all expansions eventually come to an end. Measured by time alone, the current economic upswing looks rather mature. However, it’s not the calendar, but data that triggers contraction. There are reasonable signals to worry, that’s for sure. The unusually easy global monetary policy led to credit risk mispricing and asset price bubbles. The normalization may be bumpy. But we can be optimistic about the short-term outlook. The global economy still has a material upside before the turning point. It should be negative for gold. But let’s notice these two points: 1) the U.S. economic expansion is maturing, but it’s still receiving an extraordinary degree of monetary – despite tightening, financial conditions remain easy – and fiscal policy stimulus; 2) and, again, the U.S. economic expansion is in a more advanced than in the Eurozone. Both factors should erode the greenback’s value. It should encourage the price of gold to travel north.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor