Biggest Gold-Buying Day Of The Year Following The Festival Of Diwali

Strengths

- The best performing precious metal for the week was spot gold, up 1.96%. Nomad Royalty Company has entered a gold stream with respect to Orion’s 40% interest in Greenstone Gold Mines, which operates the Greenstone Gold Project located in Canada. The company will make cash payments totaling $95 million for 5.9% of gold production attributed to Orion’s 40% interest in Greenstone until 120,333 ounces have been delivered, and 4.0% thereafter. Nomad will make ongoing payments equal to 20% of the spot gold price and, in addition, will make payments of $30 per ounce to fund mine-level ESG (Environmental, Social and Governance) programs.

- Gold edged higher from a three-week low as the Federal Reserve signaled it will be patient on raising interest rates, after announcing it will start reducing bond purchases this month. Chair Jerome Powell on Wednesday stressed that the tapering – at a pace of $15 billion per month – doesn’t mean policymakers will hike rates any time soon for they want to see the labor market heal further first. A Federal Open Market Committee (FOMC) statement also included new language that inflation might not prove to be entirely transitory. Based on the market reaction, (equities up, gold up, cyclical commodities up), the market perceived it as dovish.

- Several gold companies reported better than expected earnings. Kirkland Lake reported earnings per share (EPS) of $0.91/share ahead of consensus at $0.81/share on production of 370,000 ounces better than consensus at 349,000 ounces. Fosterville and Detour drove the third quarter beat, with throughput at Detour at an annual high. Royal Gold reported third quarter results that exceeded consensus. EPS was $1.07, ahead of the consensus of $0.97, supported by total production of 97,000 ounces (5% ahead of consensus). The company increased second half 2021 stream guidance by 3%.

Weaknesses

- The worst performing precious metal for the week was silver, but still up 1.08%. Marathon is focused on the Valentine Gold Project, the largest gold project in Newfoundland with a resource base of 4.8 million ounces. Management announced the start of construction would be delayed after the province requested additional information for the Environmental Impact Study. Construction will commence in the third quarter of 2022 (previously 1Q 2022) with first gold production in third quarter 2024 (previously 1Q 2024).

- Pure Gold Mining reported third quarter production of 9,000 ounces of silver, 23% below the 12,000 consensus, largely due to significantly lower milled grades in September owing to inaccessibility of high-grade stopes as underground development rates lagged long hole production. Additionally, Pure Gold lowered its fourth quarter throughput and grade guidance to 600-700 tons per day and 5.5-6.5 grams/ton, respectively, while simultaneously postponing expectations to sustain 1,000 tons per day mill throughput.

- B2 Gold Headline reported EPS of $0.12, below the consensus of $0.13 because of higher income taxes and slightly higher cash costs. Total cash cost came in moderately above consensus. Total cash costs from the B2-operated mines came in at $572/ounce (versus consensus of $536/ounce). Wheaton Precious Metals reported third quarter EPS of $0.30, a miss vs. $0.34 consensus. Third quarter cash flow per share was $0.45, also a miss versus the $0.48 consensus. The EPS miss was driven fundamentally by lower revenue.

Opportunities

- This morning, Chifeng Jilong Gold Mining announced it is acquiring Golden Star Resources for $470 million in cash. Golden Star owns the Wassa Mine in Ghana. Chifeng Jilong tried to buy the Bibiani Mine in Ghana from Resolute Mining for $105 million earlier this year but ran into problems with the mining lease; Asante Gold ended up buying Bibiani for $90 million. In less than three years, nine producers/mines and ten pre-production companies/projects that have been acquired in the region.

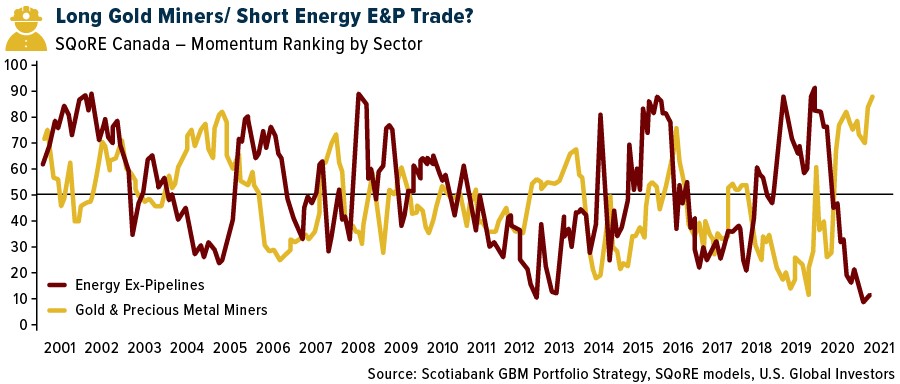

- According to Michael Letros at Scotiabank, he has been advocating for a Long Gold Miners / Short Energy E&P trade as the relative price momentum of the gold miners is at two-decade lows and the energy producers are at two-decade highs (both are relative to the S&P/TSX Composite). Based on Jean-Michel Gauthier’s (Scotiabank quant analyst) updated monthly report, the energy price momentum (red line) continues to break-out and the gold miner price momentum (yellow line) has only bounced a tiny bit off its lows.

- Indians flocked to jewelry stores on Tuesday on the biggest gold-buying day of the year, with a bumper sales period for precious metals that culminates during the festival of Diwali expected for the first time since the pandemic began. Dhanteras is traditionally seen as the most auspicious day in the Hindu calendar to buy gold, with many shops remaining open until midnight and jewelers offering discounts and gifts. Indians typically buy ornaments for marriage celebrations, and coins and bars for investment surge during a series of celebrations that culminates with Diwali, or the Festival of Lights, which fell on a Thursday this week.

Threats

- For Ghana, the gold disappears when you put a tax on it for small scale producers. Ghana introduced the levy in May of last year to boost revenue from its resource base. Before the tax went into effect, Ghana would export about 5 tonnes of gold a month from small miners, but that number is less than 1 and dropping now. Countries across West Africa are taking more steps to help formalize the artesian gold markets and Ghana announced they are reconsidering the implementation of the tax. In addition, Ghana’s first state-owned gold refinery is set to start operations in December with a process capacity of 400 kilograms a day with a goal of refining 30% of the country’s production.

- Chris Wood, global head of equity strategy at Jefferies, has upped his allocation to 10% from 5% for Bitcoin at the expense of gold bullion in his recent Greed and Fear report for his Asia ex-Japan portfolio. Chris cites the arrival of the Bitcoin ETF in America and the growing interest in crypto as a reason to pivot further to Bitcoin as a second lever to hedge a collapse of the U.S. dollar standard.

- Investors in Newfound Gold woke up to news released by the company of 30 selected samples of drill core that were re-assayed for gold content for quality control/quality verification analysis. The results showed the original core samples demonstrated a strong bias towards higher grades, particularly with the higher-grade samples in comparison to the new assays. Newfound Gold’s share price plunged as much as 27% during intraday trading to finish the day with its biggest 1-day loss in a year. The spectacular gold grades they were reporting had been a key driver of the share price. Historic event driven analysis done by CIBC World Markets on “Mining Stock Risks – Delays and Disappointments” showed that on average, a major exploration disappointment lowers the valuation of the company by about 45% and it takes 18-months to recover.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of