Breakouts Galore In Gold And Silver

Gold broke-out last week on Brexit, while Silver waited a week to join the party. The miners, meanwhile cleared 2014 resistance last Friday. To be sure there are breakouts across the board in the precious metals space.

The weekly candle charts of Gold and Silver are plotted below. Gold appears to have digested the Brexit pop well as it gained another 1.5% on the week to $1339. If it holds above monthly and quarterly resistance ($1330s), then it should be on its way to $1380-$1400. Meanwhile, Silver surged 9.9% on the week to $19.59. It has broken out from an Inverse Head&Shoulders pattern to nearly a 2-year high. The pattern projects to a target of $22.

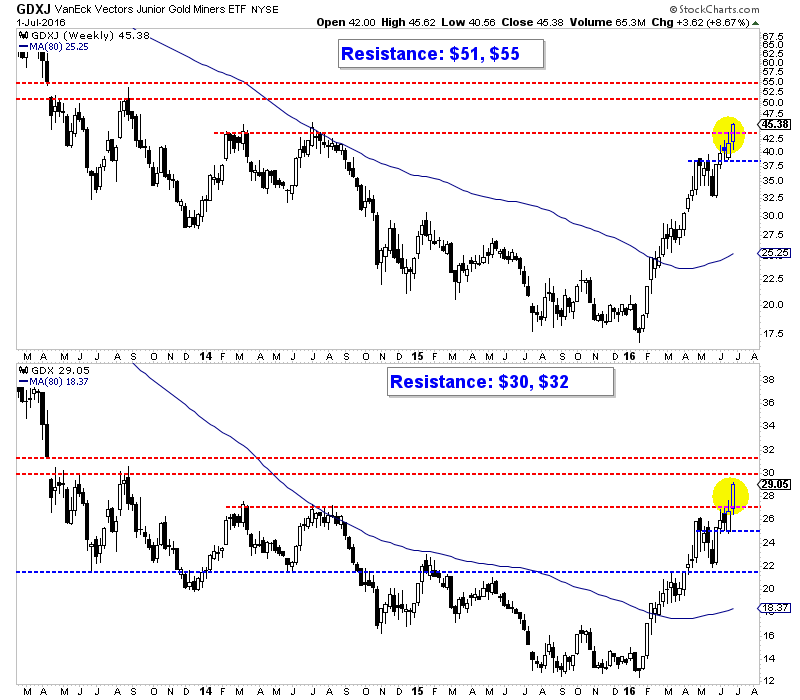

The breakouts in Gold and Silver were foretold by the strength and leadership from the mining stocks, which closed the week with gusto. GDX surged 4.8% Friday and GDXJ surged 6.5%. Both closed near the highs of the day and broke 2014 resistance in clean fashion. GDX has upside to resistance at $30 and $32. GDXJ, which has more upside has resistance at $51 and $55.

We had been looking for weakness or at least some consolidation> However, Friday’s action suggested that was becoming unlikely. The chart below is one we sent to premium subscribers in a flash update. The 2-hour bar chart shows that miners had formed a Reverse Head&Shoulders Continuation pattern, which because of its upward slant indicated more strength than the typical pattern. The pattern projects to a target of about $51 for GDXJ and $32 for GDX. Those targets are consistent with the above resistance targets.

I am one of the biggest precious metals bulls, but even I at times have underestimated the strength of this bull market (particularly in the miners). The miners correct less than I expect or do not correct at all. While it is tough to chase strength and stay bullish after a huge rebound, we maintain our posture as we expect Gold to test $1400 and perhaps $1550, before a significant counter trend move. Buy weakness and hold. That is how to make money in a bull market.

Jordan Roy-Byrne, CMT, MFTA