Bullion Banks: Unexpected Allies

Most investors buy gold because they are nervous about the financial system, government debt/bureaucracy, central bank money printing, and dangerous geopolitical developments. In a nutshell, that’s the “fear trade” for gold.

Most investors buy gold because they are nervous about the financial system, government debt/bureaucracy, central bank money printing, and dangerous geopolitical developments. In a nutshell, that’s the “fear trade” for gold.

The fear trade is a great reason to own a core position in gold now, and forever. Gold should be the first item bought in any investment portfolio. That’s because lowest risk assets must be bought first, not the ones that appear to offer the most potential reward.

Ironically, it’s probably going to be the “love trade” (gold jewellery), not the fear trade, that makes the Western gold community a lot richer.

In late 2013, I suggested that gold would undergo a sea change in 2014. One of the main gold price drivers of the fear trade was quantitative easing (QE). Most analysts believed in “QE to infinity”. In contrast, I argued that a “taper to zero” was coming, and it would be bullish for gold. That’s what has happened.

My main theme for 2014 is not how high the price of gold is going, but how calm and confident investors should be about holding it.

Suddenly, gold community investors have a powerful and unexpected ally. Over the past month, most bank economists are quickly dropping their outrageous bearishness, and their “gold must be sold right now” rhetoric.

Most of the top bank analysts are now calmly rationally embracing gold stocks as assets of quality. “Barrick Gold Corporation (NYSE: ABX) was added to the prized Conviction Buy List at Goldman Sachs….” – 24/7 Wall Street News, August 8, 2014.

Not to be outdone, mega-bank RBC recently set a $25 target for Barrick, and gave it an “outperform” rating.

I’ve argued that a key leading indicator for gold is the yen.

All of the technical indicators and oscillators are either flashing major buy signals, or very close to doing so.

Forex trading is dominated by banks (commercial traders). Again, Western gold community investors may be surprised to find that the banks are allied with them.

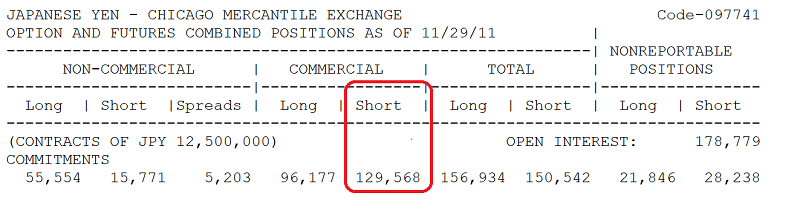

That’s a snapshot of the COT report for the yen in November of 2011, around the time when gold and the Japanese currency both began a significant decline.

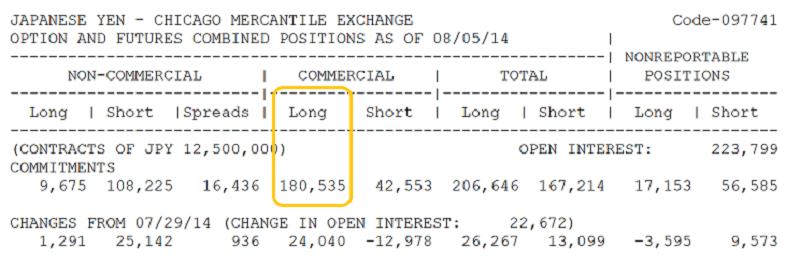

To view the current positioning of the banks in the yen, please see the above chart. The gargantuan net long position held by the banks, suggests they are anticipating a powerful rally in the yen, which I believe will be accompanied by higher gold prices.

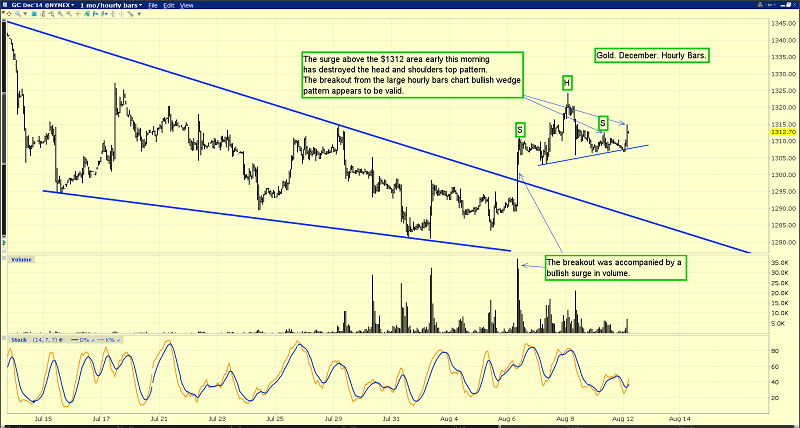

What about gold itself? This hourly bars chart for gold is quite interesting. After breaking out from a bullish wedge pattern, a small head and shoulders top pattern formed. A rally above the right shoulder destroys the bearish implications of that pattern, and that just occurred early this morning.

Gold stock charts look solidly bullish, perhaps because of institutional liquidity flows based on bank economist recommendations. This daily GDX chart looks fabulous. There’s a stoker (14,7,7 Stochastics series) buy signal in play, and volume is bullish.

I think the growing institutional liquidity flows will push GDX to my intermediate trend target zone of $31, without much difficulty.

In the big picture, the recent actions of the Indian central bank to allow non-bank exporters to import gold, has likely strengthened the all-critical Indian market more than the import duty has weakened it.

Raghuram Rajan is probably the world’s most brilliant central banker. His superb strategy has quickly cut the Indian gold market bid-ask premiums to almost zero (from $100 - $200 an ounce), and forced the bullion banks to compete with non-banks for import volume.

Having said that, a cut in the import duty would simply add to the “gold bull era party” that is in play.

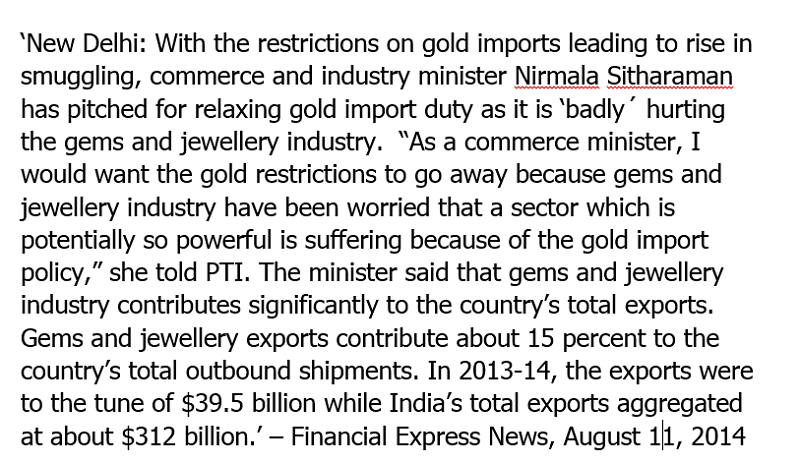

Nirmala Sitharaman is India’s Minister of Commerce. She doesn’t wield as much power as Finance Minister Jaitley, but she’s still a strong ally of the gold jewellery industry, which is India’s second largest employer.

Please click here now. The world’s most advanced gold processing facility is now in India, and mines have begun sending substantial amounts of ore there for refining.

LMBA certified, this refinery is a state of the art operation with 150 tons annual refining capacity, and more like it appear to be on the way. The head of MMTC says he envisions 6 -7 such operations in the coming years, handling about 1000 tons of gold annually.

This is a huge game changer, because these refineries could totally eliminate the need for India to import gold bars from Switzerland and other countries. The gold jewellery bull era will feature a much more direct link between the Western gold community’s mining companies and Indian jewellers, a win-win situation for all!

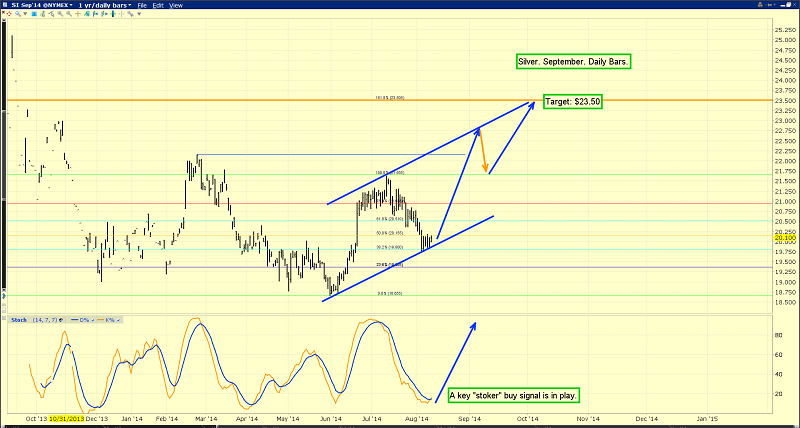

Of all the precious metal sectors, silver is the one I like in the most immediate timeframe. The stoker oscillator is flashing a fabulous buy signal this morning, and I’ve set a $23.50 intermediate trend target, based roughly on the 161% Fibonacci retracement line. Hi, ho, silver!

********

Special Offer For Gold-Eagle Readers: Please send me an email to [email protected] and I’ll send you my free “Goldilocks” report. The senior gold stocks are too sluggish for many investors, and the juniors carry a lot of risk. The intermediate-size producers provide a great combination of risk management and upside reward; a “Goldilocks” situation. I’ll show you the top five intermediate gold stocks I’m focused on right now, and why.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: